The equity market on Tuesday once again admitted the bulls occasioned by gain in the share price of Dangote Cement. This recent positive vibration shows that the market has begun recovery as prices of stocks are actually coming up. It appears the euphoria in the money market on the new rates has been abated. The market has been able to overcome that shock.

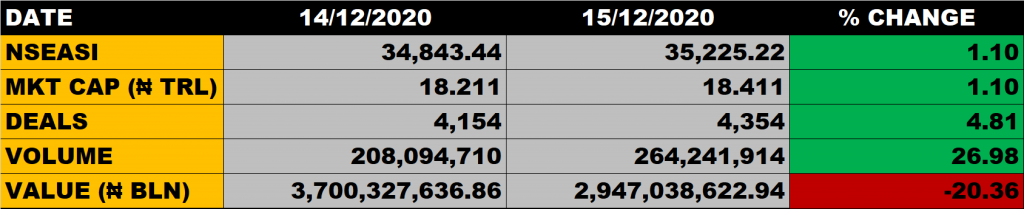

Transactions on the floor of the Nigerian Stock Exchange closed on a positive note as the All Share Index appreciated by 1.10% to settle at 35,225.22 points from the previous close of 34,843.44 points. The market capitalization grew by 1.10% to N18.411 trillion from the previous close of N18.211 trillion, which translates to N200 billion gain.

Stocks to Watch

We have always advised investors to take position in fundamentally sound stocks. If such stocks drop in a down market, there is every tendency that there position will come back when the market becomes good. We need to continue to look at stocks that will continue to pay good dividend if you miss capital appreciation, you will be compensated by good dividend.

Investors should take position in stocks that are going to have good dividend yield as fourth quarter (Q4) result is around the corner. By January, we will begin to see results of quoted companies that do not go through rigorous regulations like banks.

An aggregate of 264.24 million units of shares were traded in 4,354 deals, valued at N2.947 billion.

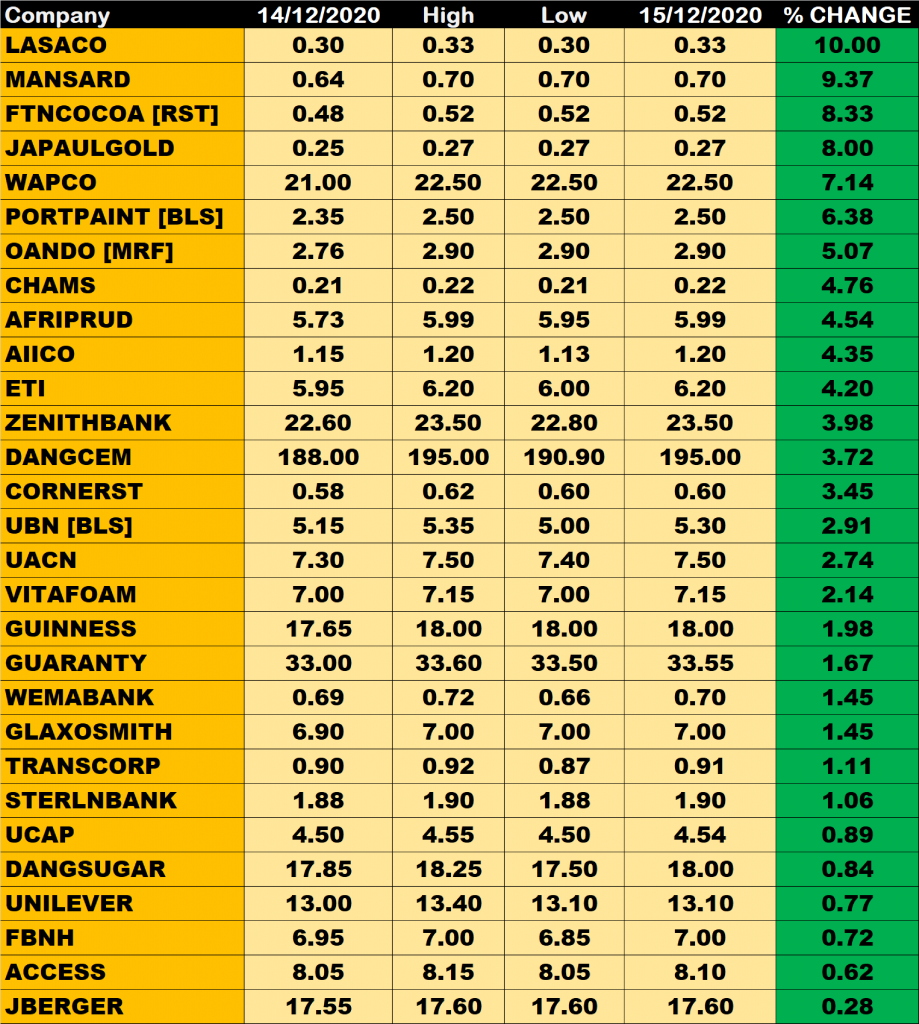

The market breadth closed positive as 29 stocks gained while 14 stocks declined in their share prices.

Percentage Gainers

LASACO led other gainers with 10% growth to close at N0.33 from the previous close of N0.30.

AXA Mansard and FTN Cocoa among other gainers also grew their share prices by 9.37% and 8.33% respectively.

Percentage Losers

Greif Nigeria Plc (VANLEER) led other price decliners as it shed 9.89% of its share price to close at N8.20 from the previous close of N9.10.

Red Star Express and Unity Bank among other price decliners also shed their share prices by 9.76% and 8.82% respectively.

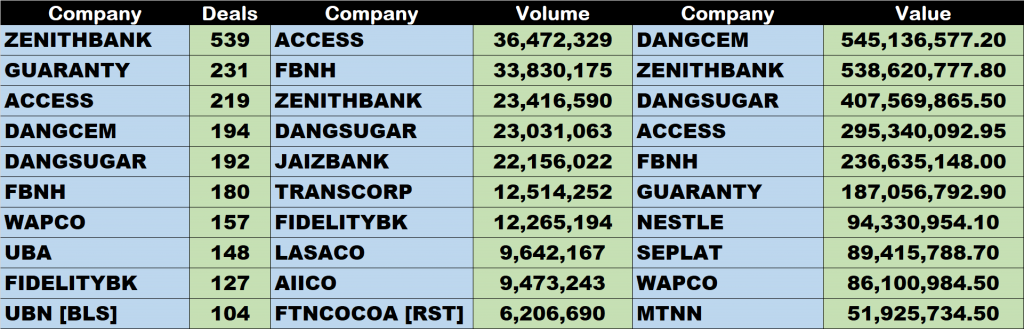

Volume Drivers

- Access Bank traded about 36.47 million units of its shares in 219 deals, valued at N295.34 million.

- FBN Holdings traded about 33.83 million units of its shares in 180 deals, valued at N236.64 million.

- Zenith Bank traded about 23.42 million units of its shares in 539 deals, valued at N538.62 million.