- Linkage Assurance emerge top in profit margin

- Prestige Assurance sets pace in dividend pay out

Performance of insurance firms in year 2020 was quite impressive despite the impact of covid-19 pandemic on businesses. Comparing the figures released in the audited reports published so far with what was achieved in the pre-covid year, a number of insurance firms achieved significant growth in their top line and bottom line figures.

Just about 9 insurance firms have published their audited reports for year 2020; though majority have released their Q4 results which are unaudited. Audited report released so far include that of NEM Insurance, Prestige Assurance, AXA Mansard, Linkage Assurance, AIICO, Sunu Assurances, Sovereign Trust, Consolidated Hallmark Insurance and Regency Assurance.

Insurance firms yet to release their audited results include: Cornerstone, LASACO, Coronation (WAPIC), Mutual Benefit, Staco, Standard Alliance, Niger Insurance and Unic Insurance.

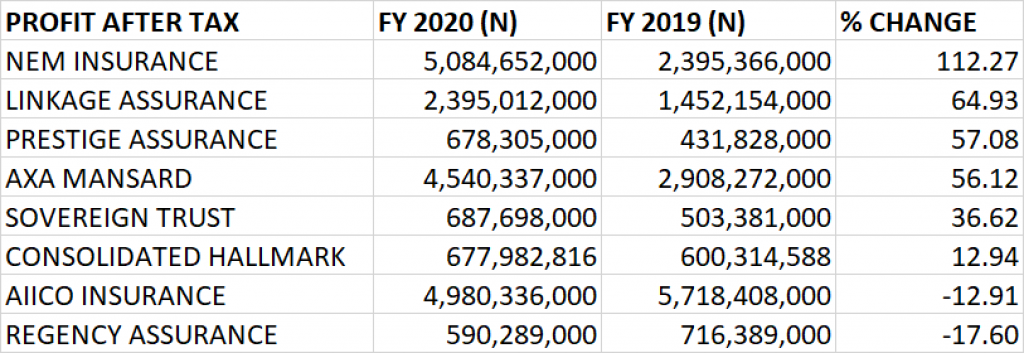

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- NEM Insurance Plc grew its profit after tax by 112.27% year on year from N2.395 billion to N5.08 billion, emerging best in terms of growth in profit after tax among others in the insurance sector.

- Linkage Assurance emerged second best in terms of growth in profit after tax as profit grew by 64.93% year on year from N1.452 billion to N2.395 billion.

- Prestige Assurance grew its profit after tax by 57.08% to N638.305 million from N431.828 million, emerging third on the ranking in terms of growth in profit after tax.

- AXA Mansard achieved profit after tax of N4.54 billion, up by 56.12% from N2.908 billion achieved in 2019, emerging fourth in ranking in terms growth in PAT.

- Sovereign Trust Insurance grew its profit after tax by 36.62% from N503.381 million to N687.698 million.

- Consolidated Hallmark Insurance grew in profit after tax by 12.94% year on year to N677.98 million from N600.31 million.

- AIICO Insurance reported profit after tax of N4.98 billion, down by 12.91% from N5.72 billion achieved the previous year.

- Regency Assurance declined in profit after tax by 17.60% year on year to N590.289 million from N716.389 million reported in 2019.

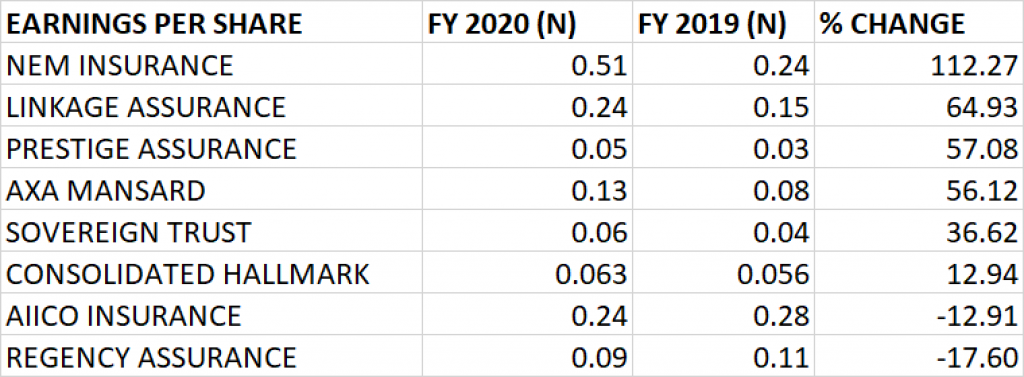

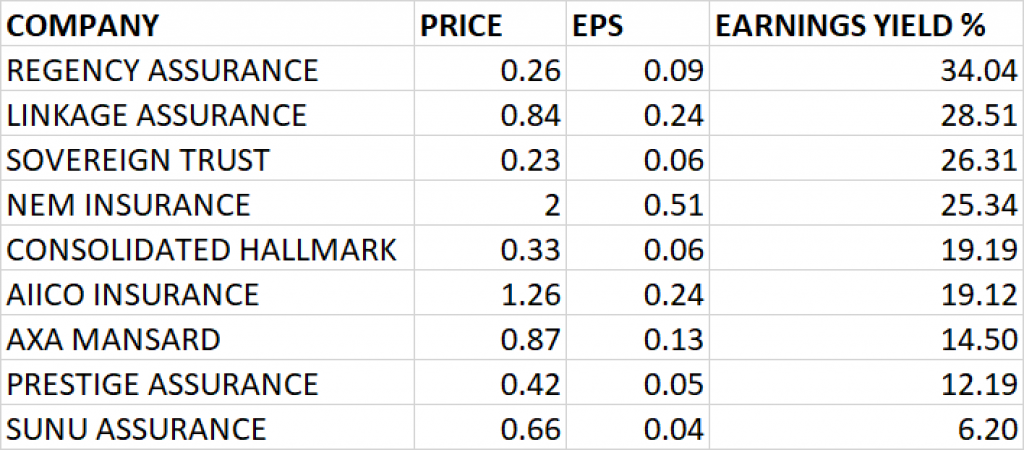

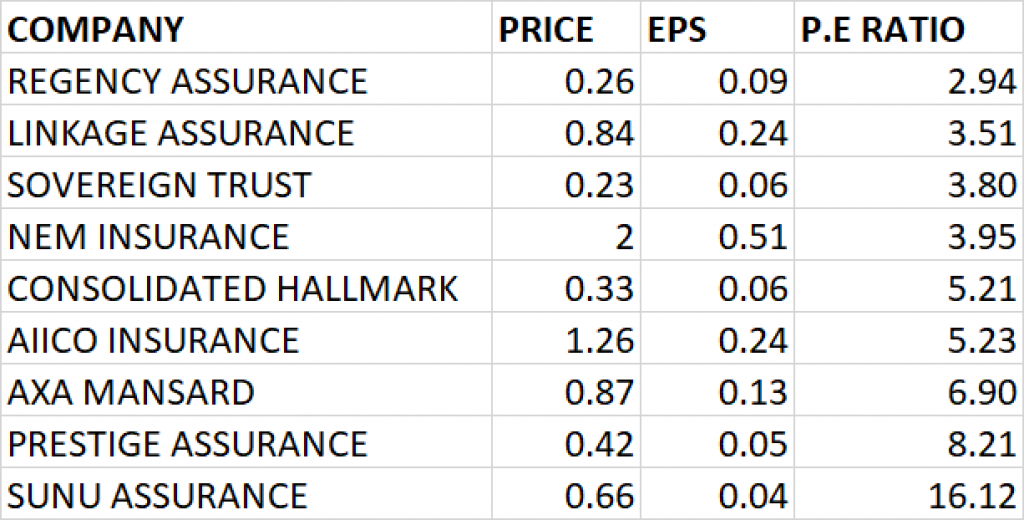

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNINGS YIELD

- Earnings per share of NEM Insurance increased by 112.27% to 51 kobo from 24 kobo, emerging as overall best in terms of growth in earnings per share in the insurance sector. At the share price of N2, the P.E ratio of NEM stands at 3.95x with earnings yield of 25.34%.

- Linkage Assurance emerged second best in terms of growth in earnings per share as EPS grew by 64.93% year on year from 15 kobo to 24 kobo. At the share price of 84 kobo, Linkage Assurance has a P.E ratio of 3.51x with earnings yield of 28.51%.

- Prestige Assurance grew its earnings per share by 57.08% to 5 kobo from 3 kobo, emerging third on the ranking in EPS growth. At the share price of 42 kobo, the P.E ratio of Prestige Assurance stands at 8.21x with earnings yield of 12.91%.

- AXA Mansard achieved earnings per share of 13 kobo, up by 56.12% from the EPS of 8 kobo achieved in 2019, emerging fourth in ranking in terms of growth. At the share price of 87 kobo, P.E ratio of AXA Mansard stands at 6.90x with earnings yield of 14.50%.

- Sovereign Trust Insurance grew its earnings per share by 36.62% to 6 kobo from 4 kobo. At the share price of 23 kobo, the P.E ratio of Sovereign Trust Insurance stands at 3.80x with earnings yield of 26.31%.

- Consolidated Hallmark Insurance grew its earnings per share by 12.94% year on year to 6.3 kobo from 5.6 kobo. At the share price of 33 kobo, the P.E ratio of Consolidated Hallmark Insurance stands at 5.21x with earnings yield of 19.19%.

- AIICO Insurance declined in its earnings per share by 12.91% to 24 kobo from 28 kobo. At the share price of N1.26, the P.E ratio of AIICO Insurance stands at 5.23x with earnings yield of 19.12%.

- Regency Assurance declined in earnings per share by 17.60% year on year to 9 kobo from 11 kobo. At the share price of 26 kobo, the P.E ratio of Regency Assurance stands at 2.94x with earnings yield of 34.04%.

- In terms of Earnings yield, Regency Assurance emerged top among others with earnings yield of 34.04%.

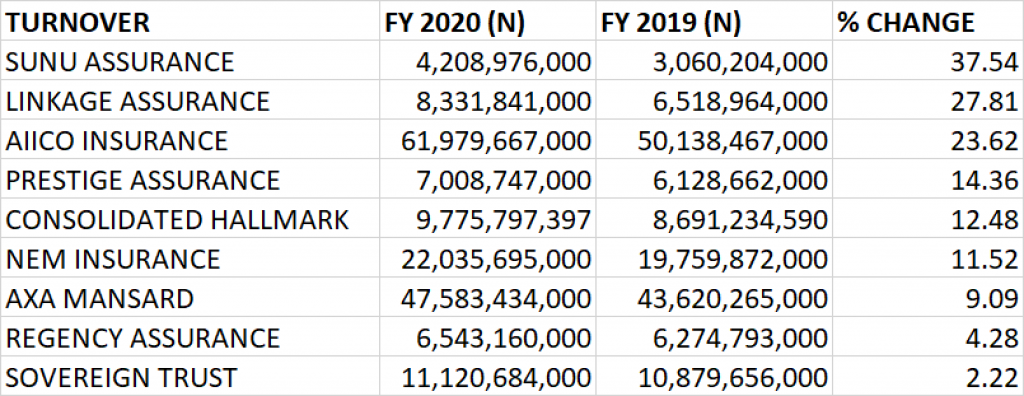

PERFORMANCE IN TURNOVER GROWTH

- Sunu Assurance emerged top in terms of turnover growth among others in the insurance sector as it grew its Gross Premium Written by 37.54% year on year to N4.2 billion from N3.06 billion.

- Second on the list is Linkage Assurance with Gross Premium Written of N8.33 billion, up by 27.81% from N6.52 billion in 2019.

- AIICO Insurance is third among others as Gross Premium Written increased by 23.62% year on year to N61.98 billion from N50.14 billion.

- Prestige Assurance is fourth in ranking of turnover growth as it grew its Gross Premium Written by 14.36% to N7 billion from N6.13 billion.

- Consolidated Hallmark Insurance emerged fifth in terms of turnover growth as revenue increased by 12.48% to N9.78 billion from N8.69 billion.

- NEM Insurance grew its turnover by 11.52% to N22.04 billion from N19.76 billion.

- AXA Mansard grew turnover by 9.09% to N47.58 billion from N43.62 billion.

- Regency Assurance increased its revenue by 4.28% to N6.54 billion from N6.27 billion.

- Sovereign Trust Insurance grew its turnover by 2.22% to N11.12 billion from N10.88 billion.

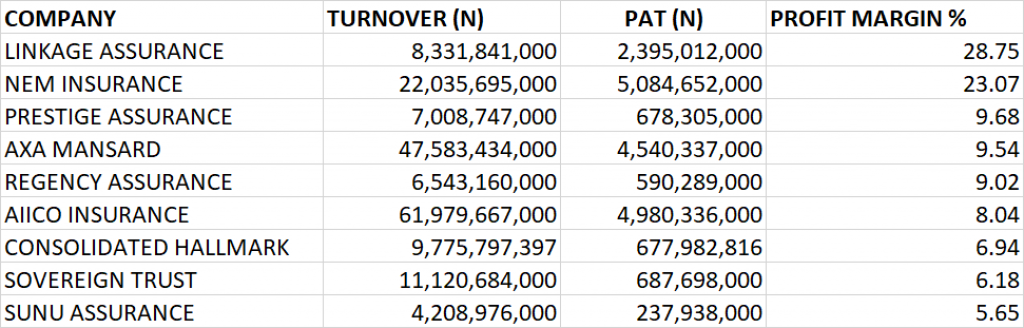

PROFIT MARGIN

- Linkage Assurance emerged top among others with a profit margin of 28.75% in year 2020.

- NEM Insurance achieved a profit margin of 23.07%, emerging second among others in the insurance sector in terms of profit margin.

- Prestige Assurance in 2020 financial year achieved a profit margin of 9.68%, emerging third among others.

- AXA Mansard achieved a profit margin of 9.54% emerging fourth among others.

- Regency Assurance made a profit margin of 9.02% in 2020 financial year.

- AIICO Insurance made a profit margin of 8.04%

- Consolidated Hallmark Insurance has a profit margin of 6.94%

- Sovereign Trust Insurance has a profit margin of 6.18%.

- Sunu Assurance has a profit margin of 5.65%

Dividend Pay-out

Prestige Assurance is the only insurance firm that declared dividend so far in 2020 financial year. The company declared 2.5 kobo dividend to its shareholders. At the share price of 42 kobo, dividend yield of Prestige Assurance stands at 5.95%.

Qualification date for dividend is 17th of May, 2021. Closure of Register is from 18th May to 21st of May, 2021. Payment date is on the 28th of May 2021.