The equity market on Thursday continued its downward trend occasioned by rate improvement in the fixed income space and portfolio realignment by investors.

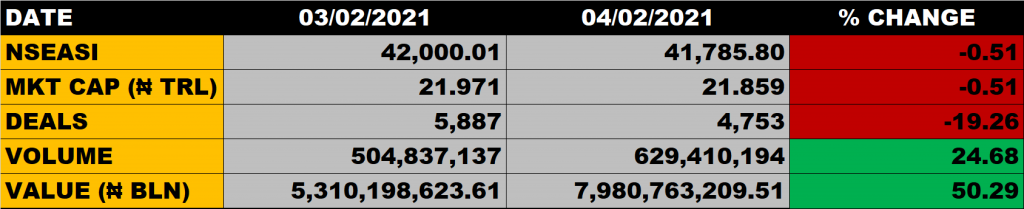

The All Share Index depreciated by 0.51% to settle at 41,785.80 points from the previous close of 42,000.01 points. Market Capitalisation closed at N21.859 trillion, down by 0.51% from the previous close of N21.971 trillion, thereby shedding N112 billion.

An aggregate of 629.4 million units of shares were traded in 4,753 deals, valued at N7.98 billion.

The Market Breadth closed negative as 22 equities emerged as gainers while 25 equities declined in their share prices.

Stocks to Watch

- Access Bank traded flat at N8.9. It is currently trading 15.24% away from its 52 weeks high of N10.5. With the book value of N19.12, Access Bank is considered cheap at the current share price of N8.9.

- FBN Holdings traded flat at N7.35. It is trading 18.33% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N19.84, relative to the current share price of N7.35, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank dropped to N26.75 from N26.95. It is trading 6.14% away from its 52 weeks high of N28.5. With the book value of N32.94, relative to the current share price of N26.75, Zenith Bank is underpriced.

- WAPCO grew to N27.65 from N27.55. It is trading 12.22% away from its 52 weeks high of N31.5. There is uptrend potential in Wapco as records have it that it has touched about N52 a few years back.

- UBA dropped to N8.75 from N8.85. It is trading 10.71% away from its 52 weeks high of N9.8. With the book value of N19.16 as against its current share price of N8.85, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N33 from N33.05. It is trading 14.17% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

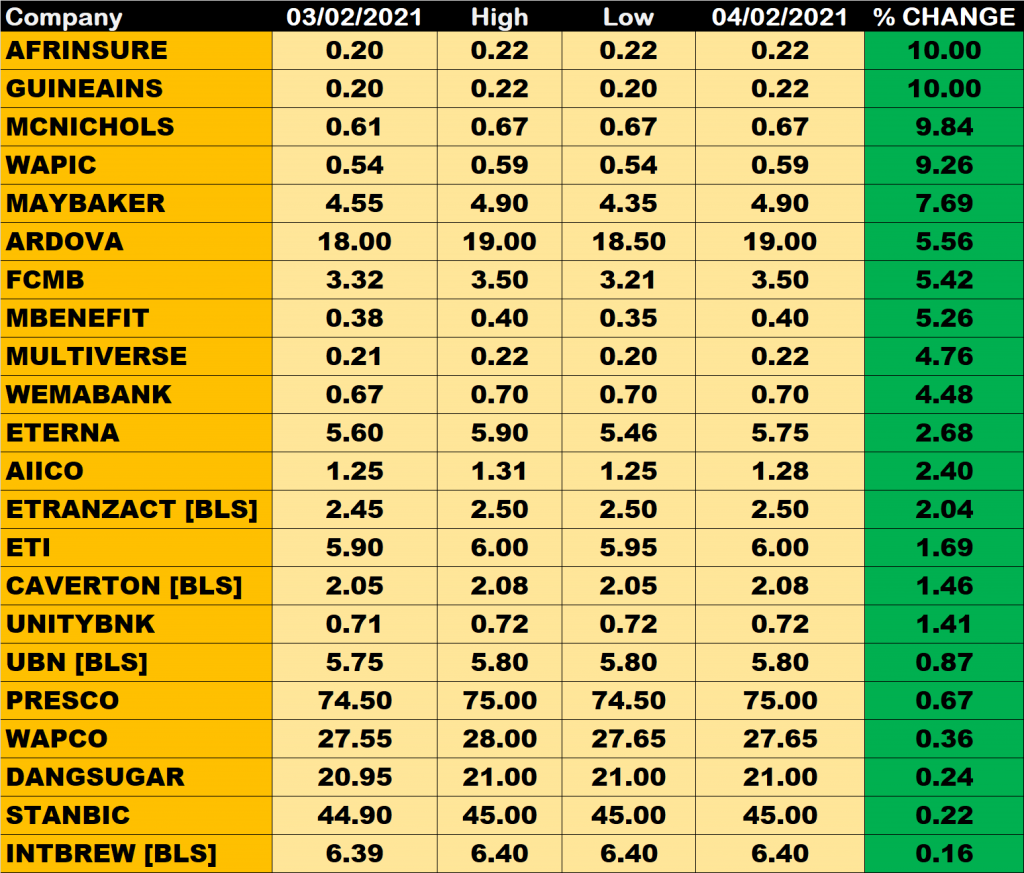

Percentage Gainers

Africa Alliance Insurance and Guinea Insurance both gained 10% to close at N0.22 respectively.

MCNICHOLS and Wapic Insurance among other gainers also grew their share prices by 9.84% and 9.26% respectively.

Percentage losers

Northern Nigerian Flour Mills (NNFM) led other price decliners as it shed 9.94% of its share price to close at N7.88 from the previous close of N8.75.

Champion Breweries, Linkage Assurance and FTN Cocoa Processors among other price decliners also shed their share prices by 9.73%, 9.59% and 9.43% respectively.

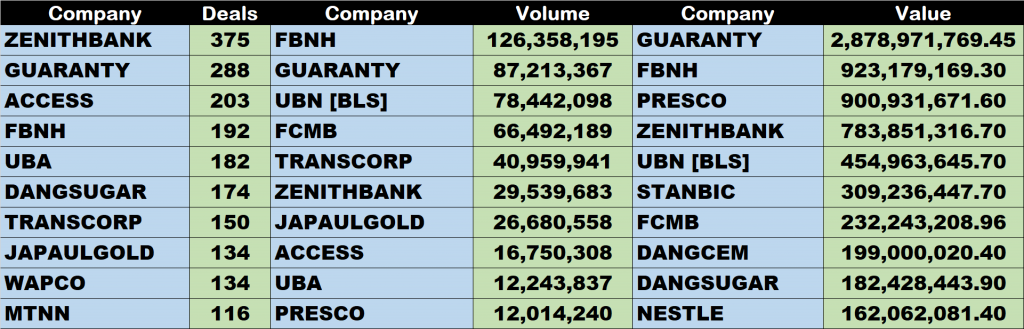

Volume Drivers

- FBN Holdings traded about 126.358 million units of its shares in 192 deals, valued at N923.179 million.

- Guaranty Trust Bank traded about 87.213 million units of its shares in 288 deals, valued at N2.88 billion.

- Union Bank traded about 78.442 million units of its shares in 37 deals, valued at N454.9 million.