Equity market on Tuesday November 16, 2020 ended on a bearish note as the All Share Index closed lower by 1.53% to settle at 34,242.83 points from the previous close of 34,774.08 points. Market Capitalisation also shed N277 billion to close at N17.893 trillion from the previous close of N18.170 trillion.

From the pattern observed in the market, today is likely the end of the bears as there were lots of recovery moves by the market. The decline in the market today is largely caused by the decline in the share prices of Dangote Cement and Nestle. The market was on the verge of recovery when Dangote Cement and Nestle lost 6.45% and 3.45% respectively.

Going forward, the market is expected to recover based on the recovery moves already observed in Banking stocks like Guaranty Trust Bank, FBNH, Ecobank, Fidelity and Union Bank.

At the close of trade on today, an aggregate of 9.36 billion units of shares were traded in 8,712 deals, valued at N12.02 billion.

Market Breadth

The market breadth closed negative as 17 equities gained while 30 equities declined in their share prices.

Percentage Gainers

BOC Gas led other gainers with 9.96% growth to close at N5.85 from the previous close of N5.32.

Glaxosmith and Conoil among other gainers also grew their share prices by 9.56% and 9.45% respectively.

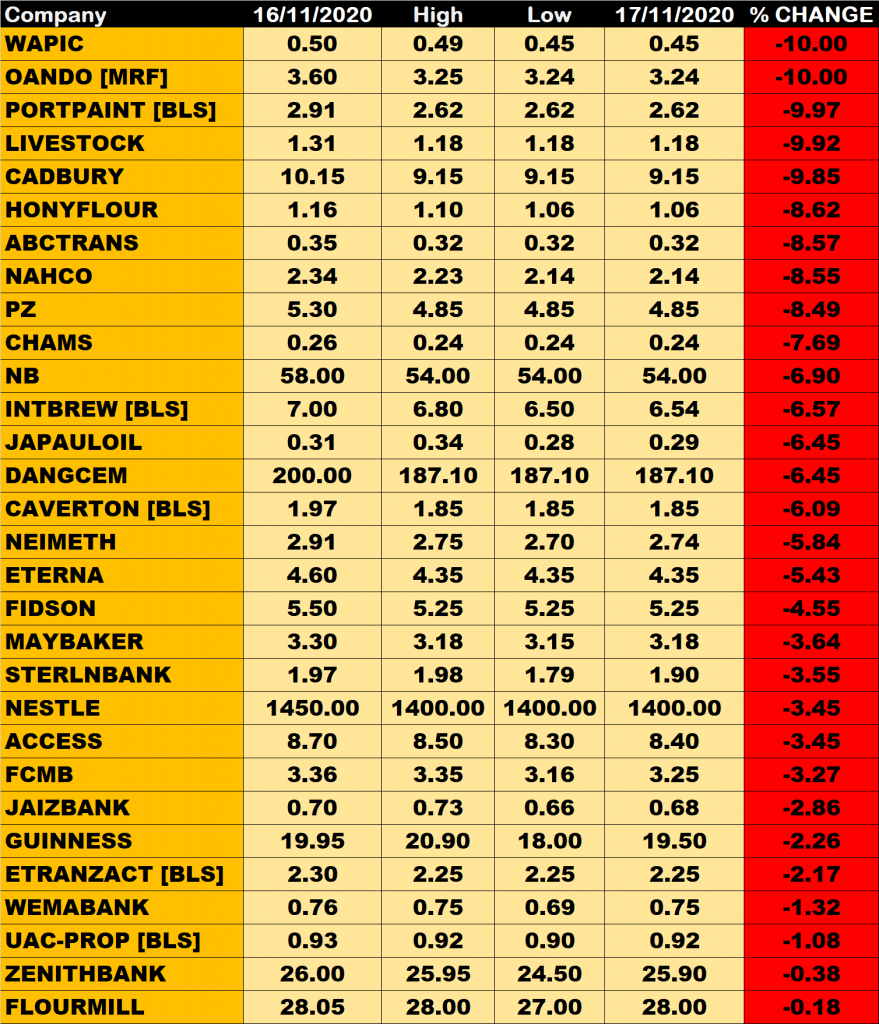

Percentage Losers

Coronation Insurance (formerly Wapic Insurance) and Oando led other price decliners as they as they shed 10% of their share prices respectively.

Portland Paint, Livestock Feeds and Cadbury among other price decliners also shed their share prices by 9.97%, 9.92% and 9.85% respectively.

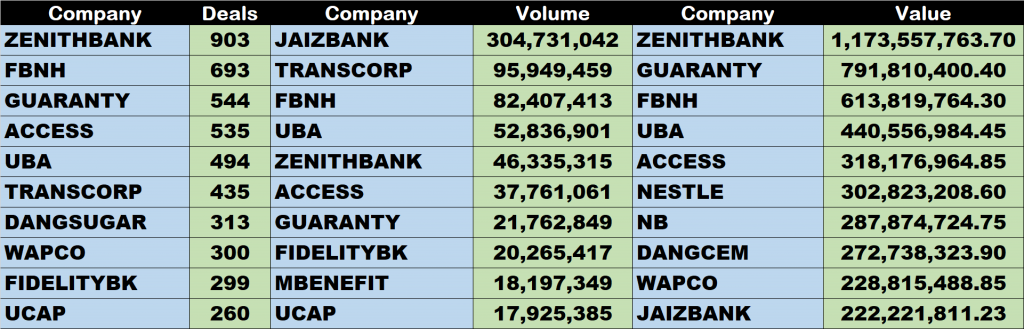

Volume Drivers

- Jaiz Bank traded about 304.73 million units of its shares in 66 deals, valued at N222 million.

- Transcorp traded about 95.95 million units of its shares in 435 deals, valued at N97.93 million.

- FBN Holdings traded about 82.4 million units of its shares in 693 deals, valued at N613.8 million.

Stocks to Watch

Today we have seen recoveries in banking stocks like Guaranty Trust Bank, FBNH, Ecobank, Fidelity and Union Bank.

Investors should take position in Access Bank, FBNH, Zenith Bank UBA, FCMB and Fidelity Bank because they will be the next to rally. Considering the recent major bull when the Zenith and Guaranty started coming up, Access Bank, FBNH, UBA, FCMB and Fidelity Bank rather declined, but afterwards began to rally. Based on this observed pattern, these above mentioned banking stocks will be the next focus of the market to rally.