- GTCO leads in turnover growth and profit margin

- Comparative Analysis of Banking Sector in H1 2023

Wole Olajide

Performance of banking stocks in the first half of 2023 to a large extent was quite impressive as most of the banks reported growth in their top line and bottom line figures. Except for Unity Bank that reported loss after tax of N38.87 billion.

Apart from the fact that performance of the banking sector was good, there is also improvement in their dividend pay-out as most of the banks that usually pay interim dividend increased it, when compared to the previous year. Zenith Bank and GTCO for instance increased their interim dividends to 50 kobo from 30 kobo. UBA increased interim dividend pay-out to 50 kobo from 20 kobo. Access Holdings increased their interim dividend to 30 kobo from 20 kobo. Fidelity Bank also increased interim dividend to 25 kobo from 10 kobo.

Prices of these stocks have been rewarded significantly in the past few weeks based on their impressive Q2 2023 results, coupled with other positive economic signals.

Ranking the performance of the banking sector regarding their second quarter earnings, UBA emerged best in terms of Gross Earnings (turnover), Profit after tax (PAT), PAT growth, P/E ratio and earnings yield. At that, UBA is currently the most attractive stock, based on H1 2023 earnings performance.

The metrics below show the detailed performance of Banks listed on the Nigerian Exchange (NGX) for the period ended 30 June 2023.

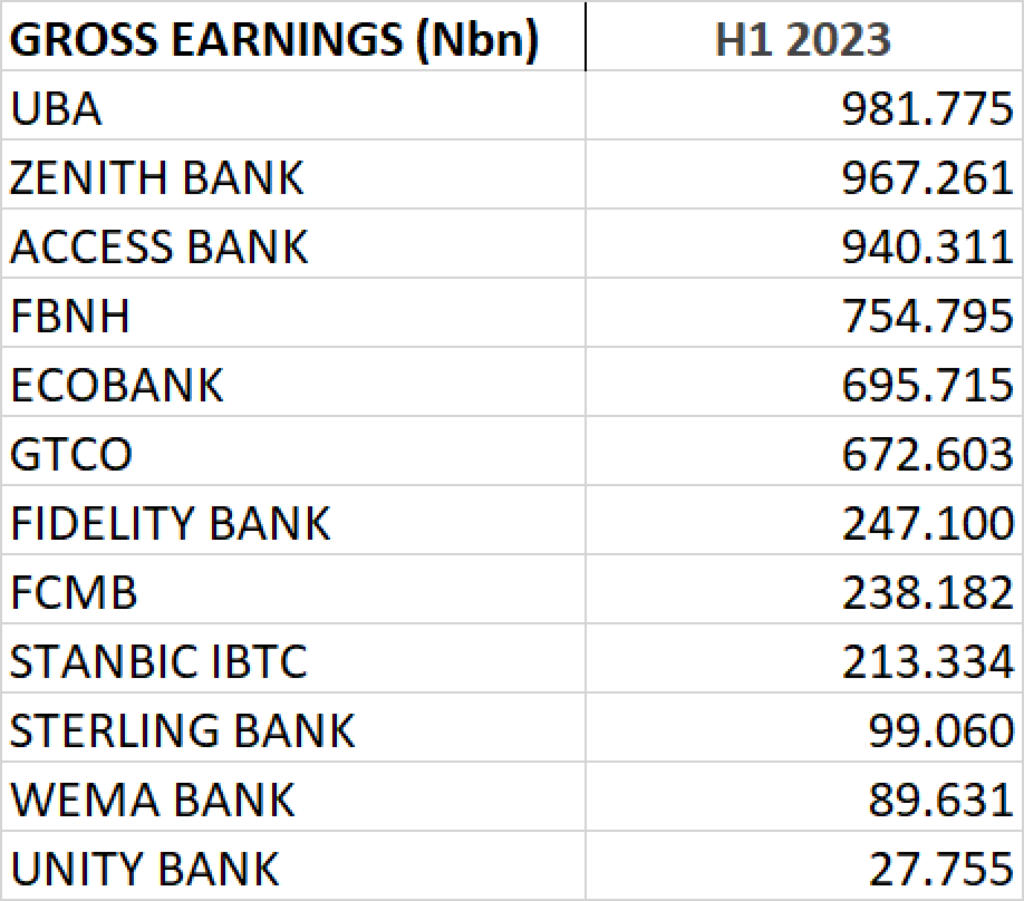

TURNOVER

UBA, Zenith Bank and Access Holdings are ranked first, second and third respectively in turnover for the 6 months period. UBA achieved Gross Earnings of N981.775 billion, Zenith Bank recorded Gross Earnings of N967.261 billion and Access Holdings recorded N940.311 billion as Gross Earnings.

Others that surpassed N500 billion mark in turnover include: FBNH, Ecobank and GTCO with a Gross Earnings of N754.795, N695.715 and N672.603 billion respectively.

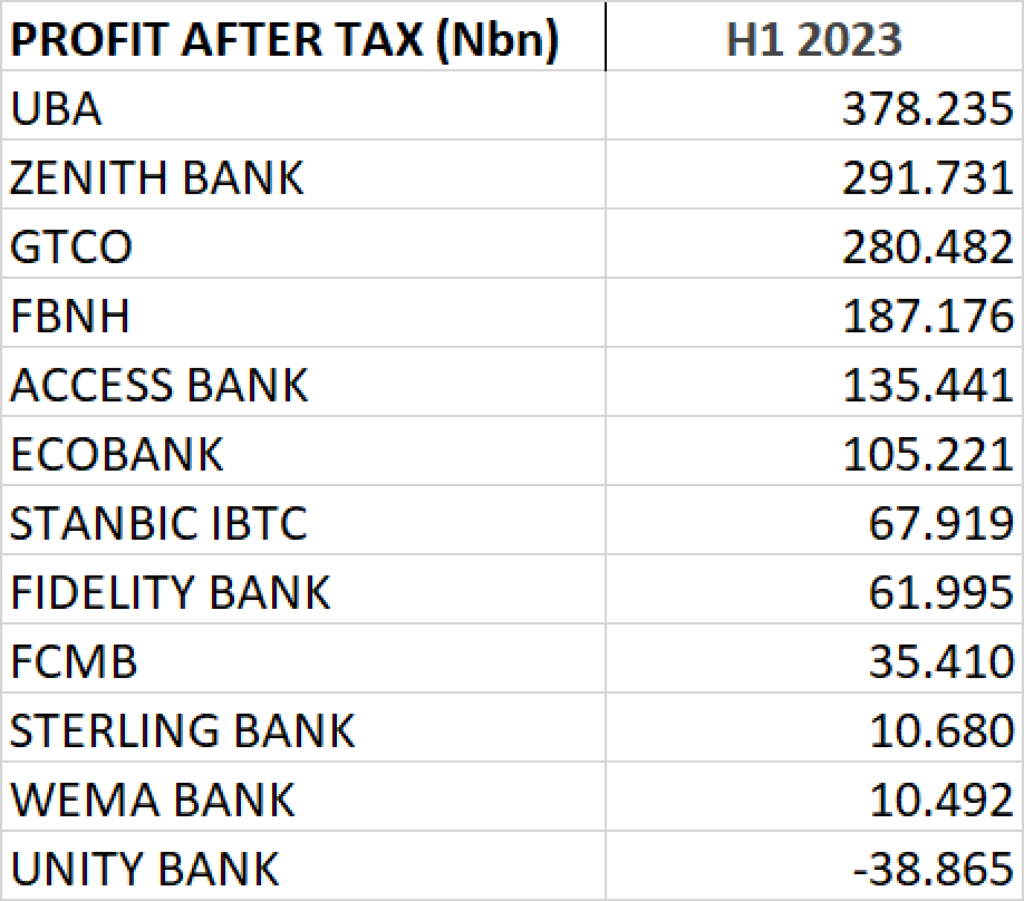

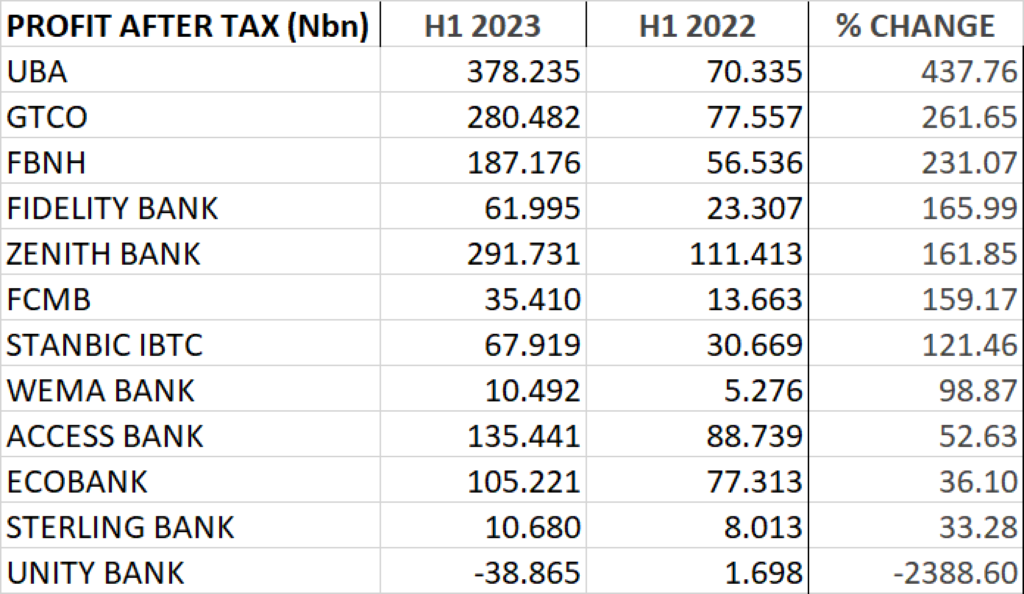

PROFIT AFTER TAX

- UBA emerged top in profit after tax for the period under review. The bank reported N378.235 billion as profit for the 6 months period.

- Second in the rank is Zenith Bank with Profit after Tax of N291.731 billion in the first half of 2023.

- Third in the rank is GTCO which recorded N280.482 billion as profit after tax for the 6 months period

- Fourth and Fifth on the rank are FBNH and Access Holdings with the profit after tax of N187.176 billion and N135.441 billion respectively.

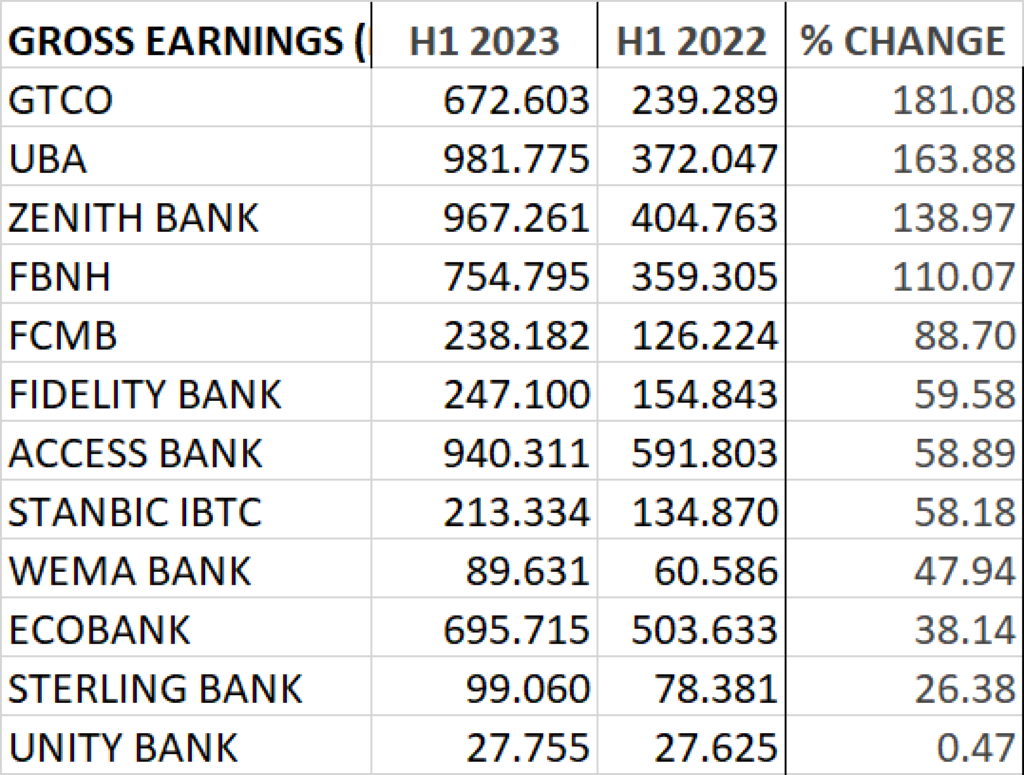

PERFOMANCE IN TURNOVER GROWTH

- GTCO emerged first in terms of turnover growth in half year 2023 as it reported Gross Earnings of N672.603 billion, up by 181.08% from N239.289 billion reported the previous year.

- Second in rank in terms of growth in turnover is UBA. The bank achieved Gross Earnings of N981.775 billion for the 6 months period, being the highest. This represents a growth of 163.88% from N372.047 billion achieved the previous year.

- Zenith Bank emerged third in terms of turnover growth. The Bank reported Gross earnings of N967.261 billion for the 6 months period, up by 138.97% from N404.763 billion reported the previous year.

- Others in the ranking for turnover growth include: FBNH (111.07%), FCMB (88.07%), Fidelity Bank (59.58%), Access Holdings (58.89%), Stanbic IBTC (58.18%), Wema Bank (47.94%), Ecobank (38.14%), Sterling Bank (26.38%) and UNITY Bank (0.47%) respectively.

PERFORMANCE IN PAT GROWTH

- UBA grew its profit after tax, year on year by 437.76% to N378.235 billion from N70.335 billion reported the previous year, emerging as best in terms of PAT growth.

- GTCO ranked second in terms of growth in profit after tax. The financial institution reported profit after tax of N280.482 billion, up by 261.65% from N77.557 billion reported the previous year.

- FBNH grew its profit after tax by 231.07% year on year to N187.176 billion from N56.536 billion reported in H1 2022.

- Fidelity Bank grew its profit after tax by 165.99% to N61.995 billion from N23.307 billion achieved the previous year.

- Fifth on the ranking is Zenith Bank with a PAT growth of 161.85% year on year, recording N291.731 from N111.413 reported the previous year.

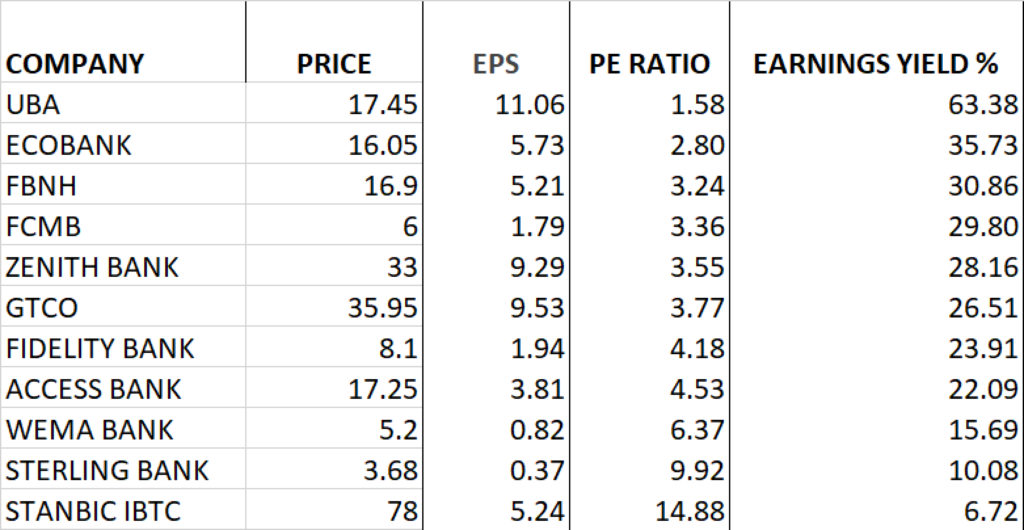

PERFORMANCE IN P/E RATIO AND EARNINGS YIELD

- UBA is currently trading at N17.45. With the Q2 2023 earnings per share (EPS) of N11.06, a low P/E ratio of 1.58x and earnings yield of 63.38% makes UBA very attractive, as a matter of fact the most attractive banking stock at the moment.

- Ecobank is currently trading at N16.05. With EPS of N5.73, the P/E ratio of the Ecobank stands at 2.80x with earnings yield of 35.73%.

- FBNH is currently trading at N16.90. With the EPS of N5.21, the P/E ratio of the Big Elephant stands at 3.24x with earnings yield of 30.86%.

- FCMB is currently trading at N6. With the EPS of N1.79, the P/E ratio of FCMB stands at 3.36x with earnings yield of 29.80%.

- Zenith Bank is currently trading at N33. With the EPS of N9.29, the P/E ratio of the Zenith stands at 3.55x with earnings yield of 28.16%.

- GTCO is trading at N35.95. With the EPS of N9.53, the P/E ratio of GTCO stands at 3.77x with earnings yield of 26.51%.

- Fidelity Bank is trading at N8.10. With the EPS of N1.94, the P/E ratio of Fidelity stands at 4.18x with earnings yield of 23.91%.

- Access Holdings is trading at N17.25. With the EPS of N3.81, the P/E ratio of Access stands at 4.53x with earnings yield of 22.09%.

- Wema Bank is trading at N5.20. With the EPS of N0.82, the P/E ratio of Wema Bank stands at 6.37x with earnings yield of 15.69%.

- Sterling Bank is trading at N3.68. With the EPS of N0.37, the P/E ratio stands 9.92x with earnings yield of 10.08%

- Stanbic IBTC Holdings is trading at N78. With the EPS of N5.24, the P/E ratio is 14.88x with earnings yield of 6.72%.

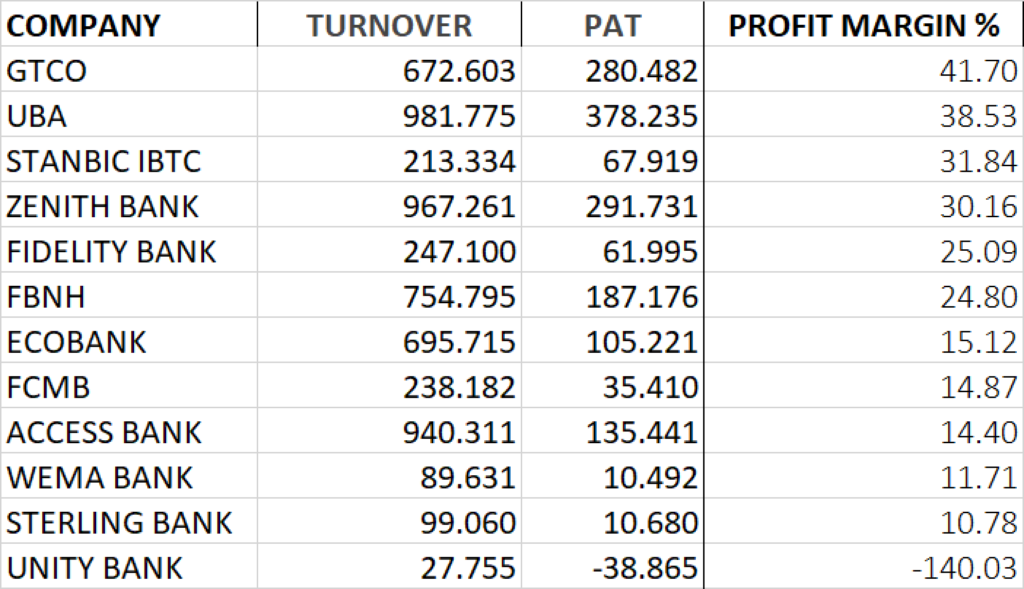

PROFIT MARGIN

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every revenue generated.

Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry.

It is calculated as Profit After Tax, divided by Revenue or Turnover, multiplied by 100.

GTCO achieved the profit margin of 41.7%, emerging top in the banking sector for the period under review. This is followed by UBA, Stanbic, Zenith Bank and Fidelity Bank with the profit margin of 38.53%, 31.84%, 30.16% and 25.09% respectively.