The Nigerian equity market on Wednesday ended on a bullish note as prices of equities continue to rally. This is a confirmation of recovery from the losses of last week occasioned by the new rates regime in the money market.

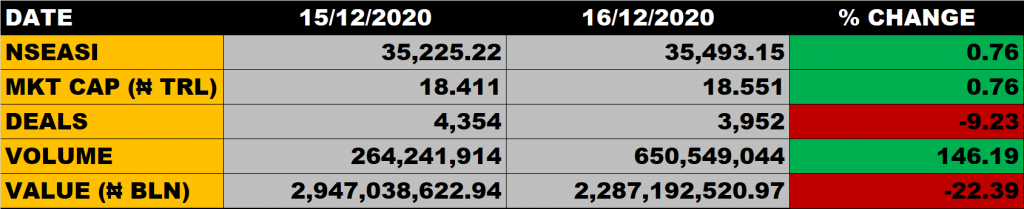

The All Share Index grew by 0.76% to 35,493.15 points from the previous close of 35,225.22 points. Investors gained N140 billion as Market Capitalization grew to N18.551 trillion from the previous close of N18.411 trillion.

An aggregate of 650.55 million units of shares were traded in 3,952 deals, valued at N2.287 billion.

The market breadth closed positive as 26 stocks gained while 13 stocks declined in their share prices.

Stocks to Watch

We have always advised investors to take position in fundamentally sound stocks. We need to continue to look at stocks that will continue to pay good dividend, such that, if you miss capital appreciation, you will be compensated by good dividend. Fourth Quarter (Q4) result is around the corner, investors should consider stocks that are going to have good dividend yield.

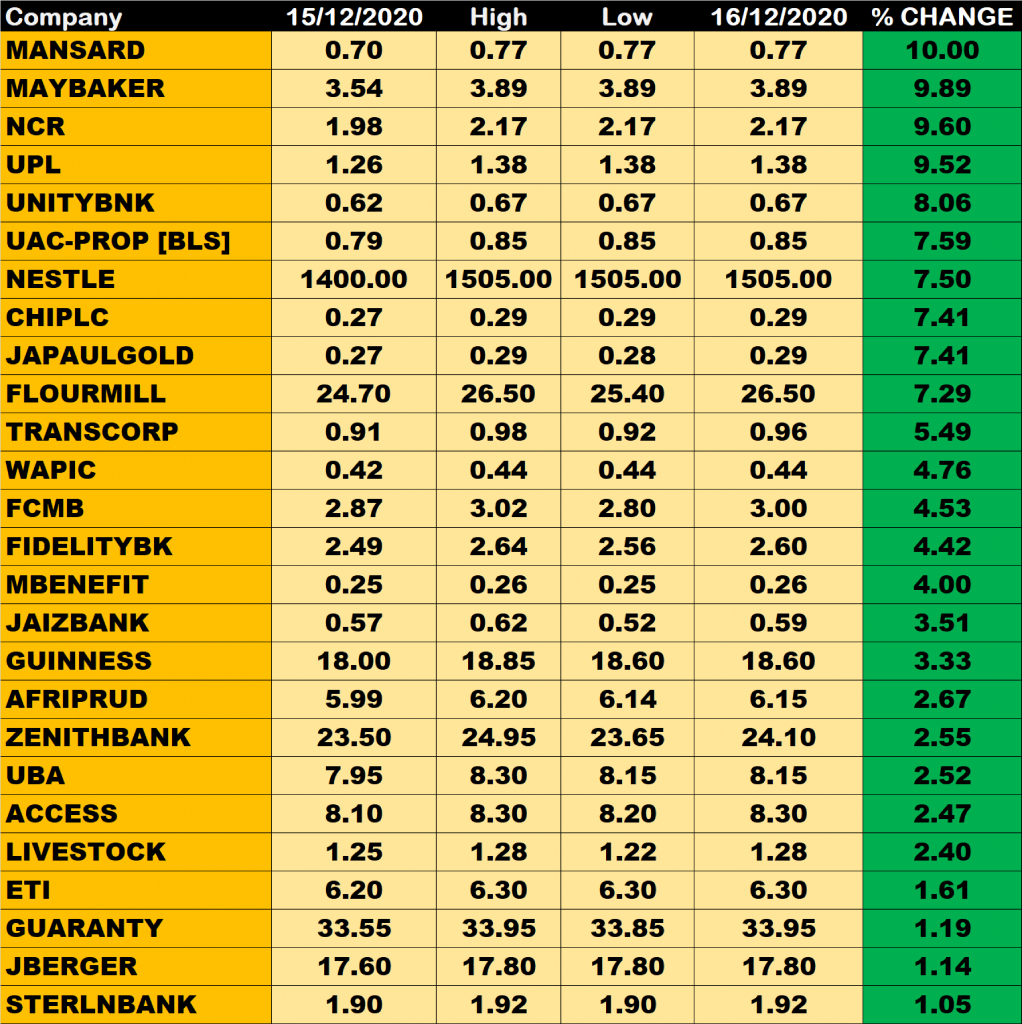

- Access Bank grew to N8.30 from N8.10. The stock is currently trading 30.83% away from its 52 weeks high of N12. At that, there is uptrend potential in the share price of Access Bank.

- FBN Holdings closed flat at N7.00. It is trading 22.22% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant.

- Zenith Bank grew to N24.10 from N23.50. It is trading 15.44% away from its 52 weeks high of N28.5.

- WAPCO dropped to N22 from N22.50. It is trading 15.38% away from its 52 weeks high of N26, which implies an uptrend potential for the share price of the company.

- UBA grew to N8.15 from N7.95. It is trading 16.84% away from its 52 weeks high of N9.8. There is growth potential in the share price of the bank.

- Guaranty Trust Bank grew to N33.95 from N33.55. It is trading 11.70% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

Percentage Gainers

AXA Mansard led other gainers with 10% growth to close at N0.77 from the previous close of N0.70.

May & Baker, NCR Nigeria and University Press among other gainers also grew their share prices by 9.89%, 9.60% and 9.52% respectively.

Percentage Losers

Cornerstone Insurance led other price decliners as it shed 8.33% of its share price to close at N0.55 from the previous close of N0.60.

Linkage Assurance and LASACO among other price decliners also shed their share prices by 8.16% and 6.06% respectively.

Volume Drivers

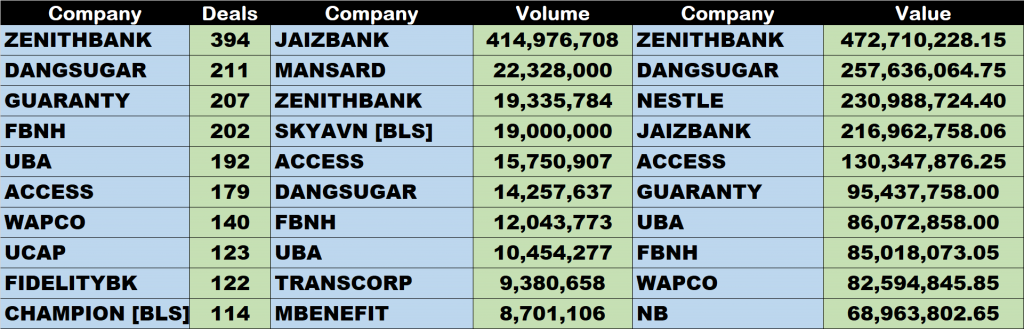

- Jaiz Bank traded about 414.98 million units of its shares in 109 deals, valued at N216.96 million.

- AXA Mansard traded about 22.33 million units of its shares in 30 deals, valued at N17.19 million.

- Zenith Bank traded about 19.34 million units of its shares in 394 deals, valued at N472.71 million.