BUA Cement is one of the heavy weight stock on the main board of the Nigerian Stock Exchange. BUA Group possesses a strong capacity in cement manufacturing with 3 major subsidiaries and plants in Northern and Southern Nigeria as well as a 2 million metric tonnes per annum floating terminal serving niche markets. The Group also holds a stake in Damnaz Cement Company Ltd which is the Majority Shareholder in Cement Company of Northern Nigeria. The Group’s plants have the capacity to provide various grades of cement as required in the local Nigeria markets and meet the highest standard of cement manufacturing.

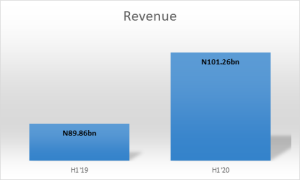

In the first half of year 2020, BUA Cement reported a turnover of N101.26 billion, up by 12.69% from N89.86 billion achieved in the first half of 2019.

Cost of sales for the period under review which include depreciation (factory), energy cost and repair & maintenance was N54.52 billion. This brings Gross Profit to N46.74 billion, up by 5.54% from N44.29 billion achieved in H1’19.

Other Income reported was N4.01 billion, which came from haulage, insurance claims, and sundry income.

Selling and distribution cost gulped about N6.39 billion while N4.75 billion was spent on administrative expenses.

There was an impairment write back of N1.199 billion bringing the company’s Operating Profit to N40.81 billion, up by 7.02% from N38.13 billion reported in H1’19.

Finance Cost for the period under review reduced by 33.54% to N1.64 billion as against N2.47 billion spent on servicing loan.

Profit before Tax (PBT) grew by 9.83% to N39.16 billion from the PBT of N35.66 billion.

Tax paid for the period under review reduced by 13.86% to N4.35 billion as against N5.04 billion paid on income tax.

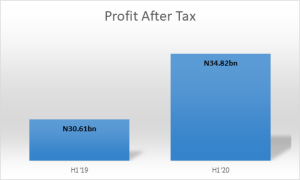

Profit after tax appreciated by 13.74% to N34.82 billion from the PAT of N30.61 billion achieved in the first half of 2019.

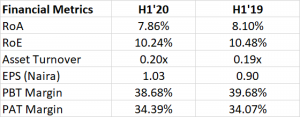

Earnings per share grew to N1.03 from the EPS of N0.90 which translates to N13.74% growth year on year.

Return on Assets (RoA): This is an indicator of how profitable a company is relative to its total assets. ROA gives investor an idea as to how efficient a company’s management is at using its assets to generate earnings. For the period under review, Return on Asset for BUA Cement was evaluated as 7.86%, down by 0.24 percentage points from the RoA of 8.10% in H1’19.

Return on Equity (RoE): The return on equity (ROE) is a measure of the profitability of a business in relation to the equity. ROE measures how many naira of profit are generated for each naira of shareholder’s equity. ROE is a metric of how well the company utilizes its equity to generate profits. Return on equity for the period under review was 10.24% down by 0.24 percentage point as against the RoE of 10.48%.

Asset turnover: It is the ratio of total sales or revenue to assets. This metric helps investors understand how effectively companies are using their assets to generate sales. Asset turnover for the period under review increased to 0.20x from 0.19x in half year 2019.

PBT Margin: The Profit before Tax (PBT) margin of BUA Cement during the period under review declined by 1 percentage point, though PBT grew by 9.83% in the same period.

PAT Margin: The Profit after Tax (PAT) margin of the firm grew by 0.32 percentage point as PAT also increased by 13.74% in the same period.