- Access Best in Non Performing Loan Incidence

- Guaranty Best in Capital Adequacy Ratio

Clement Adewuyi

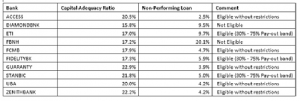

The CBN released an amendment to its internal capital generation and dividend payout policy on the 31st of January 2018. The new amendment gives room for banks with strong capital adequacy ratio (3% above the required regulatory minimum) and non-performing loan ratio higher than 5% to increase their dividend payout ratio to as high as 75% (from the initial cap of 30%) provided their NPL ratio does not exceed 10%. However, it is important to emphasise that contrary to the information in some media outlets, the policy is not new and was only amended as stipulated above. The dividend policy has been effective as far back as 2014. Below, we have analysed the impact of the CBN’s dividend policy on our coverage banks.

What the dividend policy says:

- Banks that do not meet the minimum capital adequacy ratio (banks with international license: 15%; Systemically Important Banks: 16% ) will not be allowed to pay dividend

- Banks with non-performing loans (NPLs) above 10% will not be allowed to pay dividend

- Banks that meet the minimum CAR requirement but have NPL ratio of more than 5% but less than 10% will be allowed to pay a maximum of 30% of earnings as dividend

- Banks with CAR of at least 3% above minimum requirement and NPL ratio of more than 5% but less than 10% will be allowed to pay up to a maximum of 75% of earnings as dividends.

- Banks that meet the minimum capital adequacy ratio and non-performing loan ratio have no regulatory restrictions to pay dividend.

Implications for our coverage banks

The CBN dividend policy assesses banks on their eligibility to pay dividends based on the capital adequacy ratio (CAR) and their non-performing loans (NPL). Below, we have analysed our coverage banks based on these metrics and highlighted how this policy will impact dividend payment for FY’17.

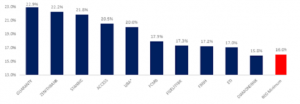

Figure 1: Capital Adequacy Ratio of coverage banks.

From the graph above, DIAMONDBNK as at 9M’17 is currently below the minimum capital adequacy ratio required for systemically important banks. If the trend persists into full year, DIAMONDBNK will not be eligible to pay any dividend. We highlight that ETI and FBNH are also close to the regulatory minimum but it is highly unlikely that these banks will breach this by FY’17 given that they are expected to capitalize their earnings after the full year audit – this is expected to strengthen CAR.

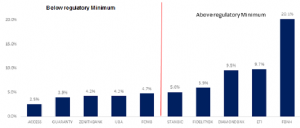

Figure 2: Non-performing loans as at 9M’17.

As at 9M’17, STANBIC, FIDELITYBK, DIAMONDBNK, ETI and FBNH are all above the minimum 5% threshold hence, if they are eligible to pay dividend it will be capped between 30% and 75% according to the rule stipulated above.

For DIAMONDBNK, the capital adequacy rule will prevent it from paying any dividends at all. FBNH is currently breaching the 10% NPL rule hence will not be able to pay dividend from its commercial banking business. However, the bank may pay dividends from the earnings of its other subsidiaries as it did in FY’16. FIDELITYBK and ETI fall within the threshold of 30% and 70% dividend payout band. The final probable payout will, however, depend on the level of their capital adequacy ratio when their full-year result is released. Nevertheless, FIDELITYBK three-year average dividend payout ratio is c.33% which is not materially different from the lower band of 30% should its CAR come in below the 300bps premium required to the regulatory minimum.

Figure 3: Verdict based on 9M’17 Earnings.