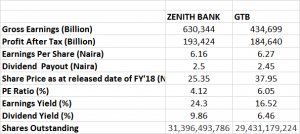

Nigeria’s two financial giants, Zenith Bank and Guaranty Trust Bank plc had released the full year audited reports for the period ended December 31, 2018. As expected, dividend pay-out, proposed by both banks in naira terms, is within same range as Zenith Bank proposed N2.50 while Guaranty Trust Bank proposed N2.45.

Notably, Zenith this time around, had released its audited report earlier on February 19, 2019, while Guaranty Trust Bank’s report came afterwards on the 6th of March 2019. In previous years, reports of these two financial giants had come in within 24 hours’ interval with Guaranty Trust Bank Plc being the first to release

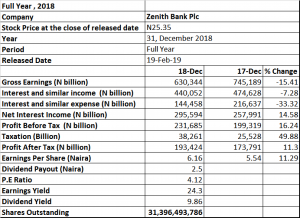

ZENITH BANK PLC:

Zenith’s audited financial report for the period ended December 31, 2018 revealed that the bank grew its Profit after Tax for the year to N193.4billion or 11.30 % from N173.8 billion recorded in 2017.

The report showed that the group’s gross earnings declined by 15.41 per cent to N630 billion when compared to N745.2 billion recorded in the corresponding period of 2017.

The report also showed that the bank had its impairment loss on financial and non-financial instruments declined by 81.29 percent to about N18 billion from about N98 billions in 2017, bringing the Net interest income after impairment loss to N277 billion in the current year from 2017’s N159 billion.

Also, the bank recorded profit before tax of N231.685 billion during the period under review thereby showing a growth of 16.24 percent againts N199.319 billion recorded in the corresponding period.

Its earnings per share appreciated by 11.30 percent from 2017’s N5.54kobo to N6.16kobo in 2018. At the reference share price of N25.35 its stock closed on the released date of FY’18 result, PE ratio of the group stands at 4.12x; with earnings yield of 24.30%

Zenith Bank proposed a final dividend of N2.50kobo per ordinary share to shareholders bringing dividend yield to be 9.86%

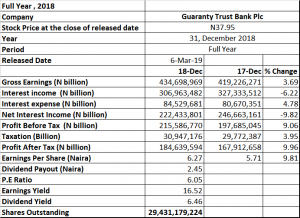

GT BANK PLC

Guaranty Trust Bank Plc grew its 2018 year-end Profit after Tax (PAT) to N184.6 billion or 9.96% against N167.9 billion recorded in 2017. Gross Earnings grew by 3.69% YoY to N434.7 billion against the previous year’s N4.19 billion.

The bank’s Profit before tax during the period under review grew by 9.06 percent, to N215.587 billion as against N197.685 billion in the corresponding period.

With about 29.43 billion shares outstanding, the earnings per share (EPS) of Guaranty Trust Bank is currently N6.27 which is 9.81% growth from the previous EPS of N5.71 recorded in 2017. At a reference price of N37.95, it traded on the released date of the full year 2018 report, the PE Ratio of Guaranty Trust Bank is 6.05x with earnings yield of 16.53%.

A Dividend of N2.45kobo per ordinary share of 50k each is proposed to shareholders bringing dividend yield to be 6.46%.

PEER TO PEER COMPARISON:

WHAT COULD BE BEHIND PRICE DISPARITY?

-

PERCEPTION:

Aside from institutional investors, there is no Director in GTB that holds major shares of the comoany whereas in Zenith, The current Chairman holds direct and indirect shares of the bank totaling 11.29%. Consequently, Zenith will more like be seen as a one-man owned institution while the spread in GTB shareholding is a key advantage in perception.

INSTITUTIONAL HOLDINGS/FLOAT: Aside from the direct and indirect holdings of the current Chairman of Zenith, other institutions held 18.06% as at year-end December 31, 2018 whereas, in GTB, 34.90% of the bank’s shares are being held by institutions. This suggests that 19.160billion units of GTB’s stocks are available as float whereas in Zenith, 22.180billion units are available as float. Please note, the float here includes shares being held by local institutional investors who are liberty to trade in the stocks at intervals.

-

RETAIL INVESTORS PARTICIPATION:

In Guaranty, 76.87% of shareholders hold 2.6% of the bank whereas in Zenith, 84.13% of shareholders hold 5.09% of the bank’s stocks.

Let’s prod further. In Zenith, total percentage of investors holding between one unit and five million units is 25.57 whereas in Guaranty Trust Bank Plc, total percentage of investors holding between one unit and five million units is 21.74.

These figures sure show seeming low margin but in reality, these little margins place more pressure on the stock price on Zenith far more than that of Guaranty.

CONCLUSION:

- Because of perception and shareholding distribution, Guaranty Trust Bank Plc stands better chance of retaining higher price level than Zenith in the short term while in dividend returns; Zenith stands better chance than Guaranty Trust Bank Plc.

- In price performance, GTB has lost 31.82% from the highest point in 2018 till date whereas; Zenith has only lost 24.42% from the highest point in 2018 till date.

- On May 19, 2008, Zenith hit its all time high of N51.15 before the eventual market crash. It was later to hit N9.00 in January 2016. It is yet to attain its highest price level ever since the market crash. On the other hands, GTB hit its highest before the market crash, of N39.98 on March 5, 2008 and lowest- after the crash of N8.52 in February 2009 and has since tested a higher level of N54.71 and currently sells around its highest range before the market crash of 2008.

- Because of price vacillation, Zenith is more suitable for short term market play with possibilities of wide margin. GTB suitable for long term hold because of ability to resist losses and quicker recovery.

READ ALSO : Zenith Bank wins sustainability award