- Comparative analysis of insurance stocks in HY 2021

The Half-Year performance of insurance firms listed on the Nigerian Exchange is mixed, though the market expected better results than what most of them reported in the covid year. Just about 50% of the underwriting firms achieved growth in their bottom line figures, even though most of them increased their market share with growth in turnover.

It is interesting to note that most insurance firms performed better in the covid year compared to what they reported in period under review.

The negative returns declared by some of these insurance companies is traceable to the market price of bonds. Most of them set their bonds available for sales; which is marked to market. Most of the bonds are trading below the opening price of January 2021, so it reflected their half year results.

Worthy of note are the performances of Veritas Kapital, Sovereign Trust Insurance, Universal Insurance, Consolidated Hallmark Insurance, NEM Insurance, Prestige Assurance and AIICO Insurance as they achieved significant growth in their profit after tax.

In order to gauge the performance of stocks in the insurance sector, we deem it necessary to do a comparative analysis of their Half Year 2021 earnings. This will gauge their performance in terms of profitability, turnover, earnings per share, earnings yield and profit margin.

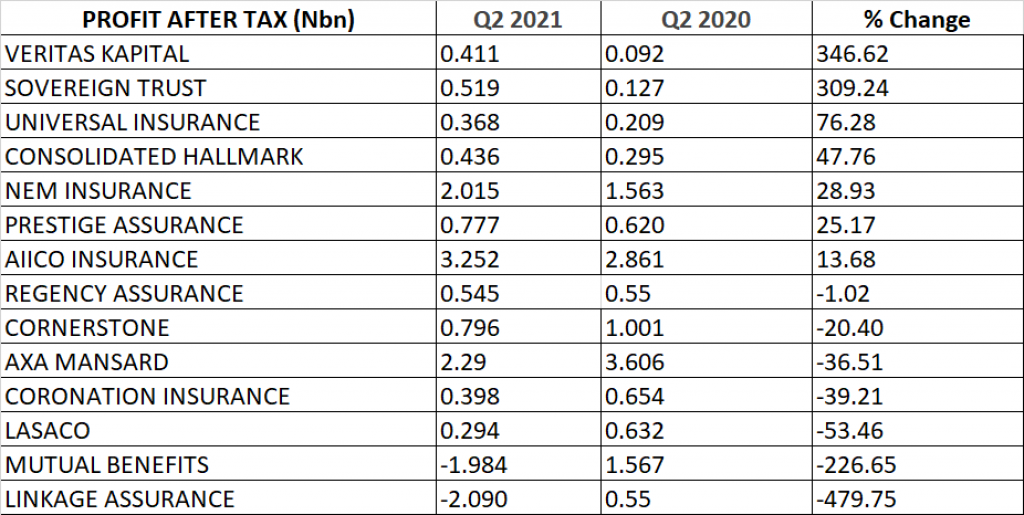

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Veritas Kapital Assurance grew its profit after tax by 346.62% year on year from N92 million to N411 million, emerging best in terms of growth in profit after tax among others in the insurance sector.

- Sovereign Trust Insurance emerged second best in terms of growth in profit after tax as it grew by 309.24% year on year from N127 million to N519 million.

- Universal Insurance grew its profit after tax by 76.28% to N368 million from N209 million, emerging third on the ranking in terms of growth in profit after tax.

- Consolidated Hallmark Insurance achieved profit after tax of N436 million, up by 47.76% from N295 million achieved the previous year, emerging fourth in ranking in terms growth in profit after tax.

- NEM Insurance grew its profit after tax by 28.93% from N1.563 billion to N2.015 billion.

- Prestige Assurance grew its profit after tax by 25.17% year on year to N777 million from N620 million.

- AIICO Insurance achieved profit after tax of N3.252 billion, up by 13.68% from N2.861 billion achieved the previous year.

- Regency Assurance declined in profit after tax marginally by 1.02% year on year to N545 million from N550 million reported the previous year.

- Cornerstone Insurance declined in profit after tax by 20.40% to N796 million from N1.001bn billion reported the previous year.

- AXA Mansard declined in profit after tax by 36.51% to N2.29 billion from N3.61 billion.

- Coronation Insurance declined in profit after tax by 39.21% to N398 million from N654 million.

- LASACO declined in profit after tax by 53.46% to N294 million from N632 million.

- Mutual Benefit Assurance declared a loss after tax of N1.984 billion as against the profit after tax of N1.564 billion declared in the first half of 2020. This translates to 226.65% decline year on year.

- Linkage Assurance declared a loss after tax of N2.090 billion as against the profit after tax of N550 million declared in the first half of 2020. . This translates to 479.75% decline year on year.

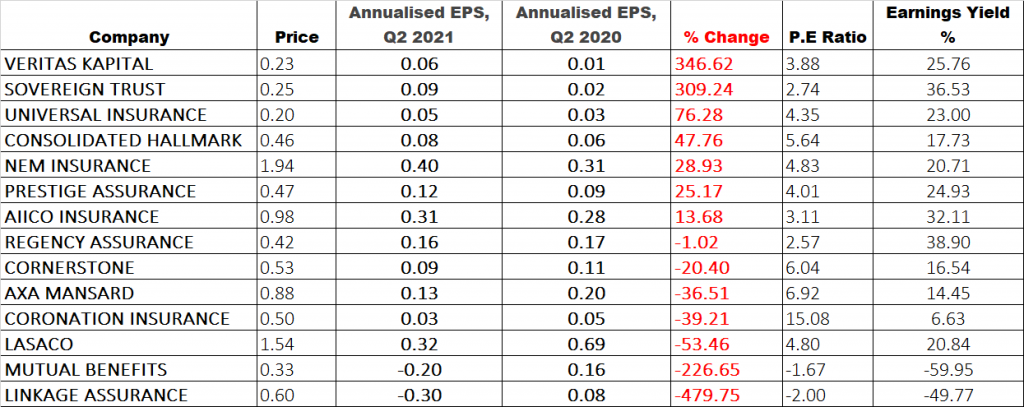

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNINGS YIELD

- Earnings per share of Veritas Kapital Assurance increased by 346.62% to 3 kobo from 1 kobo, emerging as overall best in terms of growth in earnings per share in the insurance sector. With annualized earnings per share of 6 kobo, relative to the share price of 23 kobo, the P.E ratio of Veritas Kapital stands at 3.88x with earnings yield of 25.76%.

- Sovereign Trust Insurance emerged second best in terms of growth in earnings per share as EPS grew by 309.24% year on year from 1 kobo to 5 kobo. With annualized earnings per share of 9 kobo, relative to the share price of 25 kobo, the P.E ratio of Sovereign Trust Insurance stands at 2.74x with earnings yield of 36.53%.

- Universal Insurance grew its earnings per share by 76.28% to 2 kobo from 1 kobo, emerging third on the ranking in EPS growth. With annualized earnings per share of 5 kobo, relative to the share price of 20 kobo, the P.E ratio of Universal Insurance stands at 4.35x with earnings yield of 23%.

- Consolidated Hallmark Insurance achieved earnings per share of 4 kobo, up by 47.76% from the EPS of 3 kobo achieved the previous year, emerging fourth in ranking in terms of growth. With annualized earnings per share of 8 kobo, relative to the share price of 46 kobo, the P.E ratio of Consolidated Hallmark Insurance stands at 5.64x with earnings yield of 17.73%.

- NEM Insurance grew its earnings per share by 28.93% to 20 kobo from 16 kobo. With annualized earnings per share of 40 kobo, relative to the share price of N1.94, the P.E ratio of NEM Insurance stands at 4.83x with earnings yield of 20.71%.

- Prestige Assurance grew its earnings per share by 25.17% year on year to 6 kobo from 5 kobo. With annualized earnings per share of 12 kobo, relative to the share price of 47 kobo, the P.E ratio of Prestige Assurance stands at 4.01x with earnings yield of 24.93%.

- AIICO Insurance achieved the earnings per share of 16 kobo, up by 13.68% from the EPS of 14 kobo achieved the previous year. With annualized earnings per share of 31 kobo, relative to the share price of 98 kobo, the P.E ratio of AIICO Insurance stands at 3.11x with earnings yield of 32.11%.

- Regency Assurance reported 8 kobo earnings per share, though marginally by 1.02% but same as the 8 kobo reported the previous year. With annualized earnings per share of 16 kobo, relative to the share price of 42 kobo, the P.E ratio of Regency Assurance stands at 2.57x with earnings yield of 38.90%.

- Cornerstone Insurance declined in earnings per share by 20.40% to 4 kobo from 6 kobo reported the previous year. With annualized earnings per share of 9 kobo, relative to the share price of 53 kobo, the P.E ratio of Cornerstone Insurance stands at 6.04x with earnings yield of 16.54%.

- AXA Mansard declined in earnings per share by 36.51% to 6 kobo from 10 kobo. With annualized earnings per share of 9 kobo, relative to the share price of 88 kobo, the P.E ratio of AXA Mansard Insurance stands at 6.92x with earnings yield of 14.45%.

- Coronation Insurance (WAPIC) declined in earnings per share by 39.21% to 2 kobo from 3 kobo. With annualized earnings per share of 3 kobo, relative to the share price of 50 kobo, the P.E ratio of Coronation Insurance stands at 15.08x with earnings yield of 6.63%.

- LASACO declined in earnings per share by 53.46% to 16 kobo from 34 kobo. With annualized earnings per share of 32 kobo, relative to the share price of N1.54, the P.E ratio of LASACO stands at 4.80x with earnings yield of 20.84%.

- Mutual Benefit Assurance declared earnings per share of -10 kobo in HY 2021 as against the EPS of 8 kobo declared the previous year. This translates to 226.65% decline year on year. With annualized earnings per share of -20 kobo, relative to the share price of 33 kobo, the P.E ratio of Mutual Benefit Assurance stands at -1.67x with earnings yield of -59.95%.

- Linkage Assurance declared earnings per share of -15 kobo in HY 2021 as against the EPS of 4 kobo declared the previous year. This translates to 479.75% decline year on year. With annualized earnings per share of -30 kobo, relative to the share price of 60 kobo, the P.E ratio of Linkage Assurance stands at -2x with earnings yield of -49.77%.

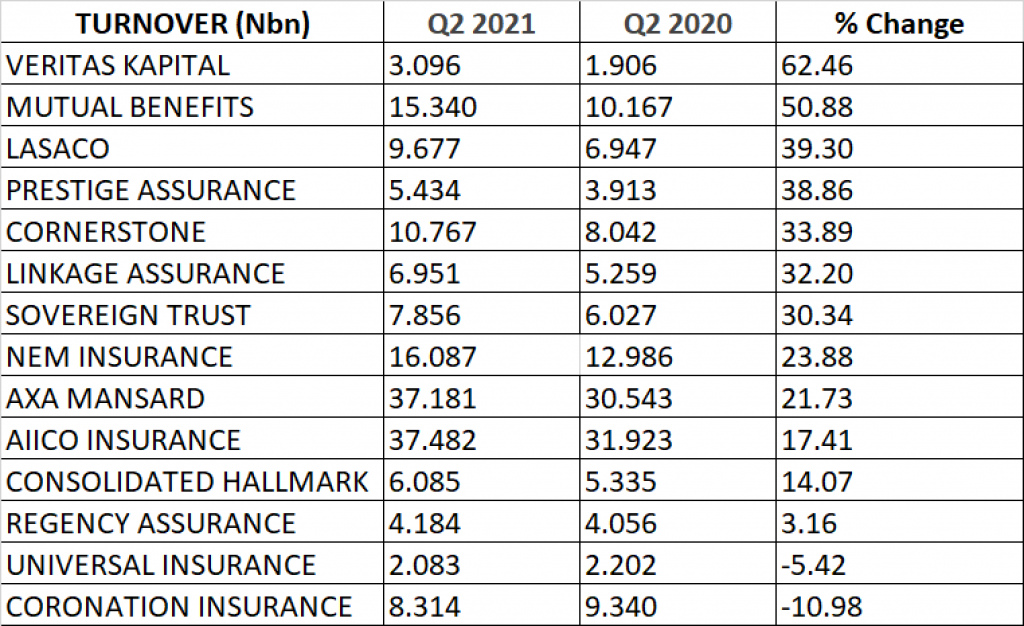

PERFORMANCE IN TURNOVER GROWTH

- Veritas Kapital Assurance emerged top in terms of turnover growth among others in the insurance sector as it grew its turnover by 62.46% year on year to N3.096 billion from N1.906 billion.

- Second on the list in terms of turnover growth is Mutual Benefit Assurance with a turnover of N15.340 billion, up by 50.88% from N10.167 billion reported the previous year. Although it eventually declared a loss after tax of N1.984 billion.

- LASACO is third on the list in terms of turnover growth as turnover increased by 39.30% to N9.667 billion from 6.947 billion.

- Prestige Assurance is fourth in ranking of turnover growth as it grew its Gross Premium Written by 38.86% to N5.434 billion from N3.913 billion.

- Cornerstone Insurance emerged fifth in terms of turnover growth as revenue increased by 33.89% to N10.767 billion from N8.042 billion.

- Linkage Assurance grew its turnover by 32.20% to N6.951 billion from N5.259 billion. It however declared a loss after tax of N2.090 billion for the period under review.

- Sovereign Trust Insurance grew its turnover by 30.34% to N7.856 billion from N6.027 billion reported the previous year.

- NEM Insurance grew its turnover by 23.88% to N16.087 billion from N12.986 billion reported in HY 2021.

- AXA Mansard grew its turnover by 21.73% to N37.181 billion from N30.543 billion reported the previous year.

- AIICO Insurance grew its turnover by 17.41% to N37.482 billion from N31.923 billion reported the previous year.

- Consolidated Hallmark Insurance grew its turnover by 14.07% to N6.085 billion from N5.335 billion reported the previous year.

- Regency Assurance grew its turnover by 3.16% to N4.184 billion from N4.056 billion reported the previous year.

- Universal Insurance reported a turnover of N2.083 billion, down by 5.42% from N2.202 billion. Despite the decline in top line figures, profit after tax grew significantly by 76.28%.

- Coronation Insurance reported a turnover of N8.314 billion, down by 10.98% from N9.34 billion reported the previous year.

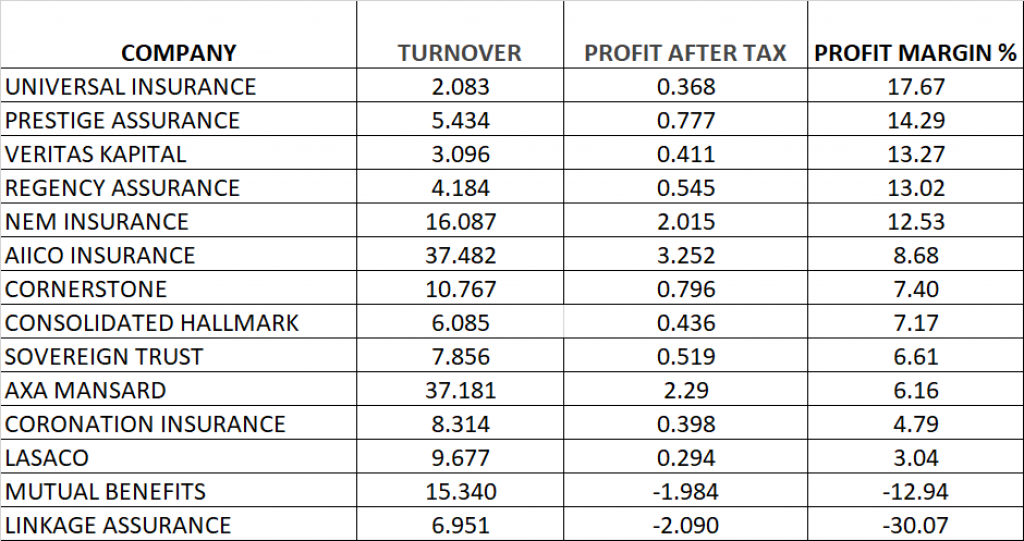

PROFIT MARGIN

Profit margin reflects a company’s overall ability to turn income into profit. It is calculated as profit after tax divided by total revenue or turnover, multiplied by 100.

- Universal Insurance emerged top among others with a profit margin of 17.67% in half year 2021.

- Prestige Assurance achieved a profit margin of 14.29%, emerging second among others in the insurance sector in terms of profit margin.

- Veritas Kapital Assurance in Half Year 2021 achieved a profit margin of 13.27%, emerging third among others.

- Regency Assurance achieved a profit margin of 13.02% emerging fourth among others.

- NEM Insurance achieved a profit margin of 12.53% in Half Year 2021, emerging fifth among others in terms of profit margin.