Profit taking on the floor of the Nigerian Exchange in the past couple of days has brought prices of many stocks down, thereby creating new entry opportunities for discerning investors.

In the last edition of this publication, we did Q2 earnings forecast for banking stocks. We shall continue our forecast this week with focus on select manufacturing stocks listed on the Nigerian Exchange.

Our projections of Q2 2022 earnings for manufacturing firms is based on their PEG ratios. PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings per share (EPS), and the company’s expected growth.

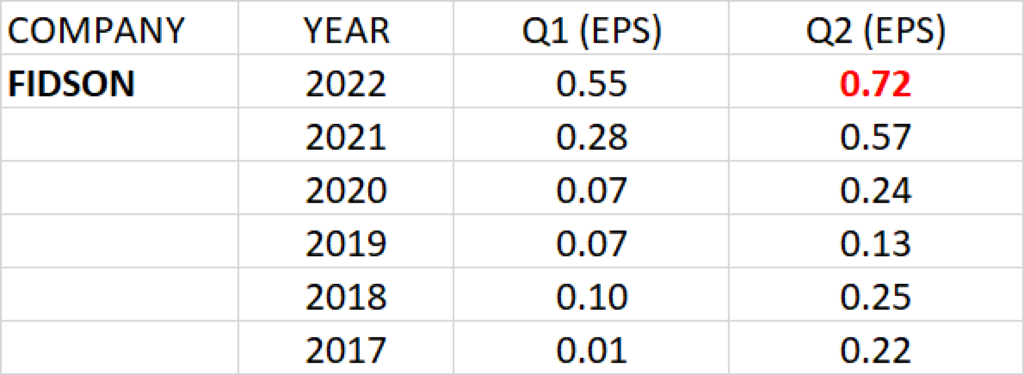

FIDSON HEALTHCARE

Q2 earnings per share of Fidson Healthcare over the last 5 years ranged between 57 kobo and 22 kobo with earnings growth rate of 26.87%.

At the share price of N12 and Q2 2021 earnings per share of 57 kobo, its P.E ratio is estimated at 21.05x.

PEG ratio against the expected Q2 2022 earnings is 0.78.

Q2 earnings per share of about N0.72 is projected for Fidson Healthcare.

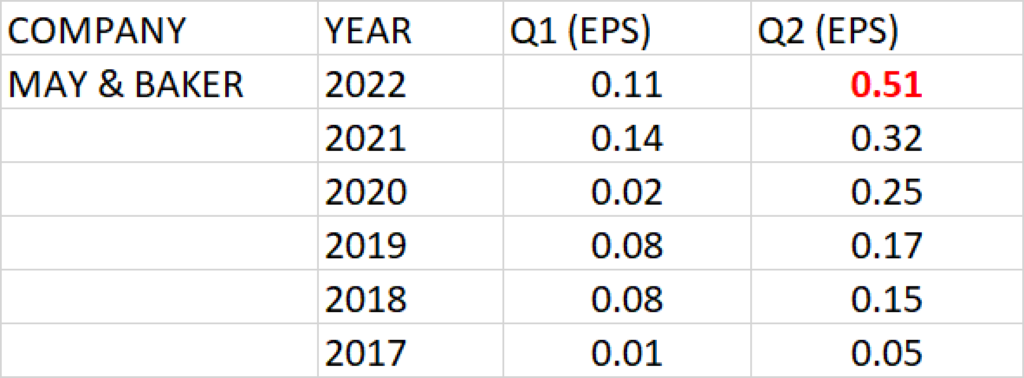

MAY & BAKER

Q2 earnings per share of May & Baker over the last 5 years ranged between 32 kobo and 5 kobo with earnings growth rate of 59.05%.

At the share price of N3.98 and Q2 2021 earnings per share of 32 kobo, its P.E ratio is estimated at 12.44x.

PEG ratio against the expected Q2 2022 earnings is 0.21.

Q2 Earnings per share of about N0.51 is projected for May & Baker.

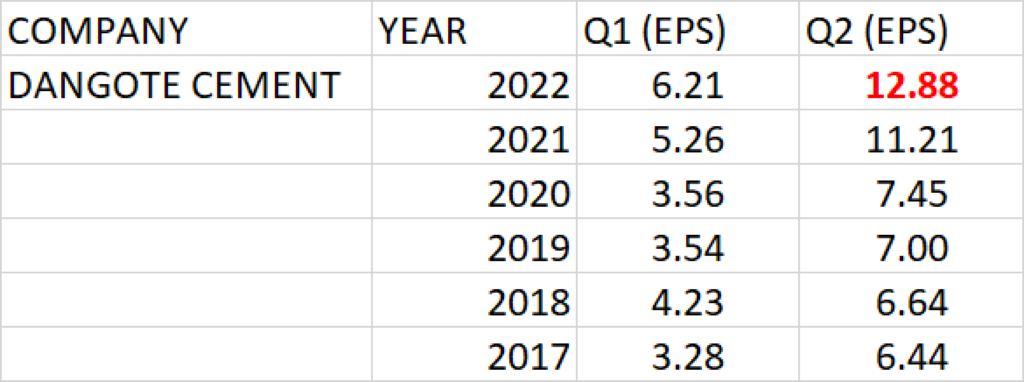

DANGOTE CEMENT

Dangote Cement over the last 5 years has Q2 earnings per share (EPS) ranging between N11.21 and N6.44 with earnings growth rate of 14.86%.

At the share price of N277 and Q2 2021 earnings per share of N11.21, its P.E ratio is estimated at 24.71x.

PEG ratio against the expected Q2 2022 earnings is 1.66.

Q2 earnings per share of about N12.88 is projected for Dangote Cement.

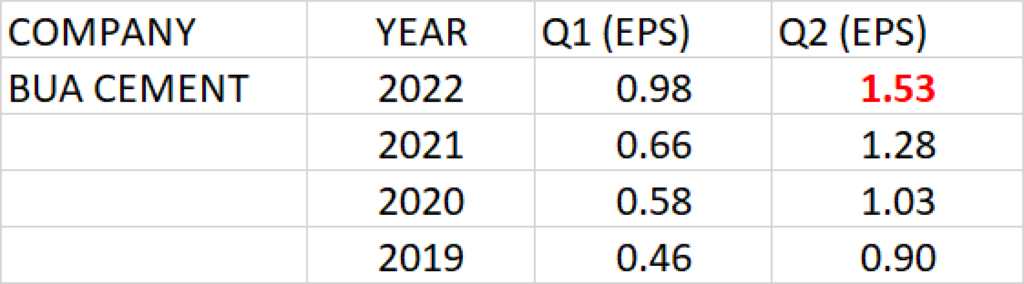

BUA CEMENT

BUA Cement over the last 3 years has Q2 earnings per share (EPS) ranging between N1.28 and N0.90 with earnings growth rate of 19.26%.

At the share price of N74.25 and Q2 2021 earnings per share of N1.28, its P.E ratio is estimated at 58x.

PEG ratio against the expected Q2 2022 earnings is 3.01.

Q2 earnings per share of about N1.53 is projected for BUA Cement.

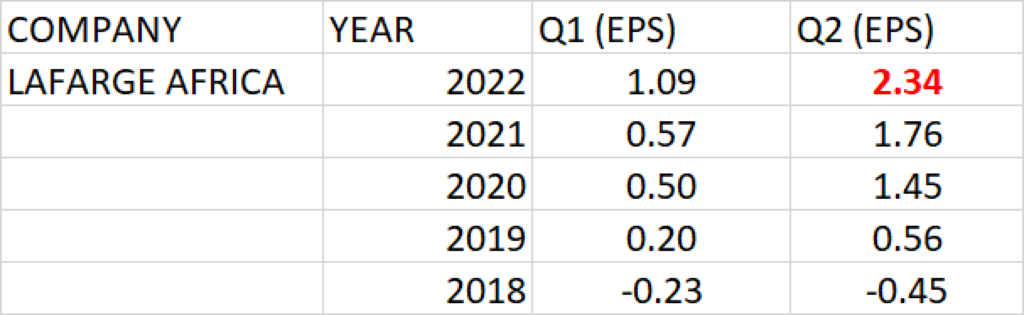

LAFARGE AFRICA

Q2 earnings per share of Lafarge Africa over the last 4 years ranged between N1.76 and –N0.45 with earnings growth rate of 33.15%.

At the share price of N27.90 and Q2 2021 earnings per share of N1.76, its P.E ratio is estimated at 15.85x.

PEG ratio against the expected Q2 2022 earnings is 0.48.

Q2 earnings per share of about N2.34 is projected for Lafarge Africa.

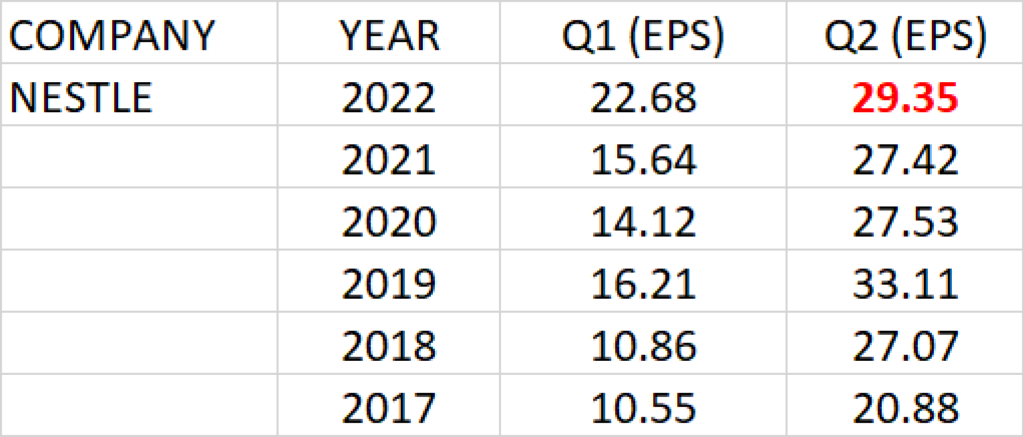

NESTLE

Q2 earnings per share of Nestle over the last 5 years ranged between N27.42 and N20.88 with earnings growth rate of 7.05%.

At the share price of N1400 and Q2 2021 earnings per share of N27.42, its P.E ratio is estimated at 51.06x.

PEG ratio against the expected Q2 2022 earnings is 7.24.

Q2 Earnings per share of about N29.35 is projected for Nestle.

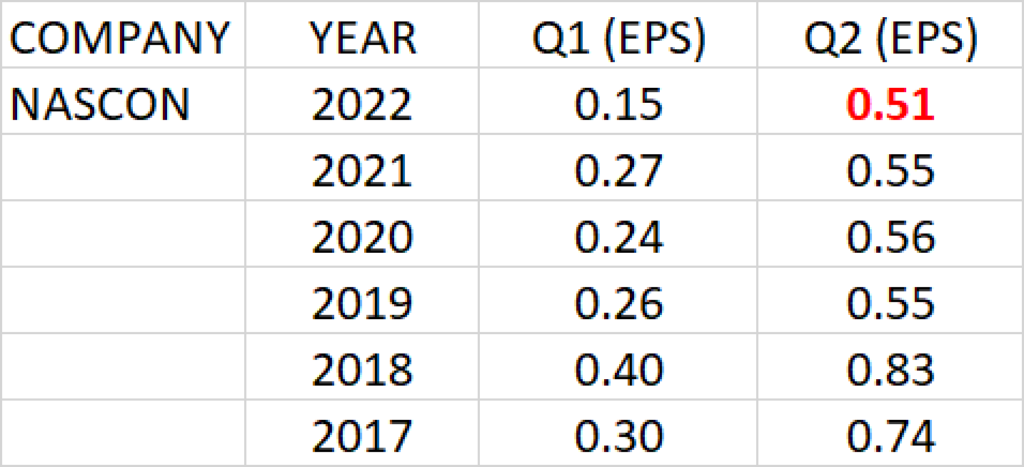

NASCON ALLIED INDUSTRIES

Q2 earnings per share of Nascon Allied Industries over the last 5 years ranged between 74 kobo and 55 kobo with negative earnings growth rate of -7.15%.

At the share price of N12.85 and Q2 2021 earnings per share of N0.55, its P.E ratio is estimated at 23.36x.

PEG ratio against the expected Q2 2022 earnings is -3.27.

Q2 Earnings per share of about N0.51 is projected for Nascon Allied Industries.

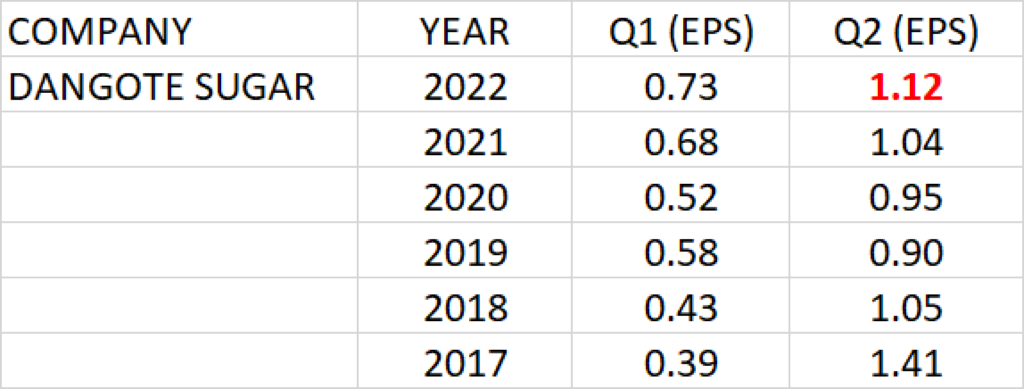

DANGOTE SUGAR

Q2 earnings per share of Dangote Sugar over the last 5 years ranged between N1.41 and 90 kobo with earnings growth rate of 7.5%.

At the share price of N16 and Q2 2021 earnings per share of N1.04, its P.E ratio is estimated at 15.38x.

PEG ratio against the expected Q2 2022 earnings is 2.05.

Q2 earnings per share of about N1.12 is projected for Dangote Sugar.

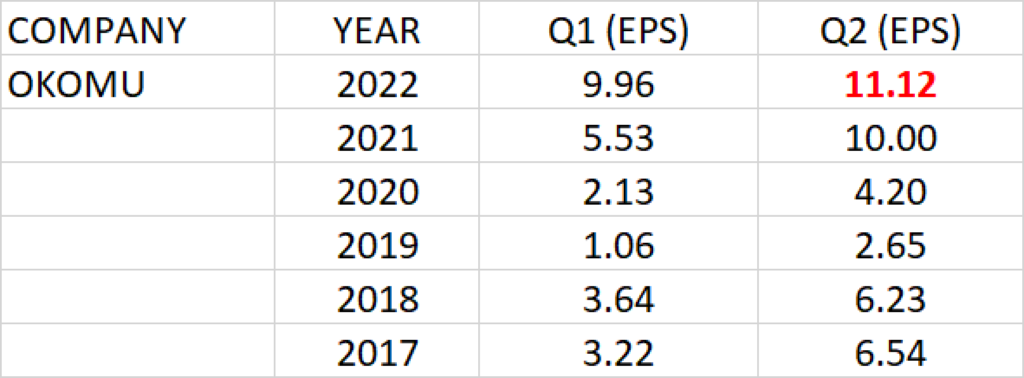

OKOMU

Q2 earnings per share of Okomu Oil Palm Company over the last 5 years ranged between N10 and N6.54 with earnings growth rate of 11.2%.

At the share price of N193.5 and Q2 2021 earnings per share of N10, its P.E ratio is estimated at 19.35x.

PEG ratio against the expected Q2 2022 earnings is 1.73.

Q2 Earnings per share of about N11.12 is projected for Okomu.

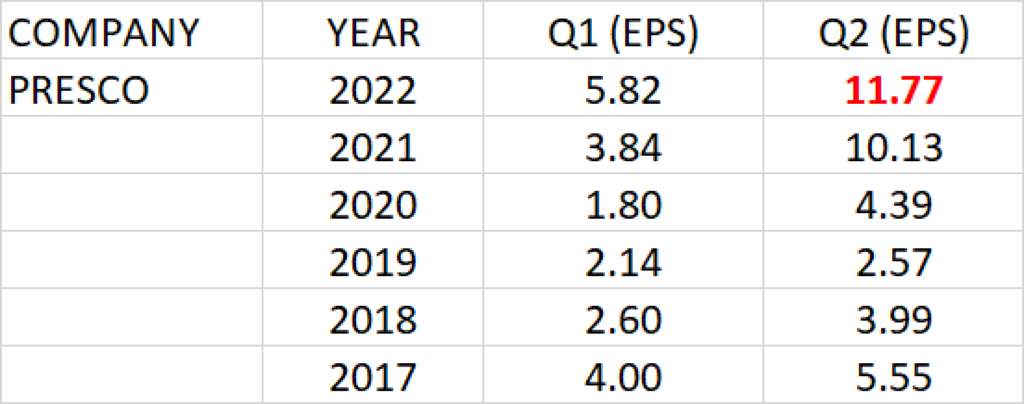

PRESCO

Q2 earnings per share of Presco over the last 5 years ranged between N10.13 and N5.55 with earnings growth rate of 16.23%.

At the share price of N166.8 and Q2 2021 earnings per share of N10.13, its P.E ratio is estimated at 16.47x.

PEG ratio against the expected Q2 2022 earnings is 1.01.

Q2 Earnings per share of about N11.77 is projected for Presco.

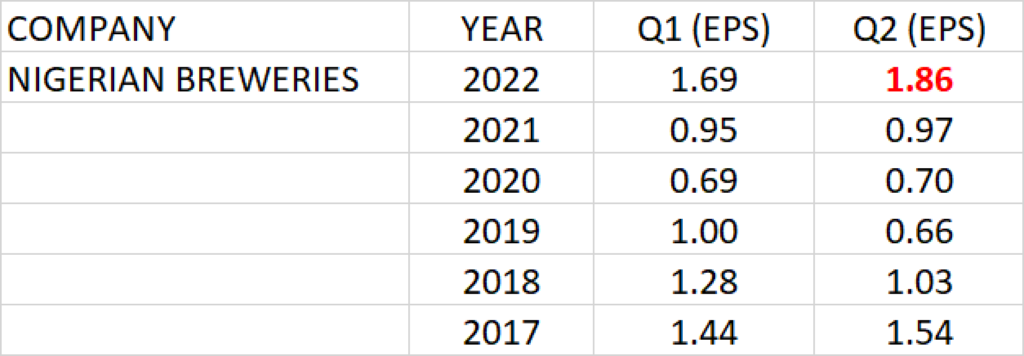

NIGERIAN BREWERIES

Q2 earnings per share of Nigerian Breweries over the last 5 years ranged between N1.54 and N0.97.

At the share price of N63.5 and Q2 2021 earnings per share of N0.97, its P.E ratio is estimated at 65.46x.

Based on its Q1 2022 earnings performance, a growth of 91.75% is projected for Nigerian Breweries in Q2 2022, relative to its Q2 2021 EPS of N0.97.

PEG ratio against the expected Q2 2022 earnings is 6.48.

Q2 Earnings per share of about N1.86 is projected for Nigerian Breweries.

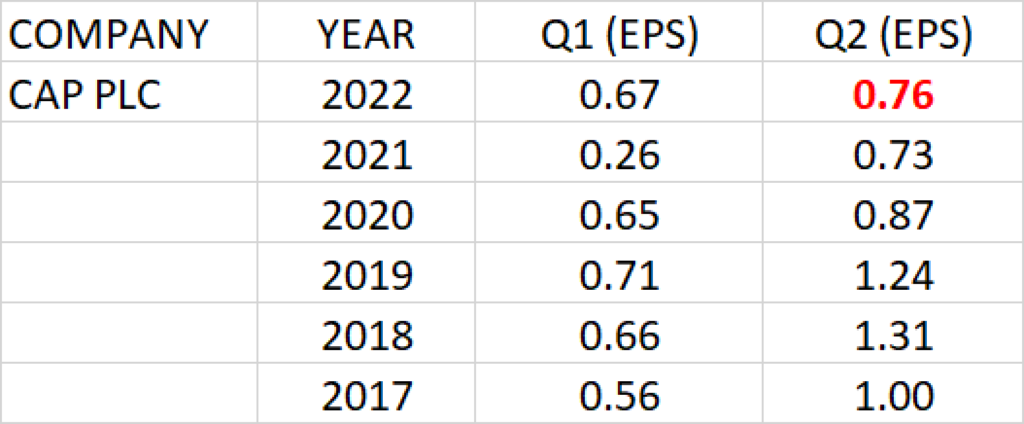

CAP PLC

Q2 earnings per share of CAP Plc over the last 5 years ranged between N1.00 and N0.73 with earnings growth rate of 4.59%.

At the share price of N18.15 and Q2 2021 earnings per share of N0.73, its P.E ratio is estimated at 24.86x.

PEG ratio against the expected Q2 2022 earnings is 5.42.

Q2 Earnings per share of about N0.76 is projected for CAP Plc.