Twelve years after the last recapitalization exercise in insurance industry, NAICOM announced last week Monday that Insurance companies with composite license will now need to upgrade their capital base from N5 billion to N18 billion to continue to underwrite life and non-life insurance businesses in the country.

The new capitalization, which translates to about 350 percentage increase from the previous capital base, kick starts a fresh recapitalization exercise in insurance sector of the nation’s economy.

The regulator also mandated General insurance companies to raise their capital base to N10 billion from N3 billion to continue to exist in insurance industry, even as Reinsurance Firms will now need N20 billion capital base to operate Reinsurance business in the country, unlike N10billion they were operating with, prior to now. The capital base for Life Insurance companies was also moved to N8 billion from N2 billion.

The circular emanating from NAICOM also stipulated that existing insurance companies will now have till June 30, 2020 to recapitalize, while a new insurance firm will need to meet up the new capitalization before it is issued a license to transact insurance business in the country.

Giving reasons for the capital regime, the commission cited astronomical increase in value of insured assets, consequent exposure to higher level of insured liabilities and operating cost of insurers, among others, as factors that necessitated the need to recapitalize the insurance industry. The insurance industry regulator also noted that the commencement date of the circular for new applications shall be May 20, 2019, while existing insurance and reinsurance companies shall be required to fully comply not later than June 30, 2020.

In the middle of the last attempt to recapitalize the industry in 2018, market observers had expressed the belief that stronger underwriters would emerge after the exercise, which would have increased the capacity of the insurance industry to absorb large risks, thereby, avoiding premium flight in which foreign insurers dominate the big-ticket risks because of their huge capitalization.

Moreover, it was expected that the recapitalized insurance firms would have enough financial buffer to pay genuine claims when they arise, while giving good returns on investment to their respective shareholders.

What that significantly portends is that:

- There will be lot of activities in that segment of the market.

- There are some of them that might find it extremely difficult to meet up with this minimum capital base. Why? Because of their current levels, so low, and for those, they might have no choice than to begin to merge or be bought over or just release their operational license.

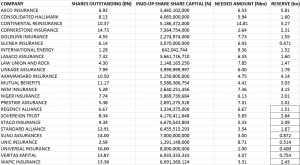

The immediate impact is that the outstanding number of shares of these Insurance Companies will become bourgeois. For example:

- If you are to retain your license as a Life Insurance company, your outstanding number of shares cannot be lower than 16 billion ordinary shares by the N8 billion paid up share capital requirement.

- If you are a General Insurance operator, you cannot command less than 20 billion ordinary shares

- For Composite Insurance Company, they cannot command less than 36 billion outstanding number of shares.

- For Re-Insurance, they cannot command less than 40 billion outstanding number of shares.

The major disadvantage is the fact that most insurance companies as at today are selling below 50 kobo. If they are to increase their outstanding number of shares to sell at 20 kobo, 30 kobo, or 40 kobo, then you can now begin to imagine the quantity of shares they will need to push to the market so as to be able to meet up within the next one year.

CURRENT STATUS OF INSURANCE COMPANIES

- AIICO Insurance:

AIICO Insurance Plc is among other few insurance companies that have so far released their Full Year audited report for 2018 and Q1, 2019.

The Full year audited report for December 2018 reveals that the Profit after Tax (PAT) of the underwriting firm grew by 145.59% to settle at N3.151 billion above N1.283 billion recorded in FY’17.The first quarter financial report for 2019 also revealed that AIICO insurance grew its Profit after Tax by 27.42% to close at N1.027bn compared to the previous PAT of N805 million in Q1 2018.

In August 31, 2018, the Board of Directors of AIICO Insurance Plc. made resolution to raise 4,400,000,000 ordinary shares of N0.50k each at N1.20kobo per share by way of private placement. It implies they plan to raise about N5.28bn if the plan was eventually executed. It was however not disclosed to the general public whether the fund raising exercise was executed.

As at today AIICO has N3.465 billion as paid-up share capital. With the new requirement of increased paid-up capital by NAICOM, AIICO Insurance would need to strategically raise N6.53bn to meet up with the regulatory requirement.

AIICO Insurance has Contingency reserve of N5.81bn which could be recapitalized and converted to paid- up share capital. At that the amount they will be needing will just be N720 million to meet up with the new requirement.

- Consolidated Hallmark Insurance:

Consolidated Hallmark Insurance operates as a General Business company. In Full Year 2018 audited report of the firm, Consolidated Hallmark Insurance made a Profit after tax (PAT) of N406.71 million which is a marginal growth of 0.12% compared to the PAT of N406.21 million recorded in 2017. Profit after Tax in Q1 2019 was N198.92, down by 5.12% when compared to the Profit after Tax recorded in Q1 2018.

The underwriting firm currently has paid-up share capital of N4.065 billion. With the new minimum paid-up capital of N10 billion required by NAICOM, the firm will need to raise additional N5.94bn to run as a General Business Insurance company.

Consolidated Hallmark Insurance has contingency reserve of N1.6 billion. If their reserve is recapitalised, they only need to raise N4.34bn as against N5.94bn.

- NEM Insurance:

NEM Insurance currently has shares outstanding of 5.28bn with market capitalisation of N12.46bn. The paid-up share capital of the firm is currently N2.64bn. As a General Business operator, the new paid up share capital requirement of N10bn implies that that the underwriting firm will need to raise an additional fund of N7.36bn to continue in business. The audited report of NEM Insurance for full year 2018 reveals that the underwriting firm made a Profit after Tax (PAT) of N2.697bn, down by 12.87% when compared to the PAT of N3.095bn recorded in 2017. The first quarter report of the firm for 2019 however showed a growth of 12.98% in Profit after Tax.

NEM Insurance has contingency reserve of N3.15 billion. If their reserve is recapitalised and converted to paid-up share capital, the firm will only need to raise N4.21bn as against N7.36bn in order to meet up with the new capital base requirement.

- Cornerstone Insurance:

Cornerstone Insurance is yet to release its financial report for Full Year 2018 and Q1 2019. As regards, the new capital base requirement, Cornerstone Insurance is in a comfortable zone. In order to meet up with the N10bn capital base to run General Business Insurance, the firm will need to raise just N2.64 billion as it currently it currently has paid up capital of N7.36. If the contingency reserve of N2.31bn is recapitalised, Cornerstone Insurance will only need to raise N33 million.

- AXA Mansard:

AXA Mansard Insurance made a Profit after Tax of N2.48bn in full year 2018 result and N889.97 million in the first quarter of 2019. With the outstanding number of shares of 10.50 bn, the paid up share capital the firm currently has is N5.25bn. They will need to raise an additional fund of N4.75bn, in order to meet up with the new capital base requirement. If AXA Mansard recapitalises its contingency reserve of N4.14bn, the firm will only need to raise additional N61 million to meet up with the new capital base requirement.

- Universal Insurance:

Universal Insurance to a large extent is in a comfortable zone as regards the new capital base requirement for underwriting firms. Their paid up share capital is currently N8bn, implying that they need N2bn to meet up with the new paid up share capital requirement. Universal Insurance has contingency reserve of N400 million; if recapitalized, they will need to raise N1.6bn to meet up with the new capital base requirement.

- Goldlink Insurance currently has just about 2.274 billion as paid up share capital. They will be looking for about N7.73 billion. The firm has reserve of N1.55bn; if recapitalized, they will need to raise N6.18bn to meet up with the new capital base requirement

- Guinea Insurance currently has about N3.07 billion as paid up share capital, they will be looking for well over N6.93billion. Contingency reserve of the firm is just N471 million; if recapitalized, they will need to raise N6.459bn to meet up with the new capital base requirement.

- International Energy Insurance has just N642 million as paid up share capital, they need to raise N9.36bn. The firm has contingency reserve of N1.52bn; if recapitalized, they will be looking for N7.84bn. With the look of things, they might either release their license or merge with other insurance companies or be bought over.

- LASACO has N3.6bn as share capital, they will definitely be looking N6.33bn in addition. If the contingency reserve of N1.6bn is recapitalized, LASACO will now be looking for N4.73bn to meet up with the new capital base requirement.

- Law Union & Rock Insurance currently has N2.148bn as paid up share capital; they will be looking for well over N7.85bn. With contingency reserve of N1.47bn, if recapitalized, they will now need to raise N6.38bn

- Mutual Benefit Assurance has N5.6bn as paid up share capital; they will be looking for N4.4bn. If their contingency reserve of N3.03 billion is recapitalized, the firm will only need to raise additional N1.38bn to meet up with the new capital base requirement.

- Niger Insurance has N3.8bn as paid up share capital; they will be looking for N6.13bn. If their contingency reserve of N2.01bn is recapitalized, they will need to raise a balance of N4.12bn to meet up with the new capital base requirement.

- Prestige Insurance currently has paid up share capital of N2.6bn; they will be looking for well over N7.31bn. The firm has a contingency reserve of N2.01bn; if recapitalized, they will need to raise N5.3bn to meet up with the new capital base requirement.

- Regency Alliance currently has N3.33bn as paid up share capital; they will be looking for about N6.67bn. If their contingency reserve of N1.51bn is recapitalized, they will need to raise N5.16bn in order to meet up with the new capital base requirement.

- Sovereign Trust Insurance has N4.17bn as paid up share capital; they will be looking for in excess of N5.83bn. With their contingency reserve of N2.64bn, if recapitalized, they will only need to raise additional N3.19bn to meet up with the new capital base requirement.

- Staco Insurance has N4.67bn as paid up share capital; they will be looking for N5.33 billion. If their reserve of N2.09bn is recapitalized, then they only need to raise N3.24bn.

- Standard Alliance has N6.45bn as paid up share capital; they will be looking for N3.54bn. The firm has contingency reserve of N1.67bn; if recapitalized, then they will only need to raise N1.87bn.

- Wapic Insurance has N6.69bn as paid up share capital; they will be looking for N3.31bn to meet up with the new capital base requirement. If their contingency reserve of N2.43bn is recapitalized, they will only need to raise just N88 million in order to meet up with the new capital base requirement.

- Sunu Assurance has N7bn as paid up share capital. They will be looking for N3bn and obviously should be able to do that without stress.

- Unic Insurance currently has N1.29bn, they will be looking for close to N8.71 to meet up with the new requirement.

- Veritas Kapital has N6.93bn, they will be looking for N3.07bn to meet up with the new capital base requirement.

Opinions of Insurance Operators and shareholders were sampled to as regards the new minimum wage requirement.

MD/CEO, Universal Insurance Plc, Mr. Benedict U. Ujoatuonu in his response gave tacit approval and support to the new capital regime. According to him, ‘‘Recall that when NAICOM last suspended the previous recapitalization regime, the Commission did not totally abolish the idea of recapitalizing many of the ailing underwriting companies. The suspension of the process meant that NAICOM had other plans, which means there was already a future plan to implement the recapitalization for the industry.

Take a look at the various subsectors of the equity market, you find that most of the penny stocks are found in the insurance segment of the market. For owners of such companies, your guess is as good as mine, that it will be extremely difficult for their shareholders to increase their investment, let alone meet the present capital requirement, as stipulated by NAICOM. So, I foresee serious mergers or acquisitions in the coming days.

As an operator in the industry, I cannot criticize government policies. Whatever policy the regulator deemed appropriate for the insurance industry, my role as an operator is to comply. I’m not in position to criticize NAICOM policies.

Nicholas Jerry I Ojinnaka, former MD/CEO, Guinea Insurance Plc. In react to the development said, ‘‘It must be understood that the business of insurance is not an island. The industry is a subsect of other sectors of the economy. In my opinion, I think the present capital requirement, as stipulated by NAICOM, is way above what is required by insurance firms to operate successfully.

I believe the new NAICOM capital requirement is too high and will only suffocate the industry. Where will the companies get the requisite funds to biff-up their capital or is the Commission suggesting that shareholders should go off-shore to source fund?

Right now, people are not buying insurance. How will operators raise such fund? In my opinion, I think the new capital requirement will only lead to capital flight. Nigerian investors have resorted to setting up businesses outside the country like in Cote De-Voire and other African countries, which is a fallout of the huge capital required at home to set up businesses.

Finally, my take is that NAICOM should reconsider its policy on the new capital requirement for insurance firms.

The Chairman Independent Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu, who spoke on behalf of shareholders at the Annual General Meeting (AGM) of Consolidated Hallmark Insurance(CHI) Plc in Lagos, last week Wednesday said, the recapitalization exercise announced by the regulator will only further heighten the tension in the insurance sector, as public shareholders are skeptical of investing their money in insurance companies under the current regulatory atmosphere.

According to him, ‘‘the commission is only making the business operating environment very difficult for insurers, adding that, there is nowhere in the world where recapitalization exercise is done under one year, as planned by NAICOM.

‘‘With the previous investment of retail shareholders in insurance companies across the country not yielding good returns, he said, it would be very difficult for shareholders to further reinvest in the Industry.

“It is suspicious to increase capital of insurance companies like NAICOM did and insurance operators must rise up to it because it affects their respective companies. Anywhere in the world, 18 months is the most recognized timeframe for recapitalization exercise.”

Managing Director/CEO, Consolidated Hallmark Insurance Plc. Mr. Eddie Efekoha, believes the regulator came up with the exercise because it has the interest of the insurance industry at heart, stating that, operators are already engaging the regulatory body to find a common ground that will benefit all relevant stakeholders in insurance Industry.

In his own words: “We cannot fight the regulator, but we will engage them to see things from own point of view. I believe they have the interest of the Industry at heart. It is a new development and discussion will continue, for us to reach a common ground,” he pointed out.

Boniface Okezie, Chairman, Consolidated shareholders Association Nigeria in his opinion said that though recapitalization was necessary at this, he criticized the way and manner the regulator was going about it.

‘‘There is the need for insurance companies to recapitalize, but one must say that the present policy whereby the views of players in the industry are not taken into consideration by the regulator is certainly not the best solution to the poor performance of underwriting firms at the stock market.

‘‘When you take a look at the various segment of the equity market you find that insurance companies are the worst performing subsector in terms of price index and in dividend payout.

Now, if the National Insurance Commission (NAICOM), wants these poorly capitalized firms to recapitalize where does the Commission expect them to get the needed fund? Right now, over 70% of underwriting pay between 2kobo to 10kobo dividend per annum to their respective shareholders.

With such poor return on their investment, where will such investors have the motivation to place more funds; when they are getting poor returns on investment, they already have. Which investor would want stake his money on a company that pays 2kobo dividend?

So, from that stand point, I think most of the underwriting firms lack the wherewithal to attract owners of capital to their respective companies, because the incentive to do that is not there. If the local investors or shareholders will not put more money into their insurance investment, are they expected to go off-shore to raise that money?

My take on this issue, is that the regulator should sit up and come-up with other recommendation towards improving the fortunes of insurance firms in the country. This means that the Commission must re-organize itself to provide workable solutions to the non-performance of many insurance firms.

Secondly, I think the present recapitalization policy rather than help the insurance industry, might likely lead to weeding out of the weak firms in the industry and if that happens, I can only see few insurance companies surviving the new recapitalization regime.

‘‘However, NAICOM with the new policy might be scheming to force mergers or outright acquisition of the weak firms, who might not attract the needed capital as stipulated by NAICOM.

NAICOM had in July 2018 announced that the Tier Based Minimum Solvency Capital (TBMSC) exercise will fully take off on January 1, 2019, a deadline that some insurance operators, shareholders and other stakeholders resisted.

The decision of the regulator to later shift back the recapitalization deadline date from January 1, 2019 to October 1, 2018, citing reinsurance treaties which is usually is done in November and December as the major reason for changing the deadline, rocked the plan as some parties went to court to challenge it, hence, leading to the announcement by the Commission of the cancellation of the policy in October, 2018.

The insurance regulator in the new policy has mandated all insurance and reinsurance firms to strictly comply with the new directives.