The Nigerian equity market on Tuesday closed on a negative note, halting 6 consecutive days of gain, occasioned by profit taking in tier one banks.

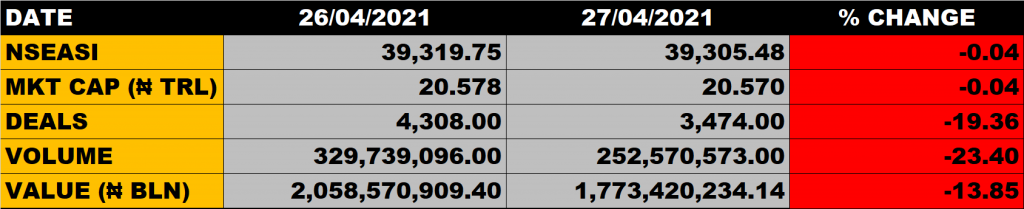

The All Share Index depreciated by 0.04%, closing at 39,305.48 points from the previous close of 39,319.75 points. The Market Capitalisation declined by 0.04% to close at N20.570 trillion from the previous close of N20.578 trillion, thereby shedding N8 billion.

An aggregate of 252.57 million units of shares were traded in 3,474 deals valued at N1.77 billion.

The market breadth closed positive as 23 equities emerged on the gainers list while 16 equities declined in their share prices.

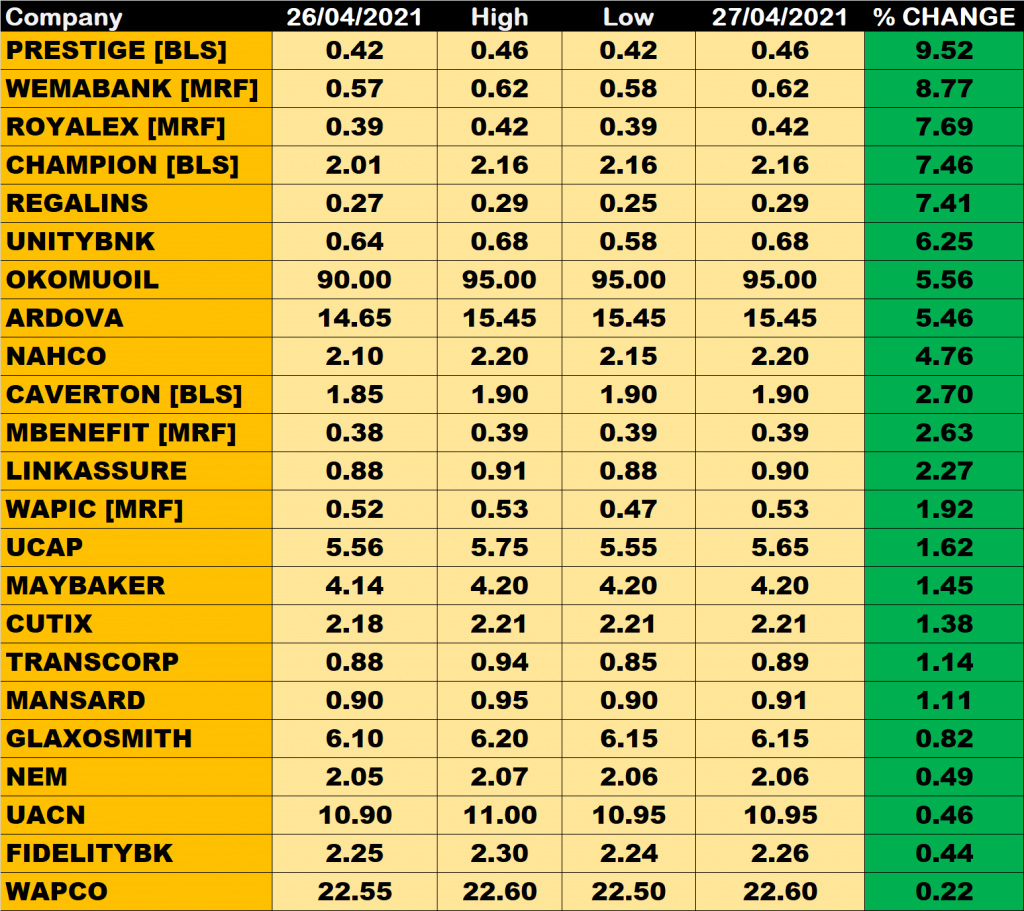

Percentage Gainers

Prestige Assurance led other gainers with 9.52% growth, closing at 46 kobo from the previous close of 42 kobo.

Wema Bank, Royal Exchange Plc and Champion Breweries among other gainers also grew their share prices by 8.77%, 7.69% and 7.46%.

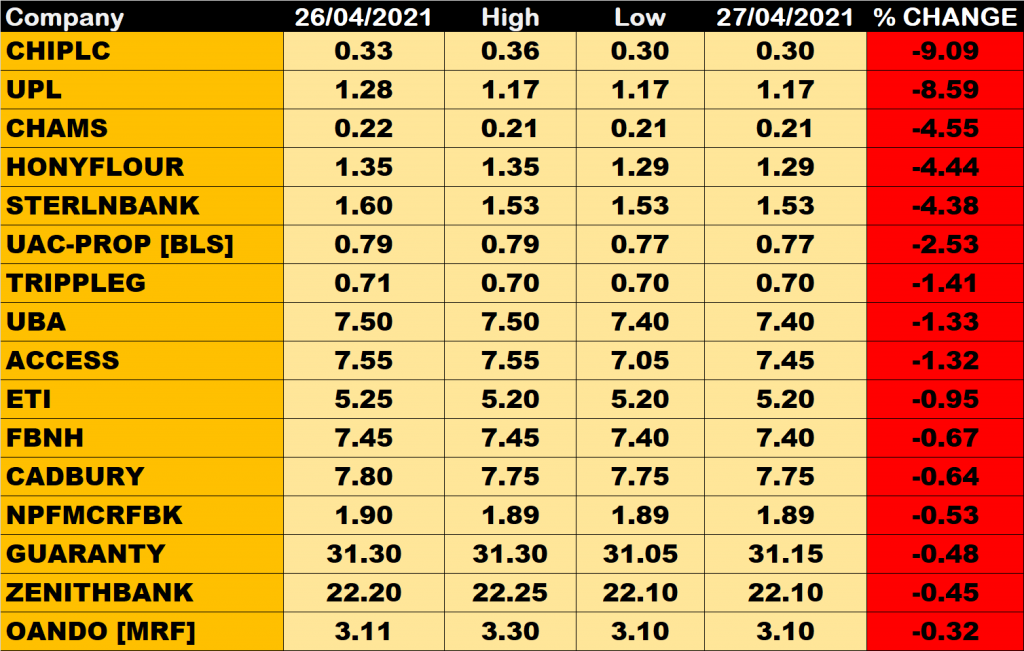

Percentage Losers

Consolidated Hallmark Insurance led other price decliners as it sheds 9.09% of its share price to close at 30 kobo from the previous close of 33 kobo.

University Press, Chams Plc and Honeywell Flour among other price decliners also shed their share prices by 8.59%, 4.55% and 4.44% respectively.

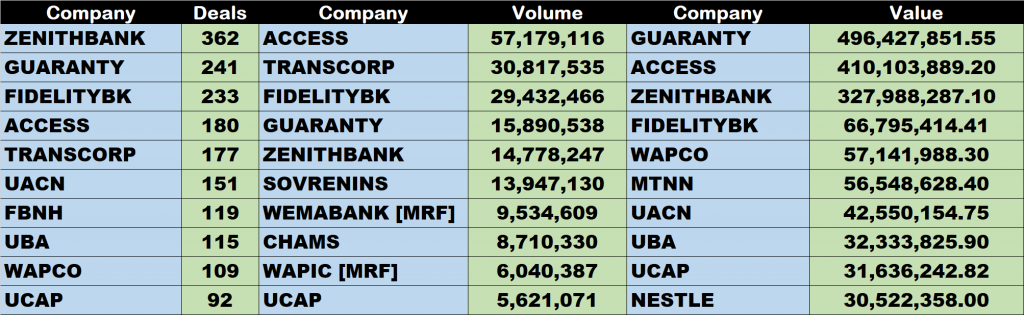

Volume Drivers

- Access Bank traded about 57.179 million units of its shares in 180 deals, valued at N410 million.

- Transcorp traded about 30.818 million units of its shares in 177 deals, valued at N27.525 million.

- Fidelity Bank traded about 29.432 million units of its shares in 233 deals, valued at N66.795 million.

Stocks to Watch

- Access Bank dropped to N7.45 from N7.55. It is trading 29.05% away from its 52 weeks high of N10.5. With the book value of N21.13, Access Bank is considered cheap at the current share price.

- FBN Holdings dropped to N7.4 from N7.45. It is trading 17.78% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N21.32, relative to the current share price, shows that FBNH is cheap at the current price.

- Zenith Bank dropped to N22.1 from N22.2. It is trading 22.46% away from its 52 weeks high of N28.5. There is uptrend potential in the share price of Zenith Bank. With the book value of N35.59 relative to the current share price, Zenith Bank is considered cheap.

- UBA dropped to N7.4 from N7.5. It is trading 24.49% away from its 52 weeks high of N9.8. With the book value of N21.17 as against its current share price, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N31.15 from N31.3. It is trading 18.99% away from its 52 weeks high of N38.45 and this implies an uptrend potential for the bank.

- Lafarge Africa (WAPCO) grew to N22.6 from N22.55. It is trading 28.25% away from its 52 weeks high of N31.5. At that, there is uptrend potential in the share price of Wapco.

i would like your magazine to develop companies data analysis application to be invaded in the web site for users of your site to access these analysis by clicking on some buttons or tags and analysis about P/E ratio, and other and profitability ratio to determine the financial health of a company before purchasing its shares.

It will attract young people if Nigerian companies will be declaring dividend at the end of each quarter of the year instead of only once in the year to make investment as a career for young investors in Nigeria and equitable distribution of National wealth and curb the menace of dangerous inflation on the income of poor people in Nigeria.

thanks .

i would like your magazine to develop companies data analysis application to be invaded in the web site for users of your site to access these analysis by clicking on some buttons or tags and analysis about P/E ratio, and other and profitability ratio to determine the financial health of a company before purchasing its shares. It will attract young people if Nigerian companies will be declaring dividend at the end of each quarter of the year instead of only once in the year to make investment as a career for young investors in Nigeria and equitable distribution of National wealth and curb the menace of dangerous inflation on the income of poor people in Nigeria. thanks .