The equity market opened the week with massive sell-off as recession news hit the market while they also await the decision of CBN on key lending rates. As predicted by most capital market experts, the Monetary Policy Committee of the Central Bank of Nigeria retained the Monetary Policy Rate (MPR) at 11.5% and other parameters such as Cash Reserve Ratio (CCR), Liquidity ratio and asymmetric corridor unchanged.

The Bulls took over the floor of the NSE on Tuesday on the backdrop of the market’s expectation of the MPC Committee meeting outcome and the fact that Donald Trump of the US has conceded defeat to the incoming President Biden.

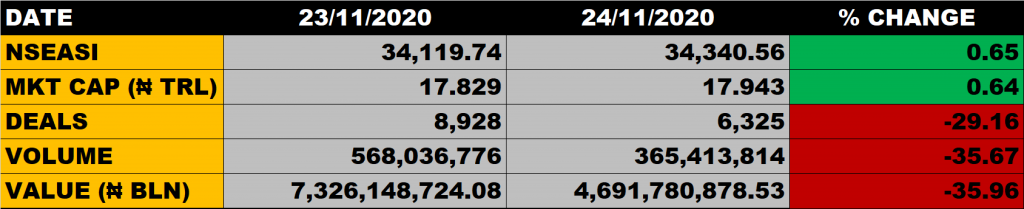

The All Share Index appreciated by 0.65% to settle at 34,340.56 points from the previous close of 34,121.78 points. The market capitalisation grew to N17.943 trillion from N17.829 trillion, which translates to N114 billion gain.

Commenting on the market performance, the Chief Dealer of Global View Capital Limited, Aruna Kebira stated thus:

The market has no choice than to rebound. It was unnecessary panic that made people to sell yesterday. Nigeria has been in recession before Buhari came in, just that bit was not announced. Well good enough that people sold. Its a fact that the market was awaiting MPC committee but to a very large extent, nobody is expecting MPC to do anything to the key lending rates till at least till 2021.

Trump has conceded defeat to Biden and ask him go ahead with transition cabinet; that’s positive news and it will definitely filter into the market. There is still liquidity at the market place. Where else will the money go to if not equity? The liquidity that is available has nowhere else to go than the equity market due to the low interest rate regime in the money market and fixed income space.

Stocks to Watch

Investors should watch fundamentally sound stocks. Looking at the stocks that have gained and the level they have gotten to; for instance Zenith got to N28.16, Guaranty Trust Bank got to N38.20, First Bank got to N9.00, Access Bank got to N10.00 and that have fallen like 10-20%, there is no way they won’t go back to where they are coming from.

Market Breadth

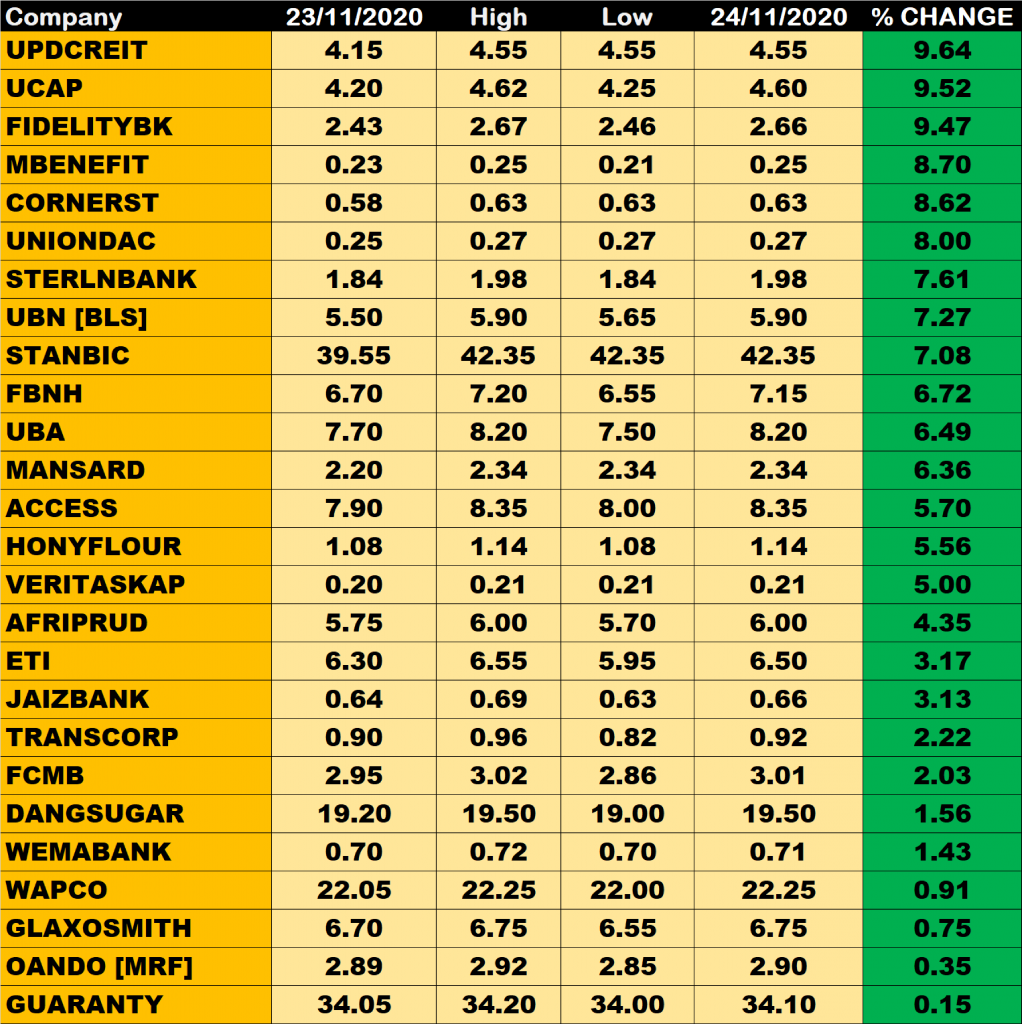

The market breadth closed positive as 26 equities gained while 16 equities declined in their share prices.

Percentage Gainers

UPDC Real Estate Investment Trust led other gainers with 9.64% growth to close at N4.55 from the previous close of N4.15.

UCAP, Fidelity Bank and Mutual Benefit Assurance among other gainers also grew their share prices by 9.52%, 9.47% and 8.70% respectively.

Percentage Losers

Eterna Plc led other price decliners as it shed 9.98% of its share price to close at N4.15 from the previous close of N4.61.

Fidson Healthcare and Champions Breweries among other price decliners also shed their share prices by 9.81% and 9.43% respectively.

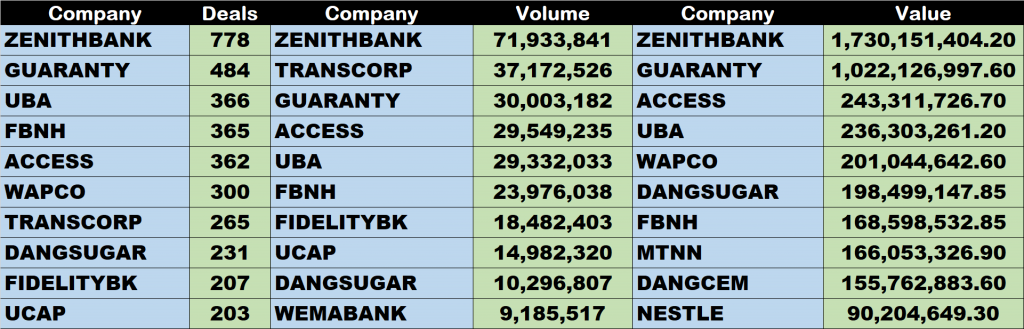

Volume Drivers

- Zenith Bank traded about 71.93 million units of its shares in 778 deals, valued at N1.73 billion.

- Transcorp traded about 37.17 million units of its shares in 265 deals, valued at N32.85 million.

- Guaranty Trust Bank traded about 30 million units of its shares in 484 deals, valued at N1.02 billion.