Vitafoam Nigeria Plc is Nigeria’s leading manufacturer of flexible, reconstituted and rigid foam products. It has the largest foam manufacturing and distribution network which facilitates just in time delivery of finished products throughout West African Sub region. Incorporated on 4th August, 1962 and listed on the floor of the Nigerian Stock Exchange in 1978, Vitafoam’s brands remain household names in the Country.

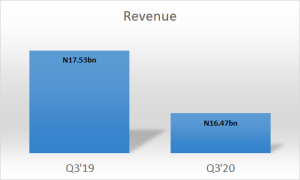

The Accounting year of Vita Foam ends in September as against what is obtainable for majority of listed companies on NSE whose year-end is in December. At that Vita Foam Plc’s third quarter ends in June. Vita Foam in its Q3 2020 financial report, achieved a turnover of N16.47 billion, down by 6.03% from the turnover of N17.53 billion achieved in the third quarter of 2019.

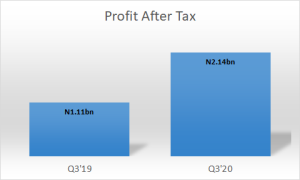

Profit before Tax (PBT) grew by 88.07% to N3.05 billion from the PBT of N1.62 billion in Q3’19. Profit after tax soared by 93.73% to N2.14 billion from the PAT of N1.11 billion achieved in the third quarter of 2019. Earnings per share grew to N1.71 from the EPS of N0.89 which translates to N93.42% growth year on year.

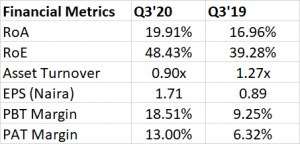

Return on Assets (RoA): For the period under review, Return on Asset of Vita Foam increased by 2.95 percentage point in Q3’20 to 19.91% from 16.96% in Q3’19. RoA is an indicator of how profitable a company is relative to its total assets. ROA gives investor an idea as to how efficient a company’s management is at using its assets to generate earnings.

Return on Equity (RoE): In Q3’20 the Company’s Return on Equity was estimated as 48.43%, up by 9.15 percentage point as against the RoE of 39.28% in Q3’19. Return on equity is a measure of the profitability of a business in relation to the equity. ROE measures how many naira of profit are generated for each naira of shareholder’s equity. ROE is a metric of how well the company utilizes its equity to generate profits.

Asset turnover: Asset turnover for the period under review declined to 0.90x from 1.27x in the third quarter of 2019. It is the ratio of total sales or revenue to assets. This metric helps investors understand how effectively companies are using their assets to generate sales.

PBT Margin: The Profit before Tax (PBT) margin of Vita Foam during the period under review increased by 9.26 percentage point, as PBT grew by 88.07% in the same period.

PAT Margin: The Profit after Tax (PAT) margin of the firm grew by 6.68 percentage point as PAT also increased by 93.43% in the same period.