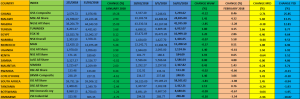

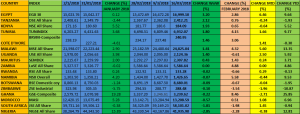

At the end of the thirteenth trading week on stock exchanges across the African continent, of the seventeen markets tracked in our analysis, only six were down while the remaining eleven so far in the year have recorded varied degrees of gains with Ghana’s GSE Composite still taking the lead with 25.85% growth. Malawi and Nigeria are next with 13.35% and 12.81% growths respectively.

Zimbabwe’s ZSE Industrial is the worst performer with 10.87% decline YtD. Other losers are Botswana’ BSE Domestic company with 1.95 decline and Tanzania’ DSE All-share with 1.93% decline.

WEEK ENDED FRIDAY MARCH 16, 2018

Meanwhile, WoW performances for the week ended Friday March 16, 2018 show that Egypt’ BGX 30 as the leader in Africa with a growth of 3.20%. Tanzania and Kenya were other markets that performed significantly in the week. While Tanzania’ DSE All-share showed a growth of 2.12%, Kenya’ NSE All-share moved higher by 1.93% in the week.

Nigeria’ NSE All-share led Africa’ losers in the week under review with a WoW decline of 2.28%. South Africa’ JSE All-share was down 1.98% while Morocco’ MASI also shed 0.57% in the week. Ghana’GSE Composite is currently the best market in Africa YtD. In the week under review declined by 0.22%.

SOUTH AFRICA:

Foreign investors upbeat on SA stocks

Foreign investors have had to face a reality check on South Africa’s economic growth outlook, but it hasn’t dampened their enthusiasm for the country or local stocks. This was one of the key takeaways from the 19th Annual Bank of America Merrill Lynch Investors Conference hosted at Sun City penultimate week.

The conference which was an opportunity for chief investment officers of local and international fund managers, pension funds and hedge funds with emerging market mandates to meet with chief executives and financial officers from corporate South Africa was attended by 59 corporate and 164 investors from 70 institutions. Roughly two-thirds of these were offshore institutions.

Strategist John Morris said foreign investors’ growth expectations were initially much higher than those of local investors or think tanks. The narrative was generally that South Africa was on a reform path and that growth rates of 3% to 4% were on the horizon.

In contrast, the IMF and World Bank don’t expect growth to exceed 2%.

“Despite that, it didn’t dampen their [the foreigners’] enthusiasm for South Africa or South African domestic stocks,” Morris said.

A survey conducted at the conference suggests that South African corporates expect growth to pick up to 2.2% on average in 2019 and that locals – think tanks, investors and corporates – expect GDP growth of between 2% and 2.5% next year.

Morris said although there had been fairly big moves in domestic share prices, foreign investors weren’t that concerned about local valuations, instead taking a longer-term reform view with the assumption that it would support earnings growth.

“The locals on the other hand feel that the valuations are punchy.”

South African investors generally have a value bias and prefer shares trading on attractive price-earnings multiples.

“They were trying to find stocks that were still reasonably attractive as opposed to the foreign investors that weren’t worried about valuations,” Morris said.

Consumer stocks in Brazil were trading at higher P/E multiples than those in South Africa, while earnings weren’t coming through that strongly either. Thus, appetite for meetings with local consumer companies was high and foreign investors seemed to be of the view that earnings growth in this area would start to come through in 2019.

Against a background of synchronised global growth and a solid macroeconomic backdrop, foreigners were not interested in rand hedges, whilst some local investors were looking to invest in this area.

Morris said local investors were taking a longer-term view and making use of the additional 5% offshore allowance granted in the budget in February.

Economic outlook

Rukayat Yusuf, economist for Sub-Saharan Africa, expects economic growth in South Africa to improve to 1.8% in 2018 and 2% in 2019, but doesn’t foresee growth to exceed 2.5% in the medium term.

“We think some of the confidence-boosting measures we are seeing will support the improvement in growth and sentiment.”

Yusuf expects inflation to accelerate to 5.2% on average in 2018, primarily on the back of the VAT hike.

“We think this can add 0.4 percentage points to inflation and in 2019 we see inflation of 5.4% again primarily due to second round effects from the VAT hike.”

As a result of the higher inflation profile, she expects the South African Reserve Bank to cut interest rates just once – by 25 basis points in March – and that rates will remain on hold thereafter.

“Based on the improvement in growth and reduced political risk we think there is now enough room for Moody’s to remain on hold at the time of the next review at the end of March. We think that the downgrade has been averted for now.”

She believes the rand is still about 7% to 15% overvalued and that it will depreciate towards R13.50 against the dollar by the end of the year.

Downside risks include lower-than-projected VAT collections, public sector wage negotiations which may require higher than anticipated increases and the discussions around land expropriation without compensation.

“We think that is another key risk to watch that could have an impact on sentiment going forward.”