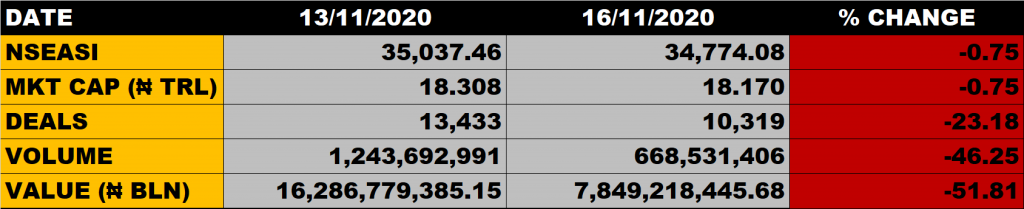

The Nigerian equity market on Monday, November 16, 2020 closed in favour of the Bears, as the All Share Index declined by 0.75% to settle at 34,774.08 points against the previous close of 35,037.46 points. Market Capitalisation declined by 0.75% to close at N18.170 from the previous close of N18.308, thereby shedding N138 billion. Year-to-date, the market has returned 29.55%.

Most times, the Bears rule the affairs on the floor of the NSE to start a new week. The admittance of the Bears is premised on the profit taking from stocks that have posted sizeable profits over the past week. The market is hopeful of a possible come back of the Bulls against the activities in the fixed income space and the low yields in the money market.

An aggregate of 668.53 million units of shares were traded in 10,319 deals, valued at N7.85 billion.

Market Breadth

The market breadth closed negative as 11 equities gained while 43 equities declined in their share prices.

Percentage Gainers

BOC Gas led other gainers with 9.92% growth to close at N5.32 from the previous close of N4.84.

Neimeth, Unity Bank and Ardova among other gainers also grew their share prices by 8.99%, 8.86% and 8.11% respectively.

Percentage Losers

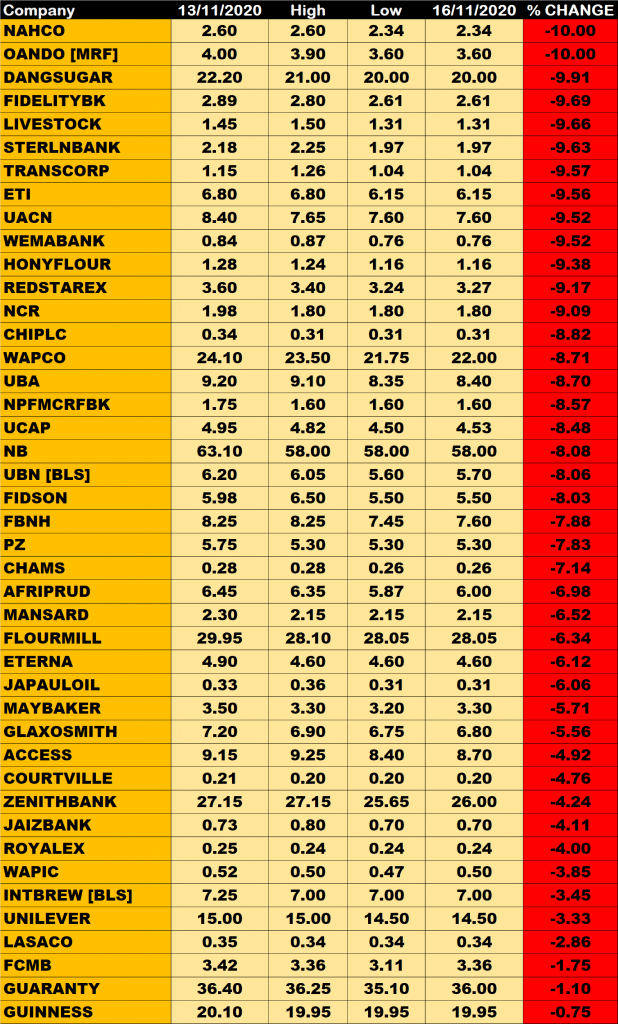

NAHCO and Oando led other price decliners as they as they shed 10% of their share prices respectively.

Dangote Sugar, Fidelity Bank and Livestock Feed among other price decliners also shed their share prices by 9.91%, 9.69% and 9.66% respectively.

Volume Drivers

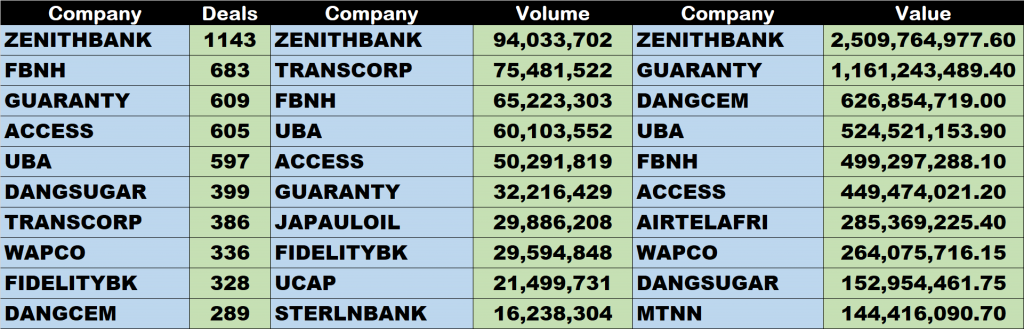

- Zenith Bank traded about 94.03 million units of its shares in 1,143 deals, valued at N2.5 billion.

- Transcorp traded about 75.48 million units of its shares in 386 deals, valued at N82.99 million.

- FBN Holdings traded about 65.22 million units of its shares in 683 deals, valued at N499.297 million.

STOCKS TO WATCH

NEIMETH

Neimeth Pharmaceuticals is currently trading at N2.91 and that translates to 369.35% growth year to date from the share price of N0.62 at the beginig of the year.

The current bull extends to other firms in the pharmaceutical space including Fidson, May& Baker, Glaxosmith. A new 52 weeks high of N2.91 was achieved by Neimeth at the close of trade on Monday.

It is obvious that pharmaceutical companies are benefiting from government intervention. Covid-19 vaccine is out and when the government will bring it in they will have to go through the pharmaceutical firms.

On the technical chart, a strong BUY recommendation is indicated for Neimeth International Pharmaceuticals.

BUA CEMENT

BUA Cement is one of the heavy weight stocks on NSE with market capitalization of N1.2 trillion. It emerged after a merger of BUA Group’s two Cement subsidiaries – CCNN and Obu Cement.

The share price of BUA Cement grew to N56 from the previous close of N52, recovering back its 52 weeks high, thus creating a new support level.

On the technical chart a strong BUY is recommended for BUA Cement.

AIRTEL

Airtel at the close of trade on Monday attained a new 52 weeks high of N500 from the previous close of N489.9.

Airtel Africa has a market capitalization of N1.84 trillion on NSE and of course it’s among the four heavy weight stocks that determines the direction of the market.

Year to date, the share price of Airtel appreciated by 67.28% from N298.9 to N500. On the technical chart, a strong BUY recommendation is indicated for Airtel Africa.

WAPCO

Lafarge (WAPCO) closed at N22, shedding 8.71% from N24.1 due to profit taking by investors. Year to date, the share price appreciated by 43.79% from N15.30. Two years back, WAPCO has traded at N52 and that shows that it has not reached anywhere.

On the technical chart, MACD indicated a BUY recommendation for WAPCO.

ZENITH BANK

Year to date, the share price of Zenith Bank has grown by 39.78% to N26 from N18.60.

With the earnings per share (EPS) of N6.65, Zenith bank has a low P.E ratio of 3.91x. This suggest that Zenith Bank is considered cheap at the current price and has further growth potential.

On the technical chart, MACD indicated a BUY recommendation for Zenith Bank.

DANGOTE CEMENT

Dangote Cement traded flat today, closing at N200.The manufacturing giant has the highest capitalization on NSE with a market capitalization of N3.41 trillion. Year to date, the share price of the manufacturing giant 40.85% to N200 from N142. Dangote Cement is just 0.94% away from its 52 weeks high of N201.90. Dangote Cement has the capacity to surpass its current price going forward.

MACD and Stochastic indicated BUY recommendation for the shares of Dangote Cement.

FIRST BANK OF NIGERIA HOLDINGS

Profit taking by investors brought down the share price of FBNH to N7.60 from the previous close of N8.25. Year to date, the share price of the big elephant has grown by 23.58% to N8.25 from N6.15.

The share price of the big elephant has performed over the years and the stock is very resilient. The effort the management of the bank have put into cleaning their book of non-performing loan is very credible.

With earnings per share of N2.05, a low P.E ratio of 3.71 suggest that the share price of FBNH is cheap at the current price.

On the technical chart, MACD indicated a BUY recommendation for FBNH.

UBA

The share price of UBA closed at N8.40, dropping by 8.7% due to profit taking by investors.

Year to date, the share price of United Bank for Africa has grown by 17.48% to N9.20 from 7.15. In the past 52 weeks, the share price of UBA has touched a high of N9.80 and a low of 4.4. It is trading 14.29% away from its year high of N9.8, hence UBA has uptrend potential. On the technical chart, MACD indicated a BUY recommendation for the shares of UBA.

GUARANTY TRUST BANK

Guaranty Trust Bank today closed at N36, shedding 1.10% to profit taking. Year to date, the share price has grown by 21.21%.

The financial giant last week Thursday touched N38.2, which is very close to its 52 weeks high of N38.45 but eventually closed at N36.40 on Friday. It dropped further to N36.

On the technical chart, MACD indicated a BUY recommendation for the shares of Guaranty Trust Bank.

ACCESS BANK

The share price of Access Bank on Monday closed at N8.70 from the previous close of N9.15 due to profit taking.

In the past 52 weeks, the share price of the bank has touched a high of N12 and a low of 5.30. Relative to the current share price of N9.15, Access Bank is trading 27.5% away from its year high of N12. At that, the share price of Access Bank has an uptrend potential.

Over the past 26 years, Access Bank has evolved from an obscure Nigerian Bank into a world-class African financial institution. Herbert Wigwe’s name is a household name as far as banking is concerned. He is taught to be intelligent and he is a good manager.