ANALYSIS

The stock can be considered for investment on long term basis, the reasons being:

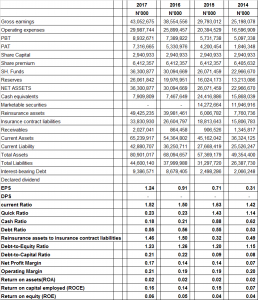

- Liquidity ratios high, very good for the company

- Reinsurance asset to insurance obligation is high, trend increasing over the years,

Lower ratio is considered to have excessive reinsurance assets, potentially lower profits, and hence less risk as compared to the reinsurance company with higher ratio. However, higher ratio indicates that a reinsurance company has taken more financial stress by making excessive reinsurance assets and also shows risk to meet insurance contract liabilities. A high figure denotes lower liquidity.

- ROA is low, trend constant over the years, not good for the company a higher ratio means better managerial performance and efficient utilization of the assets of the firm and lower ratio is the indicator of inefficient use of assets.

- The profitability ratios are low, but increasing over the years.

- ROE is low, trend increasing over the years, higher ROE means better managerial performance.

- EPS good and trend increasing over the year