The equity market on Friday continued its southward journey as profit taking persist by investors in order to pitch their tent in the money market and bond market where yields are now more attractive. Week to date, the market returned -1.74% and Year to date, the market has returned -4.03%.

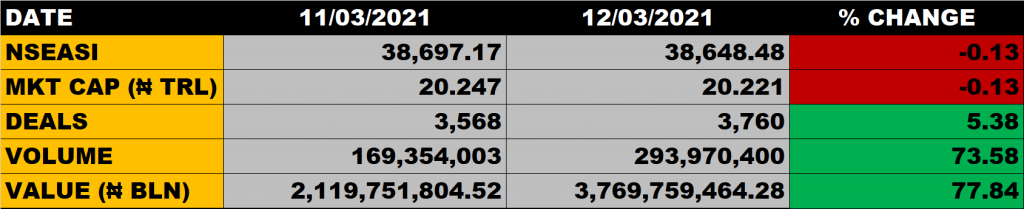

The All Share Index depreciated by 0.13% to settle at 38,648.48 points from the previous close of 38,697.17 points. The Market Capitalisation closed at N20.221 trillion, down by 0.13% from the previous close of N20.247 trillion, thereby shedding N26 billion.

An aggregate of 293.97 million units of shares were traded in 3,760 deals, valued at N3.77 billion.

The Market Breadth closed negative as 17 equities emerged as gainers against 23 equities that declined in their share prices.

Stocks to Watch

- Access Bank traded flat at N7.8. It is trading 25.71% away from its 52 weeks high of N10.5, hence there is uptrend potential in Access Bank. With the book value of N19.12, Access Bank is considered cheap at the current share price.

- FBN Holdings traded flat at N7.1. It is trading 21.11% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N19.84, relative to the current share price, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank’s share price dropped to N21.35 from N21.45. It is trading 25.09% away from its 52 weeks high of N28.5. There is uptrend potential of 24.74% in the share price of Zenith Bank. With the book value of N35.59 relative to the current share price, Zenith Bank is considered cheap.

- UBA grew to N7.15 from N6.95. It is trading 27.04% away from its 52 weeks high of N9.8. With the book value of N19.16 as against its current share price, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N30.75 from N30.95. It is trading 20.03% away from its 52 weeks high of N38.45 and this implies an uptrend potential for the bank.

- WAPCO dropped to N22 from N22.05. It is trading 30.16% away from its 52 weeks high of N31.5. There is uptrend potential in the share price of Wapco as records have it that it has touched N52 some years back.

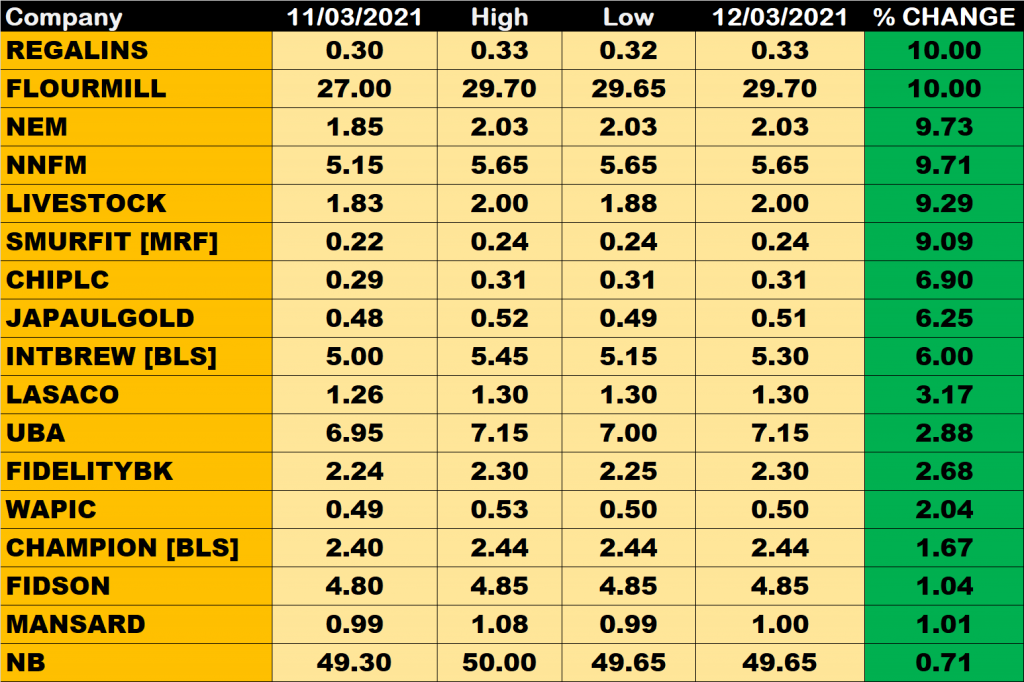

Percentage Gainers

Regency Assurance and Flour Mills both led other gainers with 10% growth to close at 0.33 and N29.7 respectively.

NEM Insurance, Northern Nigeria Flour Mills (NNFM) and Livestock Feeds among other gainers also grew their share prices by 9.73%, 9.71% and 9.29% respectively.

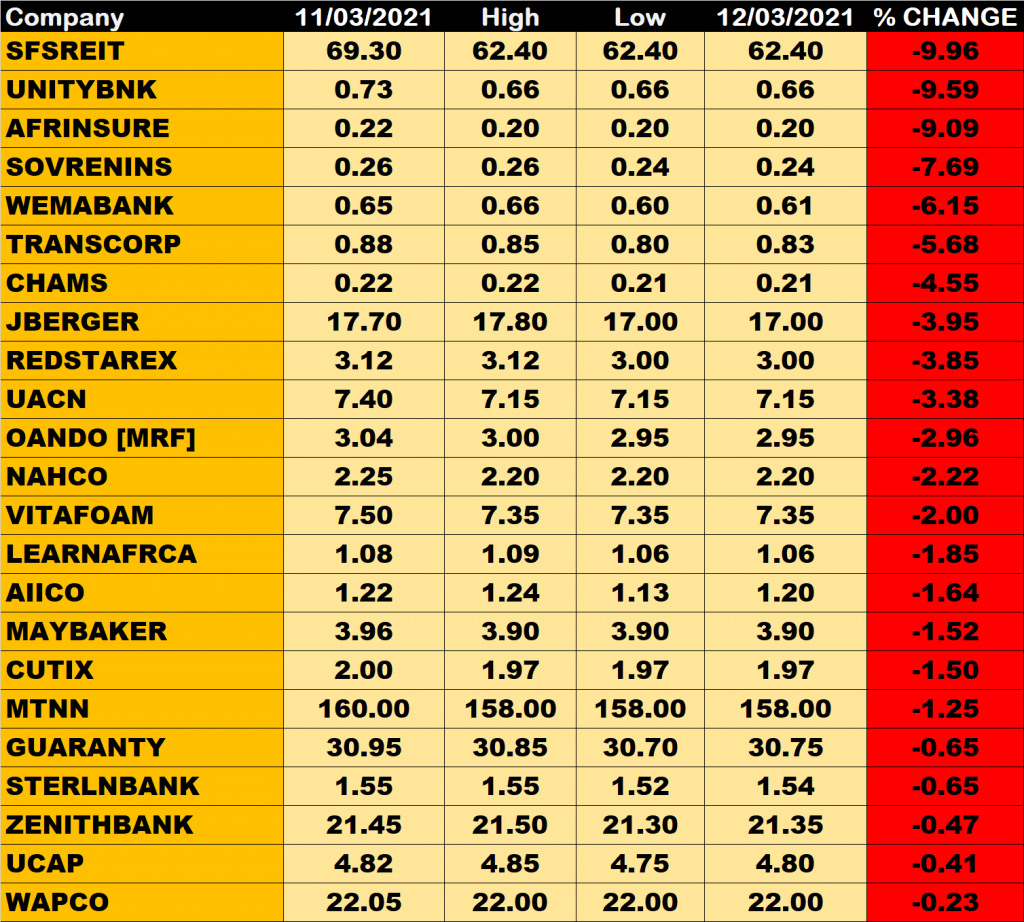

Percentage losers

SFS Real Estate Investment Trust led other price decliners as it shed 9.96% of its share price to close at N62.4 from the previous close of N69.3.

Unity Bank and Africa Alliance Insurance among other decliners also shed their share prices by 9.59% and 9.09% respectively.

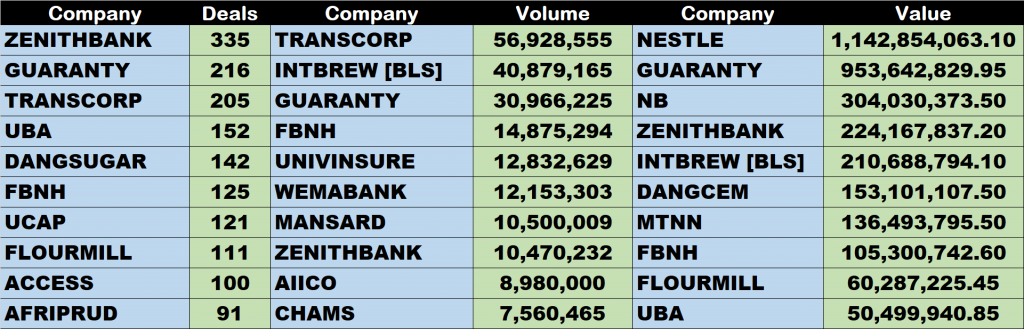

Volume Drivers

- Transcorp Plc traded about 56.93 million units of its shares in 205 deals, valued at N45.95 million.

- International Breweries traded about 40.88 million units of its shares in 44 deals, valued at N210.69 million.

- Guaranty Trust Bank traded about 30.97 million units of its shares in 216 deals, valued at N953.64 million.