In Abayonomics- insights on the behavioural patterns of stocks according to Abayomi Obabolujo, the second fundamental law of equity price movement states that the price of stocks can decline from a height but can also over time, recover all the lost ground and surpass the former heights ever attained. Technically, this is the essence of a periodic capturing and analysis of the low and high prices of stocks.

The third fundamental law of equity price movement according to Abayomi Obabolujo is akin to the second and it states that ‘the current price of a stock only oscillates within its previous low and high prices until either is broken to form another- new high or low price.

Dwelling more on Abayonomics’ third law of stock price movement, it infers that at a current price of a stock, the previous low price forms the calculated risk being undertaken at that point in time while the previous highest price is the opportunity. At that, it behoves on every investor to consider and measure this variance before an investment in stock is undertaken in any market condition.

It suffices to also state that when a previous low price is broken, the risk becomes higher and short-term recovery, somewhat difficult as such stock is bound to now oscillate between the new low and previous low as against previous low and high. Arriving at such level, until the previous low is eventually broken, journey towards previous high cannot be embarked on. In the same vein, when a stock price breaks through a previous high, it oscillates between the new high and previous high until previous high is broken. A simple understanding of these little concepts does not only guarantee good returns but also reduces panic in equity investment. In effect, declining equity prices should instruct on certain strategic moves as elucidated below.

- The best stocks to invest in are not so much those whose prices are resilience by staying up and never look down but those whose prices possess the ability to recover to former height no matter how low it came, or how long it takes to recover. The real returns in equity investment are the intrigues of price vacillation and not stagnancy.

- Any stock with lower low status will take a longer period to return to previous high. If you are holding such, the better to ask if you will live long enough to witness such a recovery. How to help yourself is to invest in that same stock at that lowest price to dilute average cost. Thereafter, wait. The condition precedence to re-investment to dilute price is the relationship between current low price and earnings.

- New high prices are always very difficult to maintain hence, don’t sleep off when your holdings arrive at such a status, if you can, take at least, a portion of your profit.

- If you are lucky to have invested at a good price and a higher high is being achieved, why the panic? Allow your profit to run.

- Please note the factors behind a price rise because high price sustenance will always be a function of factors behind the rise. When a price is rising just on information, appreciation will be short-lived until when such information becomes handy. Between information and reality, anything can change. If you missed a rally on information, please stay off as joining such rally could be brutal. On the other hands, if price growth is premised on strong earnings, short term profit takers, bargain hunters or those investment sharks will sure shake price growth in an attempt to push it down in the short term but such is the price that will be sustained going forward. At that, no panic is required if you are an existing holder. As a matter of fact, when short term profit taking pushes such prices down, you can even invest more and wait because in the long term, the price and earnings, with other basic fundamentals of a company, if positive will experience symmetric movements. And if you were not in the stock, you don’t necessarily need to join the rally particularly if the margin between the previous price and the rally is high. Trust the market, even with good earnings, price will still, after a rise, adjust down first before the final rally up. Wait for such opportunity to invest.

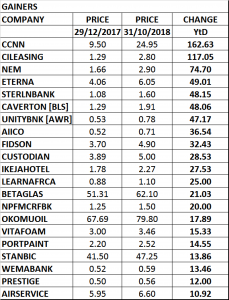

BEST STOCKS

JANUARY – OCTOBER 2018: