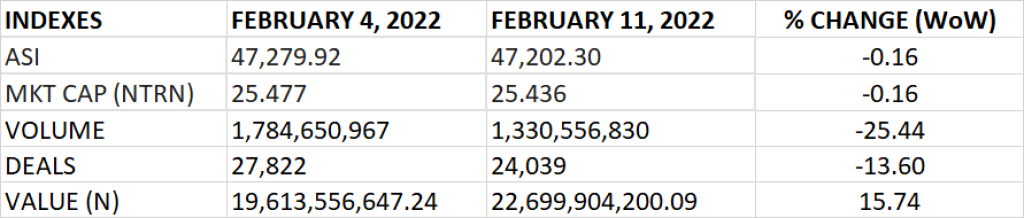

The Nigerian stock market last week closed on a bearish note, occasioned by profit taking by investors. The All Share Index and the Market Capitalisation declined by 0.16% to close at 47,202.30 points and N25.436 trillion respectively.

An aggregate of 1.33 billion units of shares were traded in 25,039 deals valued at N22.7 billion.

The Market Breadth closed positive as 44 equities emerged as gainers against 31 equities that declined in their share prices.

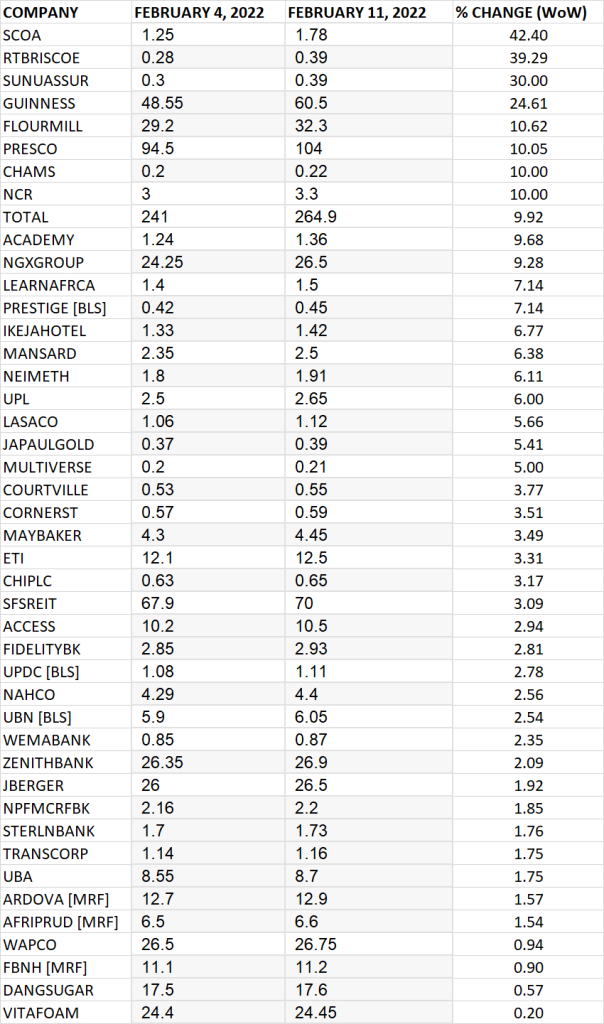

TOP 10 GAINERS

SCOA Nigeria Plc led other gainers in the course of last week with 42.40% growth, closing at N1.78 from the previous of N1.25.

RT Briscoe, Sunu Assurance, Guinness and Flour Mills grew their share prices by 39.29%, 30%, 24.61% and 10.62% respectively.

Others among top to gainers include: Presco (10.05%), Chams Plc (10%), NCR Nigeria (10%), Total (9.92%) and Acedemy Press (9.68%) respectively.

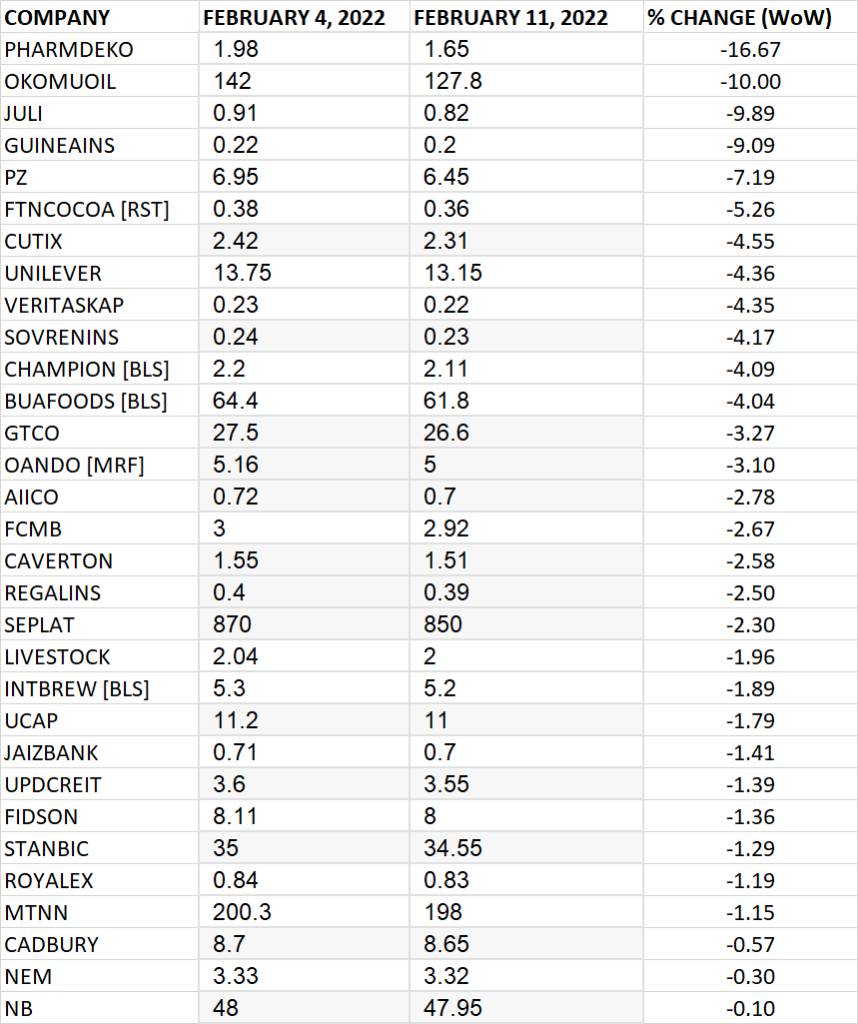

TOP 10 LOSERS

Pharmadeko led other price decliners as it shed 16.67% of its share price to close at N1.65 from the previous close of N1.98.

Okomu, Juli, Guinea Insurance and PZ shed their share prices by 10%, 9.89%, 9.09% and 7.19% respectively.

Others among top ten price decliners include: FTN Cocoa (-5.26%), Cutix (-4.55%), Unilever (-4.36%), Veritas Kapital Insurance (-4.35%) and Sovereign Trust Insurance (-4.17%) respectively.

Commenting on the market performance, the MD/CEO of Global View Capital Limited, Aruna Kebira stated thus:

“The reason why market came down last week was due to profit taking. When they released the Q4 results, a number of equities had gone up. Fidson went has high as N8.90. It is now trading around N8. People took profit in Ecobank. It went as far as N13.10; it is now trading at N12.50. Okomu got to N142, it is now trading at N127.80 due to profit taking. Zenith Bank GTCO also dropped from over N27 to N26.90 and N26.60 respectively.

Those prices that retracted will definitely go back because this is earning season. It is not as if the stock we are talking about did not do well in their earnings; they did well. It’s just that people needed to take their profit. The lower the prices of those stocks that retracted, the better”.

Stocks to Watch

- Guinness: People might think that Guinness is too high. Based on their solid result, Guinness is a good BUY.

- Learn Africa came out with a fantastic Q3 results which shows that the publishing industry is coming out of the effect of covid-19

- Okomu is a good Buy at N127.8

- Access Bank has not gotten to its level. There is uptrend potential in Access Bank because it is still trading below its value.

GAINERS

LOSERS