The Nigeria’s stock market in the first quarter of the year 2020 left investors horrible experiences that made many forget their fingers in-between their lower and upper jaw, after the All share index of the Nigerian Stock Exchange dropped by a massive 20.73% in first quarter, leaving the market with about N2 trillion loss, only in the first quarter of the said year despite the impressive performance recorded in February. This is far above about 14% loss the market recorded in the entire 2019.

The advent of the novel virus pandemic sent further fears to the global economy and it became so natural to think the stock market would suffer a great deal added to the fact that prices were already at the bottom and all stimulus that should stir the bull would readily be subdued by this pandemic.

On the contrary, performance of equities on the floor of the Nigerian Stock Exchange so far in the second quarter has been unprecedentedly impressive with the market returning about 19% Quarter to date, almost wiping off the entire loss recorded since the inception of this year.

In the month of May alone, the All Share Index and the Market Capitalisation both appreciated by 9.76% and grew by 8.08% in the month of April, leaving the Year to date returns to a marginal negative 5.86%. If the positive vibration that we experience in the month of April and May reoccur in the month of June and July, it is obvious that the market will recover from the losses incurred since the beginning of the year.

In the month of May, the healthcare sector performed excellently well as all quoted companies in this sector grew their share prices significantly, featuring on the top ten gainers chart for the month of May. The pharmaceutical companies performances is premised on the fact that the market is expecting them to be net beneficiaries of any Government action on providing vaccine to covid-19.

These are the Top five gainers among the 67 equities that appreciated in their share prices in the review month:

NEITMETH PHARMACEUTICALS INTERNATIONAL

As at the last trading day in the month of May 2020, , The share price of Neimeth Pharmaceuticals International had appreciated by 88.33% from N0.6 it traded last on April 30th 2020 to N1.13 it traded last on May 29th 2020, being the last trading day for the. Within one year, the stock price had ranged between 37 kobo and N1.13, which is the 52 week low and high respectively. Year to date, the company’s share price had grown 82.26%.

The earnings per share of the firm in Q2 financial report for 6 months ended 31 March 2020 is 3 kobo. With reference to the share price of N1.13, the P.E ratio of the firm is 37.67x with earnings yield of 6.65%.

One would wonder, why the price rally for this stock in the midst of Covid-19 pandemic. It is not out of place to also say that Covid-19 pandemic is blessing in disguise for Health Care Industry as global attention is being shifted towards that direction.

Neimeth Pharmaceuticals International is among the pharmaceutical firms shortlisted by the Central Bank of Nigeria for their intervention programme in a bid to curtail the spread of the coronavirus disease. Healthcare companies were given grant to enable them to procure raw materials and equipment to boost local drug production in Nigeria.

UNILEVER NIGERIA

Unilever Nigeria emerged second among gainers in the month of May as it grew its share price by 61.90% closing at N17.

Within the past 52 weeks, the share price as touched a high of N33.00 and a low of 9.90%. Year to date share price of Unilever declined by 22.73%.

Unilever in Q1 financial report of the period ended 31 March 2020 achieved the earnings per share of 19 kobo. Relative to the share price of N17, the P.E ratio of the firm is 89.47x with earnings yield of 1.12%.

CUTIX PLC

Cutix Plc emerged third on the gainers’ list in the month of May as it grew its share price by 54.55% closing at N1.87 from N1.21 at the close of trade in April. The share price of Cutix within the last 52 weeks has touched a high of N1.88 and a low of N1.16.

Year to date, the share price of the Cutix Plc appreciated by 40.60% from N1.33 on 31 December 2019 to N1.87 at the close of trade in May.

The earnings per share of firm obtained from Q4 unaudited report for 2019 is 18 kobo.

With reference to the share price of 1.87, the P.E ratio of Cutix Plc is calculated as 10.39x with earnings yield of 9.63%.

GLAXO SMITHKLINE CONSUMER NIGERIA PLC

The share price of Glaxo Smithkline Consumer Nigeria in the month of May appreciated by 51.40%, closing at N8.10 from N5.35 at the close of trade in April. In the last 52 weeks, the share price of GSK has reached a high of N11.20 and a low N3.45. Year to date, the share price of GSK grew by 32.79%.

The firm achieved earnings per share of 77 kobo in 2019 audited report. With reference to the share price of 8.10, the P.E ratio of GSK is calculated as 10.52x with earnings yield of 9.51%.

NPF MICROFINANCE BANK

NPF Microfinance Bank in the month of May grew its share price by 44.80%, closing at N1.81 from N1.25 in the month of April. The share price in the last 52 weeks of the firm has touched a high of 1.99 and a low of N0.85.

The firm reported the earnings per share of 35 kobo in 2019 audited report. With reference to the share price of N1.81, the P.E ratio of the firm is calculated as 5.17x with earnings yield of 19.34%.

FIDSON HEALTHCARE

The share price of Fidson Healthcare Plc in the month of May appreciated by 38.78%, closing at N3.4 from N2.45 in the month of April. Fidson recently declared final dividend of 15 kobo to its shareholders in its full year audited report. The share price of the firm as touched a high of N4.55 and a low of N2.21 within the last 52 weeks. It achieved the earnings per share of 20 kobo in 2019 financial year. With reference to the share price of N3.41, the P.E ratio of Fidson Healthcare is calculated as 17.00x, with earnings yield of 5.88%.

In a chat with Mr Bright Otoghile, Managing Director of Gruene Capital Limited as he reacts to the price performance of equities in the month of May, he pointed out that the price performance is still far below the performance recorded in February.

According to him, “If we compare the current price rally to February, the price of equities is still far below February level. For February level, we all know the activities within that period, it is with respect to the expectation of corporate actions from quoted companies.

That notwithstanding, the positive vibrations in terms of vaccine development and business reopening are the factors that contributed to positive sentiment we have in the market giving uprising in recent time.

This is likely to continue. The last time I checked on Saturday, the price of Brent Crude was trading at $37 per barrel from a low of $19 or $20 per barrel in the month of April. As economies are bubbling, it gives a room for things to grow. As demand for oil is growing, it will begin to drive every other aspect of human endeavour and it is expected it continue to grow as we go into June.

As regards projections for Q2 earnings of quoted companies, Mr Otoghile stated thus:

“The earnings that companies are likely going to declare for the second quarter will obviously by large margin fall short of their expected margin/profit they have in mind at the beginning of the year.”

“Level of Income and profit will drop for the Second Quarter, but the Third Quarter will be better. We expect the same mild profit in the month of June because we are going to see some companies that likely to still pay their dividend by July or August. So all this will contribute to some positive sentiment in the month of June.

“So to be part of the rally anticipated to happen in the month of June, then we should take position that will better our lot.”

As regards expectation for the third quarter of the year, Mr Otoghile opined that we should expect a fair reporting because we should be operating close to fair capacity of the ‘new normal’ caused by Covid-19 pandemic. He however cautioned that we also need to factor other things that might unfold in the near future. According to him, the uptrend of coronavirus infection reported globally might lead to a fresh lockdown.

According to him: “The statistics of various National Disease Control Agencies still show that cases are in the upward trend. Government can still reintroduce the lockdown. So it is something we should not overlook. Another lockdown is a possibility if the trend we are currently witnessing continues to grow.”

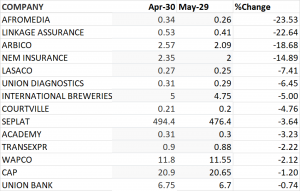

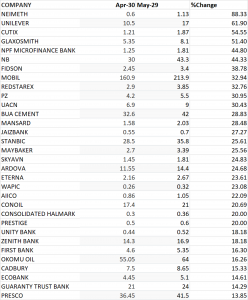

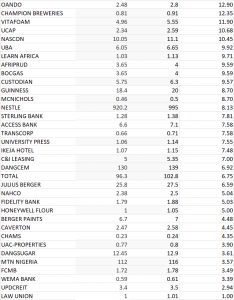

GAINERS

LOSERS