The new rates in the money market announced by Central Bank of Nigeria (CBN) yesterday brought about capital flight from the capital market to the money market and fixed income space. Investors will continue to move their resources from the capital market into those markets so long the rates are attractive. It is believed that the money market space for now is more preferable.

The government is not really predictable. As this new rate was just decided, they could come again tomorrow to fix another rate. It can be deduced that the government is not consistent with its policy as they can do whatever they like with the rates.

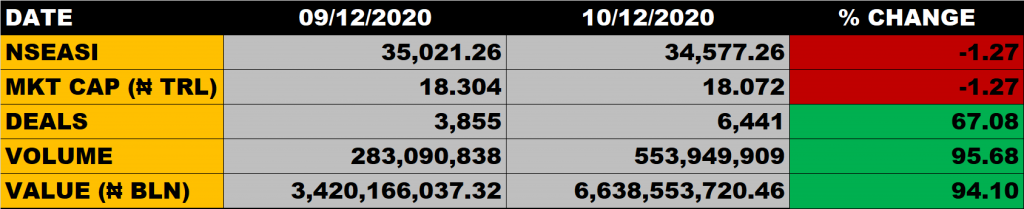

The All Share Index on Thursday depreciated further by 1.27% to settle at 34,577.26 points from the previous close of 35,021.26 points. Market capitalisation declined by 1.27% to N18.072 trillion from the previous close of N18.304 trillion, thereby shedding N232 billion.

An aggregate of 553.95 million units of shares were traded in 6,441 deals, valued at N6.64 billion.

The market breadth closed negative as only 6 stocks gained while 40 stocks declined in their share prices.

Stocks to Watch

We have always advised investors to take position in fundamentally sound stocks. If such stocks drop in a down market, there is every tendency that there position will come back when the market becomes good. There will not continue to be down. We understand that the government have expenditures to meet, and when there target is met, they will obviously come back to crash the rates; and the money will come back to the capital market.

We need to continue to look at stocks that will continue to pay good dividend if you miss capital appreciation, you will be compensated by good dividend

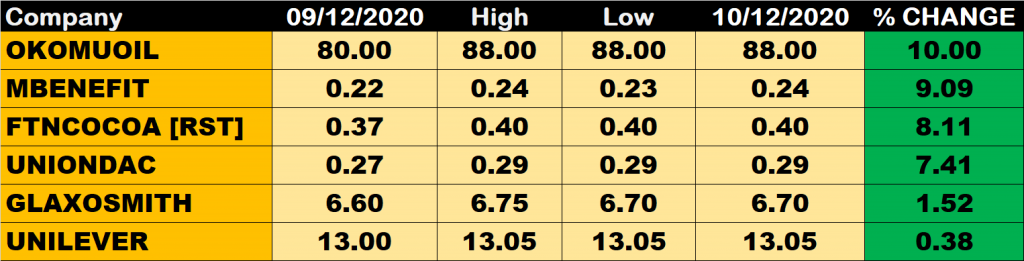

Percentage Gainers

Okomu Oil led 5 other gainers with 10% growth to close at N88 from the previous close of N80.

Mutual Benefit Assurance and FTN Cocoa Processors among other gainers also grew their share prices by 9.09% and 8.11% respectively.

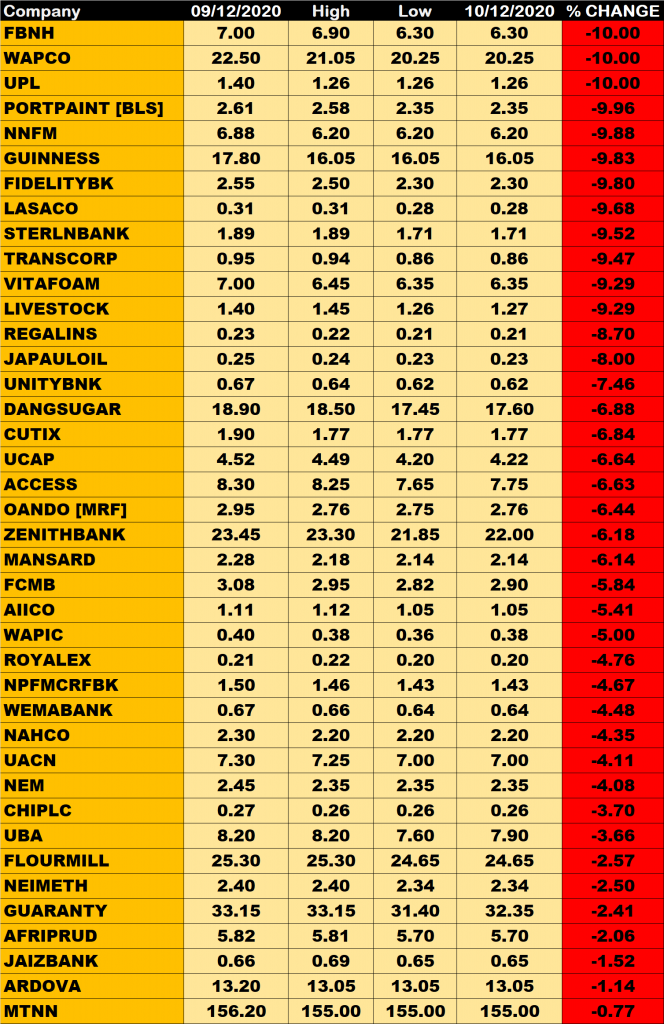

Percentage Losers

First Bank, Wapco and University Press lost 10% to close at N6.30, N20.25 and N1.26 respectively.

Portland Paints, Norther Nigerian Flour Mills (NNFM) and Guinness among other price decliners also shed their share prices by 9.96%, 9.88% and 9.83% respectively.

Volume Drivers

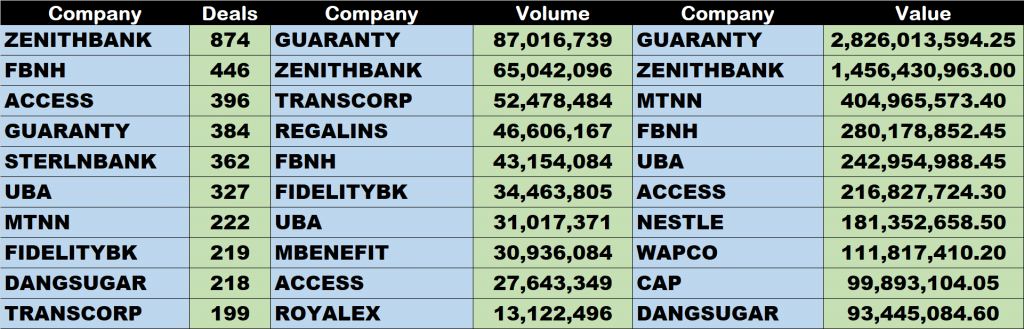

- Guaranty Trust Bank traded about 87 million units of its shares in 384 deals, valued at N2.826 billion.

- Zenith Bank traded about 65 million units of its shares in 874 deals, valued at N1.456 billion.

- Transcorp traded about 52.48 million units of its shares in 199 deals, valued at N46.08 million.