Good Earnings, Poor Dividend Payout Policy

ANALYSIS

The stock can be considered for investment either on medium and long term basis,

The reasons being:

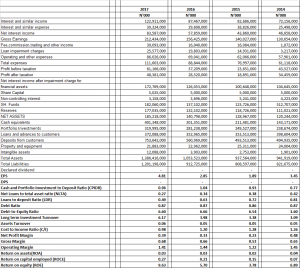

- CPIDR is low, but trend not consistent over the years

2. NLTA is low,good for the bank, trend decreasing over the years, the higher is the ratio the less the liquidity is of the bank.

3. LDR is low, trend decreasing over the years.

4. ROA is low, trend almost constant over the years, not good for the bank. A higher ratio means better managerial performance and efficient utilization of the assets of the firm and lower ratio is the indicator of inefficient use of assets

5. ROE is high, trend increasing over the years, higher ROE means better managerial performance, 2017 has a very high ratio

6. The reserves is very strong, positive and increasing reserves over the years

7. EPS very good and trend increasing over the year

8. Dividend payout is poor

AS AT 31 DECEMBER 2017