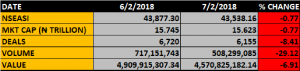

The Nigerian Stocks Market for the third straight trading sessions ended negative, after the red dominant Wednesday session saw the bourse slides 0.77% further to close at 43,538.16 points below the previous 43,877.30 points, dragging the market Year-to-Date return to 13.85%. As a result, total market capitalization declined by about N122billion to settle at N15.623trillion as against the previous N15.745trillion.

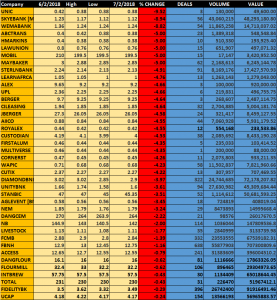

The negative close can however be traced to the bearish sentiments witnessed on heavyweight stocks like DANGOTE CEMENT which lost -2.22%, TOTAL lost -0.43%, MOBIL lost -5.00% and NIGERIAN BREWERIES also lost -2.00%.

As indicated by other metrics, Market activity slowed down in the day, as the total turnover in deals, volume and value of transactions declined by 8.41%, 29.12% and 6.91% respectively.

Sector Performance

Despite the price shedding on most tickers, the banking sector Index closed as the sole advancer for the day at 0.59%, buoyed by Bullish sentiments recorded on four banking counters, with ZENITHBANK leading to gain 2.56%, bringing its YtD change to +24.80%.

Other gaining banking stocks include Union Bank, UBA and ETI.

Huge sell-offs however continued on several counters in the sector as stocks like ACCESS which lost -0.79%, DIAMONDBNK which lost -3.97%, FIDELITYBK which lost -0.29% and FCMB which lost -1.39% witnessed an increased negative momentum.

All other sector’s indices closed negative. The industrial goods sector recorded the highest selling pressure as the price declines recorded on tickers like BERGER, CUTIX, DANGCEM and FIRSTALUM caused the sector index to shed 1.06% at the close of today’s trading session. Likewise, the NSEOILG5, NSEINS and NSEFBT10 declined by 0.81%, 0.79% and 0.31% respectively.

MARKET BREADTH

Following the bearish sentiments observed on 40 counters as against 18 counters which witnessed price advancements, the market breadth can be adjudge to be negative.

Caverton led the percentage gainers chart advancing by 9.71%, followed by Linkage assurance which gained 6.79%, and Lasaco advanced 5.88%, trading within the new per value price region.

PERCENTAGE GAINERS

On the percentage loser’s chart, Unic insurance led shedding 9.52% of its share price, followed by Skye Bank which lost 8.94% and Wema Bank among others lost 8.82%

PERCENTAGE LOSERS

BEST STOCK

FBNH in three consecutive sessions recorded the highest deal of which 55.877million units of share worth N707.3million exchanged hands this Wednesday.