Transactions on the floor of the Nigerian Stock Exchange on Tuesday closed on a positive note as demand for Dangote Cement is helping to sustain the Bullish trend in the market.

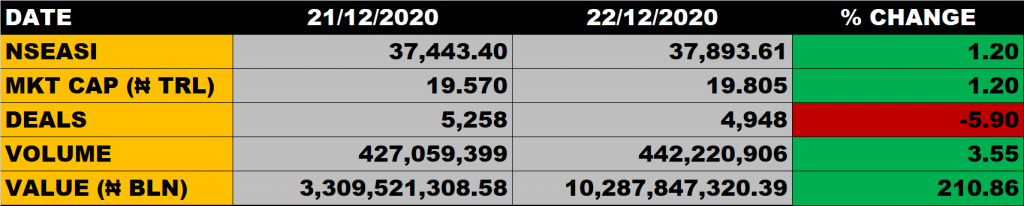

The All Share Index appreciated by 1.20% to settle at 37,893.61 points from the previous close of 37,443.40 points. The Market Capitalisation grew by 1.20% to N19.805 trillion from the previous close of N19.570 trillion, which translates to N235 billion gain.

An aggregate of 442.22 million units of shares were traded in 4,948 deals, valued at N10.288 billion.

The market breadth closed negative as 15 stocks appreciated in their share prices against 22 stocks that declined in their share prices.

Stocks to Watch

- Dangote Cement: The demand for Dangote Cement is helping to sustain the Bullish trend in the market. The share price of Dangote Cement touched a high of N253.4 today but eventually closed at N245 due to profit taking. The rally in the stock is triggered by the announced share buyback programme which will commence on the 30th of December 2020.The share buyback will reduce the Company’s Share Outstanding. The earnings per share will go up and the price will also go up. Improved earnings per share will bring about improved dividend payout going forward.

- Access Bank grew to N8.55 from N8.45. The stock is currently trading 28.75% away from its 52 weeks high of N12. At that, there is uptrend potential in the share price of Access Bank.

- FBN Holdings closed flat at N7. It is trading 22.22% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant.

- Zenith Bank grew to N24.5 from N24.3. It is trading 14.04% away from its 52 weeks high of N28.5.

- WAPCO dropped to N22 from N22.5. It is trading 15.38% away from its 52 weeks high of N26, which implies an uptrend potential for the share price of the company.

- UBA grew to N8.40 from N8.20. It is trading 14.29% away from its 52 weeks high of N9.8. There is growth potential in the share price of the bank.

- Guaranty Trust Bank dropped to 33 from N33.5. It is trading 14.17% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

Percentage Gainers

Eternal Plc gained 10% at the close of trade to settle at N4.51 from the previous close of N4.10.

FTN Cocoa, Japaul Gold and Dangote Cement among other gainers also grew their share prices by 8.82%, 8.11% and 6.34% respectively.

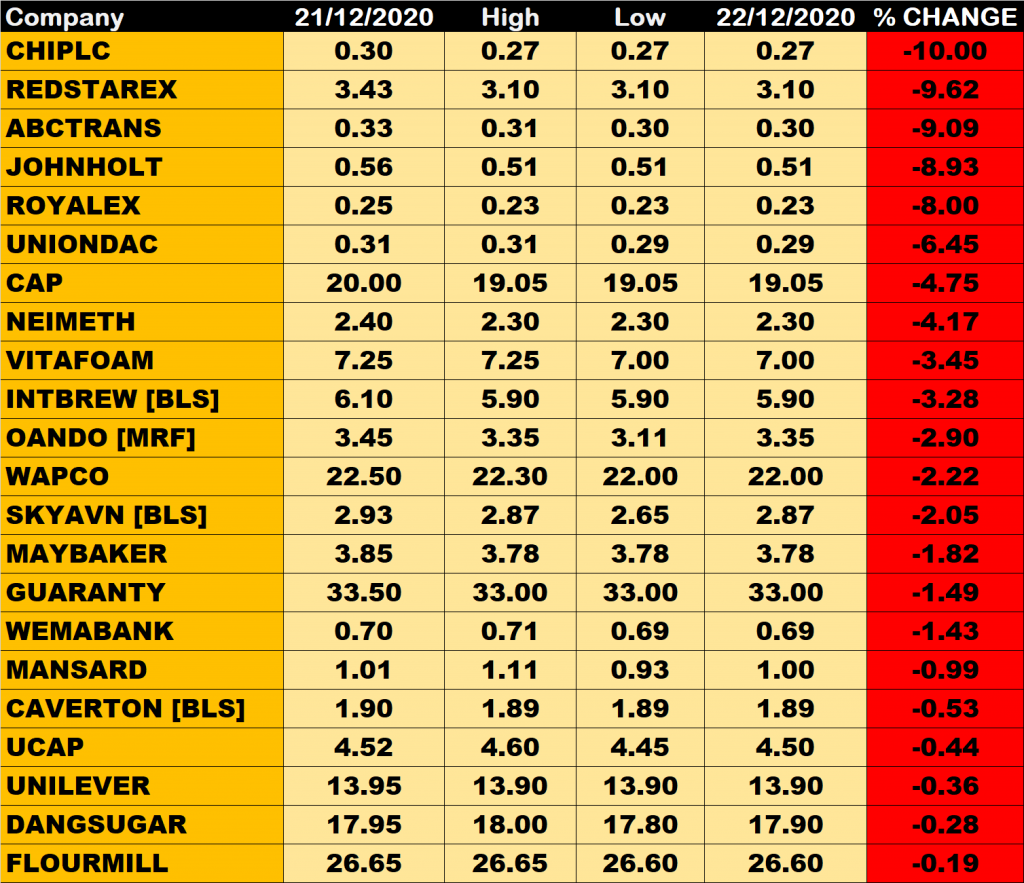

Percentage Losers

Consolidated Hallmark Insurance led other price decliners as it shed 10% of its share price to close at N0.27 from the previous close of N0.30.

Red Star Express, ABC Transport and John Holts Plc among other price decliners also shed their share prices by 9.62%, 9.09% and 8.93% respectively.

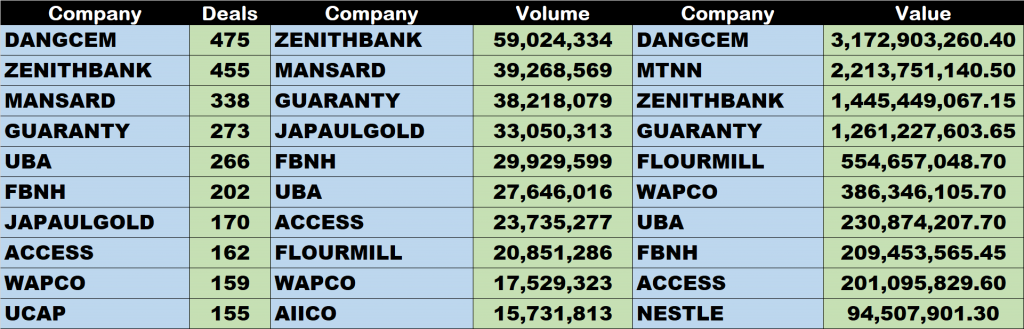

Volume Drivers

- Zenith Bank traded about 59.02 million units of its shares in 455 deals, valued at N1.455 billion.

- AXA Mansard traded about 39.27 million units of its shares in 338 deals, valued at N40.12 million.

- Guaranty Trust Bank traded about 38.22 million units of its shares in 273 deals, valued at N1.26 billion.