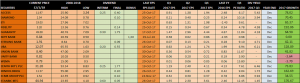

- 2017 Price performance analysis

- 2017 Factors behind price rally

- 2018 forecast and factors for

Either for the short, medium or long term, it is almost impossible investing in the Nigerian bourse without a consideration for bank stocks. For that is where the required volumes for high level trades are readily available, just pick and hold the leaders among them and you are bound to hit big profit if only you can wait and to the laggards, strategic shuttling can most times be profitable depending on market swings.

It suffices to state that the industry is the most regulated in Nigeria. To that effect, in as much as depositors’ funds remain the primary aim of the high level regulation, the multiplier effect would rub off shareholders’ funds as such will also in the long run become protected. At that, investments in bank stocks can be best described as sensible risk taking.

Notably, leading organisations in the industry pay interim dividend. In other words, there is always something to look forward to in bank stocks at intervals unlike in other industries where investors only look forward to the annual reports. This remains a high point, investing in bank stocks.

Echoes from past stiff regulations of Nigerian banks portray Nigerian bank managers as not only bold but dogged such that no matter the severity of the operating environment, they will always find their ways to survive well and when the operating environment becomes favourable, they declare super normal profits and subsequently, above average dividends to their investors. Price performances had always been enough proves. To be specific, running away from bank stocks all because of seeming negative pronouncement by the apex bank had often proven to be wrong strategy as the banks do always bounce back better and more formidable within a couple of months after such introductions.

Treasury single account policy of the Federal government and the introduction of BVN by the apex bank all have aided banking activities in the last couple of years. Going forward, these can only get better as implementation becomes more effective. To a large extent, funds outside of the banking system will gradually wane as banks’ turnover increase over time.

2017 EARNINGS PERFORMANCES:

Central Bank’ policies on foreign exchange management were largely favourable to the banks, besides, most of them raked in lots of profits by deploying technology. Today in Nigeria, banking transactions happen all within seconds unlike in days of yore when such transactions do take long hours to complete. Nigerians will readily part with a token as incentives to the banks than to travel long distance to queue in baking halls. As expected, less staff will be needed as technology gets better. Consequently, staff layoffs and reduction became imminent as the banks focussed on retail and consumer banking and in the process, saving cost. In effect, a measure of profitability was achieved in the year going by the statement of accounts presented to the market.

As we speak, with Q4 2017 results being awaited, it suffices to state that the build up in the quarterly reports were encouraging hence, audited reports being awaited promise good tidings. The caveat in a few however remains outstanding as funds belonging to the nation’s leading oil company is still hanging.

2017 PRICE PERFORMANCES:

Fidelity Bank Plc was the best in price performance in 2017 with a growth of 192.8%. Stanbic and FBNH were next with 176.67% and 162.69% price growth respectively. Wema and unity Banks ended 2017 with marginal loss of -3.70% and -3.64% respectively. Notably, these two equities had wiped off the negative returns in price within the first few trading days in 2018.

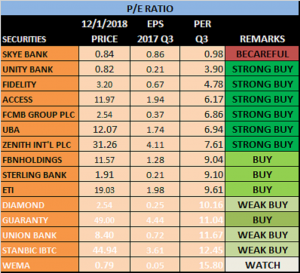

HOW PROFITABLE ARE BANK STOCKS IN 2018?

Going by the outstanding price performances in 2017, will bank stocks remain profitable in 2018 as they were in 2017? The simple answer is a straight YES. Price to Earnings Ratio of most of the banks are still largely low thus suggesting some more price distance to be covered.

2017 was a year when the stock price of Guaranty Trust Bank Plc broke its 2008 highest price level. The stock price yet did not remain stagnant but forged ahead to create a new all time high. 2018 might just be the turn of others like Zenith and to those that might not necessarily break the 2008 highest prices, 2018 seems a good year to consolidate and bridge the gap between the 2008 and current prices.

FORCES FOR 2018:

INEC’ election timetable as recently released has it that general elections have been slated for March 2019. That presupposes that candidates to contest elections will emerge in 2018 when campaigns also are meant to commence after party conventions. Money flow within 2018 is bound to be lot better as Federal and State Governments will rise to woo the populace by rising to make good their electioneering promises. Though the CBN is expected to rise to curtail inflation, it is generally believed that most financial institutions will not suffer shortage of funds so much so long government expenditure is expected to improve.

Earnings of financial institutions up until Q3 2017 were positive with a number of the banks almost reporting in Q3, their Q4 earnings of the previous year. Earnings outlook for Q4 2017 to be released to the market anytime beginning March 2018 is positive.

CHOOSING THE BEST BANK STOCKS:

- ZENITH: Currently selling at N31.26, the bank stock price will rally closer to its 2008 highest price of N53 in 2018. This will be achieved gradually and almost unnoticed. Investment in Zenith requires lots of patience as the stock price does not have records of sharp, spontaneous geometric growth. Current P/E Ratio of 7.61 lends credibility to the fact that the stock is grossly underpriced. Zenith has no TSA encumbrances. Its foreign loans are well provided for. If a 2107 Q4 expected earnings of N5 is achieved, current price will be a bargain. Interim dividend later in the year is a boost.

- ACCESS: Remains grossly underpriced at current price of N11.97 as its Q3 2017 earnings of N1.94 stands strong. The bank is currently strengthening its retail banking arm with the intentions to significantly lead in the industry. It has also revamped its technology deployment to meet expected challenges. The bank has no issues with TSA. On its journey back to the highest level in price, it is currently dwelling around its September 2008 price level. If Access meets an expected N2.50 2017 Q4 EPS, the price will still remain cheap even at N20. Interim dividend later in the year is an expected boost.

- UBA: This is one of the most resilient stocks in price on the floor of the Nigerian Stock Exchange. Investing in UBA at a low of N1.63 would have been great if held till date. If that was missed, investing at current price being considered comparably cheap offers another great opportunity on the strength of its 2017 Q3 EPS of N1.74 and current P/E Ratio of 6.94. The bank, long before others strongly mobilises grassroots savings. The deployment of technology and spread across the continent seem enough security for sure profit under whatever circumstance. Without any TSA encumbrances and expected Q4 2017 earnings of N2.40, UBA will still be considered cheap at a price near N20.

- GUARANTY: This is outstandingly the highest priced bank stock and one of the few stocks in the market that had wiped off its entire losses of 2008. The stock price is as a matter of fact selling at about 20% above its 2008 highest price level. Going forward, positive sentiment will keep the price steadily up. Current P/E ratio of 11.04 from Q3 2017 EPS of N4.44 ranks among the highest in the industry. Expected 2017 Q4 EPS of not less than N5.50 stands the stock price at N55 target price but trust Guaranty, it will silently surpass price expectation.

- FIDELITY remains strong in earnings. Major concern is however the pressure of NNPC unremitted funds in its kitty. Provisions for this might affect audited report but if it is well accommodated, risk investing at current price might be minimal. Its foreign loan was oversubscribed. Fidelity’s 2017 Q3 earnings were almost double its Q4 2016 earnings. it is expected that its Q4 2017 EPS will show a tremendous growth over its 2017 Q2. At that, Fidelity might report about N1 2017 Q4 EPS. if this is achieved, the price still stands to rise by above 50%.

- FBNH is big, old but nimble. Pressure arising from loan loss provision of its bank component beclouds its glory. As this is being dealt with strategically, with the deployment of technology and high level mobilisation across the nation, current P/E Ratio of 9.04 based on 2017 Q3 EPS of N1.28 makes the stock suitable for cautious purchase, most suitable for long term hold.

- ETI’s current P/E Ratio based on the N1.98 2017 Q3 EPS declared make the stock a buy for medium term hold. Its spread across the continent immunes the bank against factors that could incapacitate others.

- WEMA could be regarded as a penny stock in its industry. Its price is bound to rally as the prices of others in its industry improve. Wema Bank’ leading cutting edge technology and mobilisation might begin to yield in 2018. Watch out.