- Okomu leads manufacturers in PAT growth, Presco leads in Turnover Growth

- Fidson leads in earnings yield, Presco emerge top in profit margin

- Comparative analysis of manufacturing stocks in FY 2021

The year 2021 was indeed an interesting year for manufacturing firms listed on the floor of the Nigerian Exchange as they reported impressive earnings with significant growth.

Despite the odds and challenging environment against the ease of doing business in Nigeria, most of these companies were able to weather the storm and come out with good results and even paid dividend. Some of the key challenges manufacturers face include: electricity, access to forex for importation of raw materials, high cost of diesel, finance cost amongst others.

This article is focused on comparative analysis of manufacturing firms in FY 2021. Comparative analysis of stocks in terms of profitability, turnover, earnings growth, earnings yield and profit margin is essential to help investors to gauge performance and know where to pitch their tent in future investment decision.

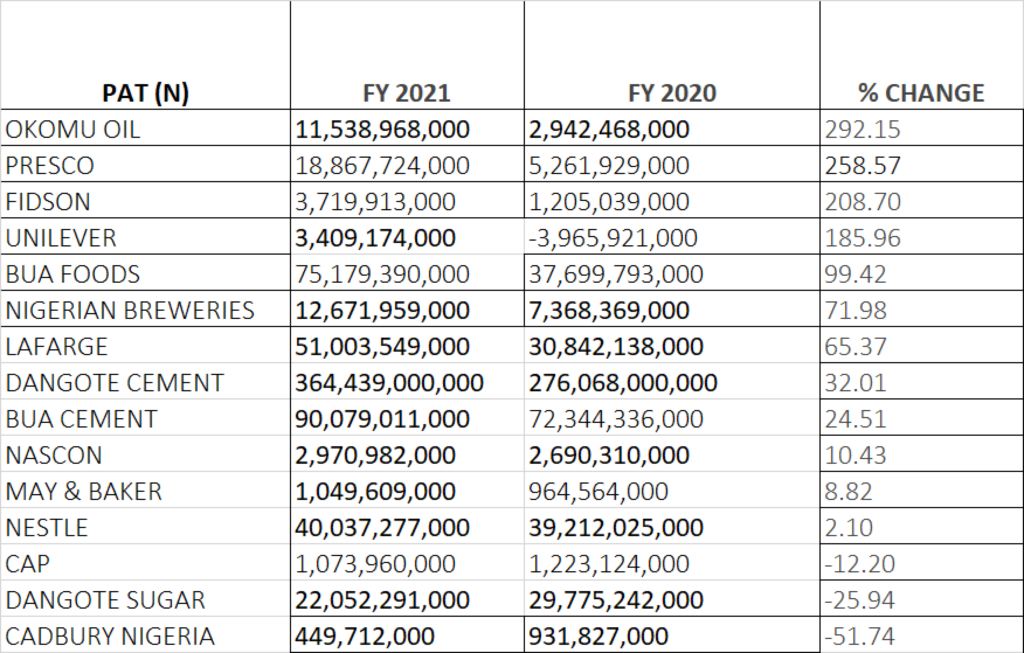

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Okomu Oil Palm Company Plc grew its profit after tax by 292.15% year on year from N2.94 billion to N11.54 billion, emerging best in terms of growth in profit after tax among others in the manufacturing sector.

- Presco emerged second in terms of growth in profit after tax as profit grew by 258.57% year on year from N5.26 billion to N18.87 billion.

- Fidson Healthcare emerged third in terms of growth in profit after tax as profit grew by 208.70% year on year from N1.21 billion to N3.72 billion.

- Unilever grew its profit after tax by 185.96% to N3.41 billion from a loss after tax of N3.97 billion reported the previous year.

- BUA Foods achieved profit after tax of N75.18 billion, up by 99.42% from N37.7 billion achieved the previous year.

- Nigerian Breweries grew its profit after tax by 71.98% from N7.37 billion to N12.67 billion.

- Lafarge Africa (Wapco) grew in profit after tax by 65.37% year on year to N51 billion from N30.84 billion.

- Dangote Cement achieved profit after tax of N364.44 billion, up by 32.01% from N276.07 billion achieved the previous year.

- BUA Cement grew in profit after tax by 24.51% year on year to N90.08 billion from N72.34 billion reported in 2020.

- NASCON Allied Industries grew in profit after tax by 10.43% to N2.97 billion from N2.69 billion reported the previous year.

- May & Baker grew in profit after tax by 8.82% to N1.05 billion from N964.56 million.

- Nestle grew in profit after tax by 2.10% to N40.04 billion from N39.21 billion.

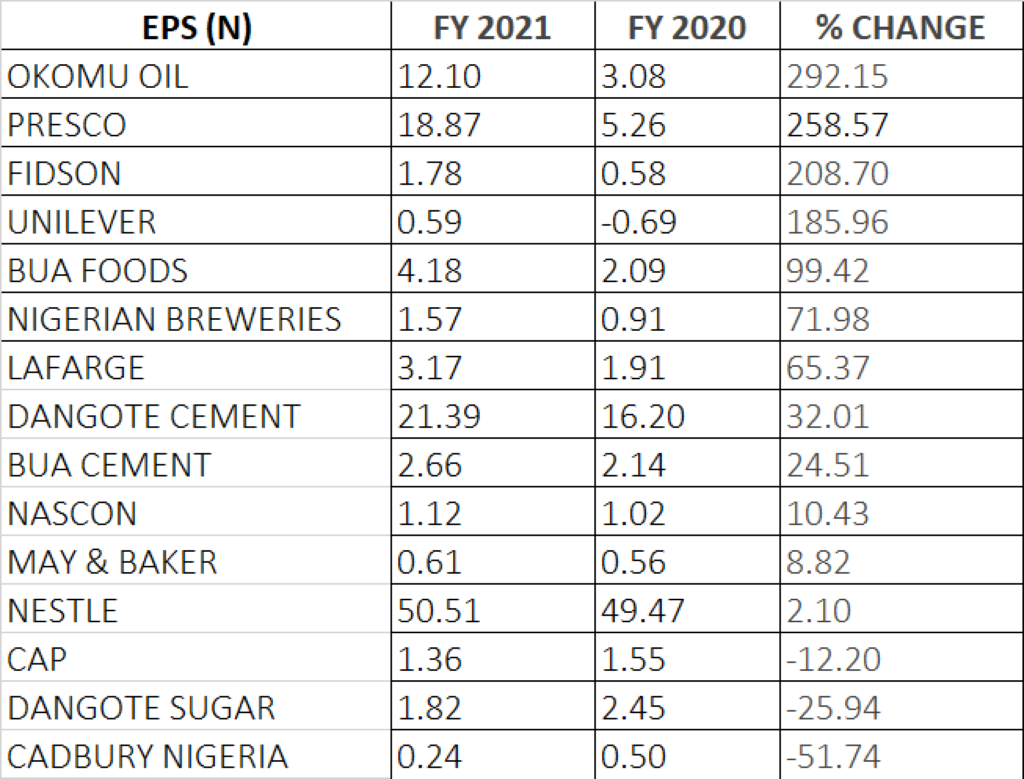

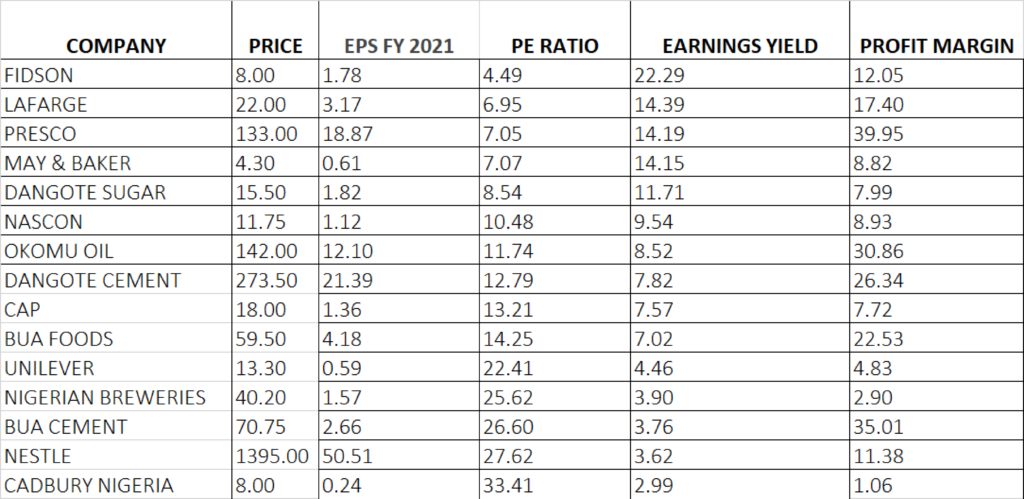

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNING’S YIELD

- Earnings per share of Okomu increased by 292.15% to N12.10 from N3.08, At the share price of N142, the P.E ratio of Okomu stands at 11.74x with earnings yield of 8.52%.

- Presco grew its earnings per share by 258.57% year on year from N5.26 to N18.87. At the share price of N133, Presco has a P.E ratio of 7.05x with earnings yield of 14.19%.

- Fidson Healthcare emerged third in terms of growth in earnings per share as it grew by 208.70% year on year from N0.58 to N1.78. At the share price of N8, the P.E ratio of Fidson stands at 4.49x with earnings yield of 22.29%.

- Unilever grew its earnings per share by 185.96% to N0.59 from a negative EPS of N0.69 reported the previous year. At the share price of N13.30, the P.E ratio of Unilever stands at 22.41x with earnings yield of 4.46%.

- BUA Foods achieved the earnings per share of N4.18, up by 99.42% from the EPS of N2.09 achieved the previous year. At the share price of N59.5, the P.E ratio of BUA Foods stands at 14.25x with earnings yield of 7.02%.

- Nigerian Breweries grew its EPS by 71.98% from N0.91 to N1.57.At the share price of N40.20, the P.E ratio of Nigerian Breweries stands at 25.62x with earnings yield of 3.90%.

- Lafarge Africa (Wapco) grew its EPS by 65.37% year on year to N3.17 from N1.91. At the share price of N22, the P.E Ratio of Lafarge Africa stands at 6.95x with earnings yield of 14.39%.

- Dangote Cement achieved the earnings per share of N21.39, up by 32.01% from the EPS of N16.2 achieved the previous year. At the share price of N273.50, the P.E ratio of Dangote Cement stands at 12.79x with earnings yield of 7.82%.

- BUA Cement grew its EPS by 24.51% year on year to N2.66 from N2.14 reported in 2020. At the share price of N70.75, the P.E ratio of BUA Cement stands at 26.60x with earnings yield of 3.76%.

- NASCON Allied Industries grew its earnings per share by 10.43% to N1.12 from the EPS of N1.02 reported the previous year. At the share price of N11.75, the PE ratio of NASCON Allied Industries stands at 10.48x with earnings yield of 9.54%.

- May & Baker grew its EPS by 8.82% to N0.61 from the EPS of N0.56. At the share price of N4.30, the P.E ratio of May & Baker stands at 7.07x with earnings yield of 14.15%.

- Nestle grew its earnings per share by 2.10% to N50.51 from the EPS of N49.47. At the share price of N1,395, the PE Ratio of Nestle stands at 27.62x with earnings yield of 3.62%.

- Overall, Fidson emerged most attractive among others with earnings yield of 22.29%. This is followed by Lafarge Africa with earnings yield of 14.39%.

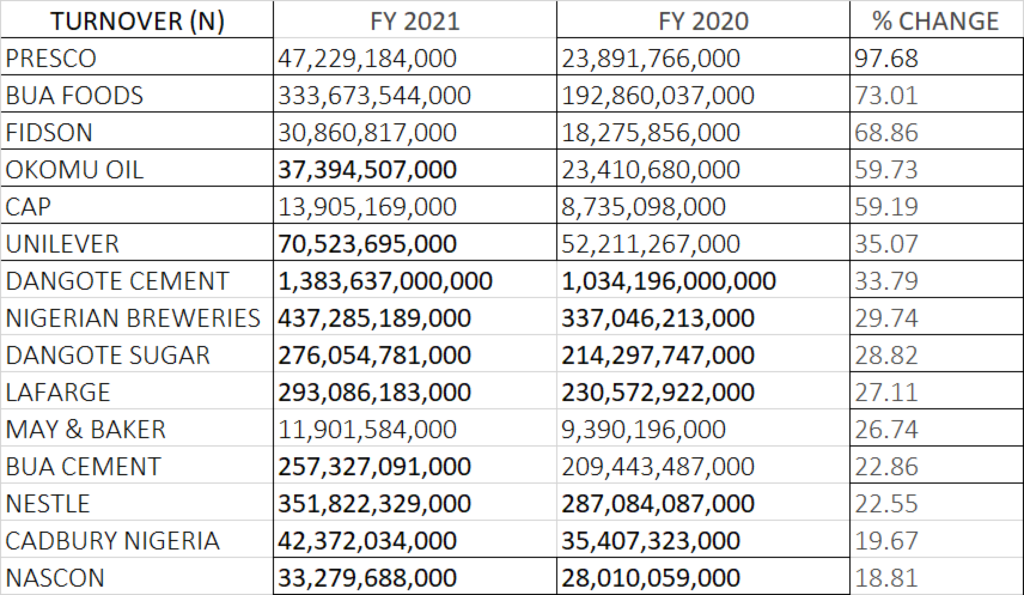

PERFORMANCE IN TURNOVER GROWTH

- Presco emerged top in terms of turnover growth among others in the manufacturing sector as it grew its turnover by 97.68% year on year to N47.23 billion from N23.89 billion.

- Second on the list is BUA Foods with a turnover of N333.67 billion, up by 73.01% from N192.86 billion reported the previous year.

- Fidson Healthcare grew its turnover by 68.86% year on year to N30.86 billion from N18.28 billion.

- Okomu Oil is fourth in ranking of turnover growth as it grew its revenue by 59.73% to N37.39 billion from N23.41 billion.

- CAP Plc emerged fifth in terms of turnover growth as revenue increased by 59.19% to N13.91 billion from N8.74 billion.

- Unilever grew its turnover by 35.07% to N70.52 billion from N52.21 billion.

- Dangote Cement grew turnover by 33.79% to N1.38 trillion from N1.03 trillion.

- Nigerian Breweries increased its revenue by 29.74% to N437 billion from N337 billion.

- Dangote Sugar grew its turnover by 28.82% to N276 billion from N214 billion.

- Lafarge Africa grew its turnover by 27.11% to N293 billion from N230.57 billion.

- May & Baker grew its turnover by 26.74% year on year to N11.9 billion from N9.39 billion.

- BUA Cement grew its turnover by 22.86% year on year to N257 billion from N209 billion.

- Nestle grew its turnover by 22.55% year on year to N351.8 billion from N287 billion.

- Cadbury grew its turnover by 19.67% year on year to N42.37 billion from N35.41 billion.

- NASCON Allied Industries grew its turnover by 18.81% year on year to N33.28 billion from N28.01 billion.

PROFIT MARGIN

- Presco emerged top among others with a profit margin of 39.95% in year 2021.

- BUA Cement achieved a profit margin of 35.01%, emerging second among others in the manufacturing sector in terms of profit margin.

- Okomu in 2021 financial year achieved a profit margin of 30.86%, emerging third among others.

- Dangote Cement achieved a profit margin of 26.34% emerging fourth among others.

- BUA Foods made a profit margin of 22.53% in 2021 financial year.