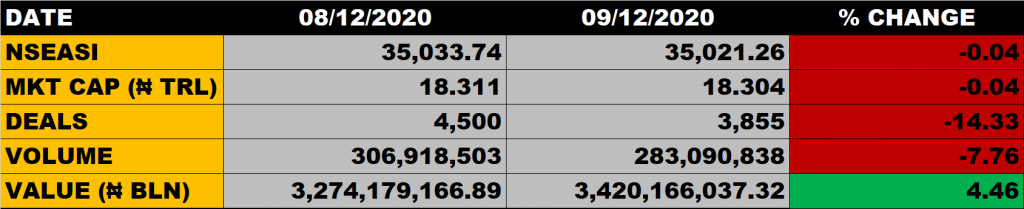

The Nigerian equity market on Wednesday closed in red as profit taking persists while investors await trigger for next direction. The All Share Index declined by 0.04% to settle at 35,021.26 points from the previous close of 35,033.74 points. Market Capitalisation closed at N18.304 trillion from the previous close of N18.311 trillion thereby shedding N7 billion.

An aggregate of 283.09 million units of shares were traded in 3,855 deals, valued at N3.42 billion.

The market breadth closed negative as 13 equities gained while 21 equities declined in their share prices.

Stocks to Watch

Fundamentally sound stocks should always be at the back of the mind of every investors. Discerning investors should take advantage of the ongoing market correction to take position in fundamentally sound stocks.

- Access Bank closed flat at N8.30. The stock is currently trading 30.83% away from its 52 weeks high of N12. At that, there is growth potential in the share price of Access Bank.

- FBN Holdings dropped to N7.00 from N7.05. It is trading 22.22% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant.

- Zenith Bank grew to N23.45 from N23.4. It is trading 17.12% away from its 52 weeks high of N28.5.

- WAPCO closed flat at N22.5. It is trading 13.46% away from its 52 weeks high of N26, which implies an uptrend potential for the share price of the company.

- UBA dropped to N8.20 from N8.25. It is trading 16.33% away from its 52 weeks high of N9.8. There is growth potential in the share price of the bank.

- Guaranty Trust Bank is resilient at N33.15. It is trading 13.78% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

Percentage Gainers

FTN Cocoa Processors Plc led other gainers with 8.82% growth to close at N0.37 from the previous close of N0.34.

Union Diagnostics, Chams Plc and Unity Bank among other gainers also grew their share prices by 8.00%, 4.76% and 4.69% respectively.

Percentage Losers

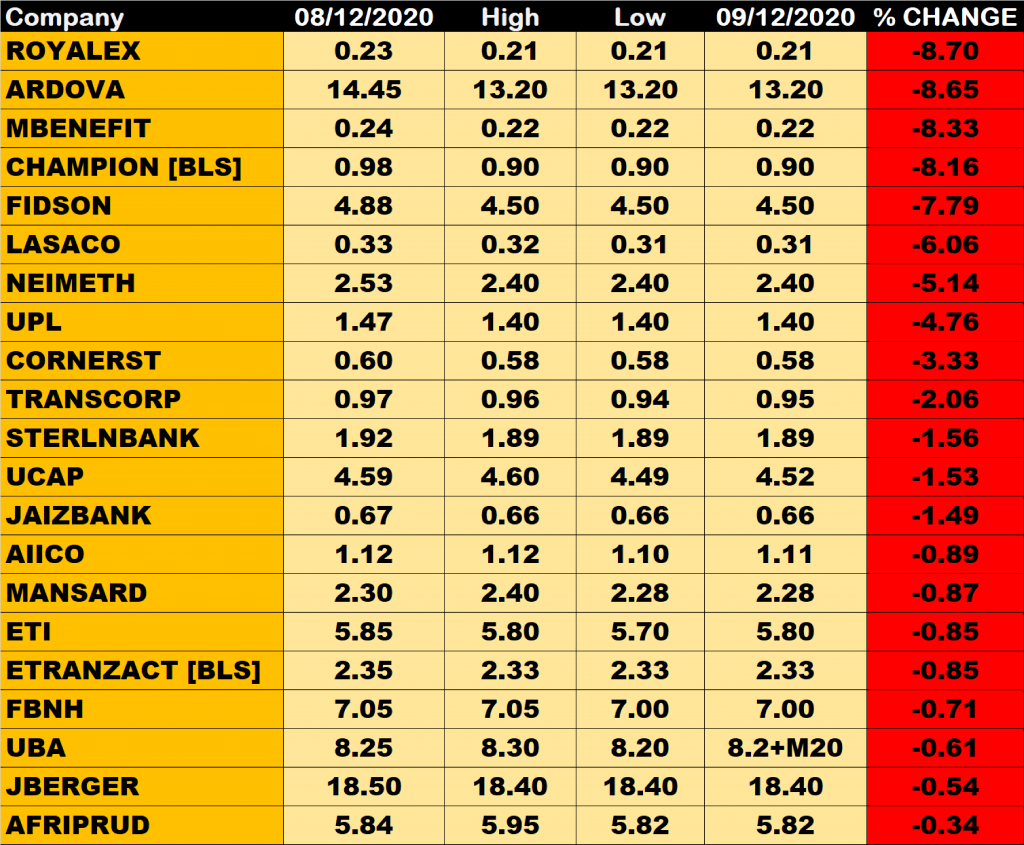

Royal Exchange Insurance led other price decliners as it shed 8.70% of its share price to close at N0.21 from the previous close of N0.23.

Ardova Plc, Mutual Benefit Assurance and Champions Breweries among other price decliners also shed their share prices by 8.65%, 8.33% and 8.16%.

Volume Drivers

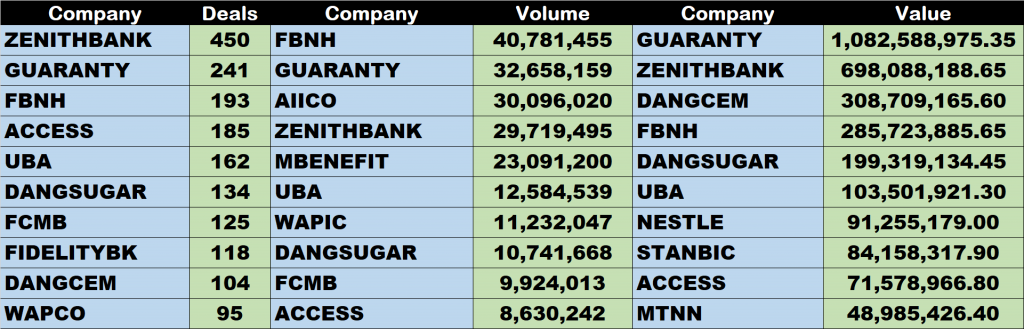

- FBN Holdings traded about 40.78 million units of its shares in 193 deals, valued at N285.72 million.

- Guaranty Trust Bank traded about 32.66 million units of its shares in 241 deals, valued at N1.08 billion.

- AIICO Insurance traded about 30.096 million units of its shares in 34 deals, valued at N33 million.