The Market Last Week:

The Nigerian bourse last week, for the first time since week ended March 09, 2018 experienced not only a higher weekly gain but also three days of green movements in a week.

It should be recalled that despite impressive 2017 Q4 earnings reports which should ordinarily propel enhanced market activities with relative price increase, the market had seen more days of red brought about by price shed of even premium stocks. Last week however witnessed a measure of positive performances though not strong enough to conclude arrival of a fresh season.

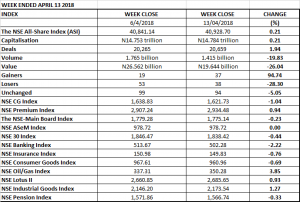

Weekly Performance review:

SECTOR PERFORMANCE

- Increased numbers of gainers in the week, when juxtaposed with lower numbers of decliners, in comparison with records of the preceding week are positive indicators. It suggests that Sellers are wary while Buyers are moderately considering purchases at current prices.

- Numbers of gainers and losers for the week were at par. This suggests a bouncing back if sustained.

- Numbers of unchanged stocks are lower last week than the preceding week.

- Volume for the week under review was down. Ditto value of stocks traded. This suggests low money flow. Buyers are still wary. Deals increased slightly.

- More sector Indexes were down last week. This infers concentrations on stocks in Oil and Gas and Industrial goods.

CONCLUSION:

Putting all the above together, one can deduce that market performance last week was propelled by activities in few stocks in two major industries. Sustainability is still largely an issue hence; Investors are advised to still tread on the path of caution.

Inflation and the prices of stocks:

The National Bureau of Statistics, NBS, last week stated that inflation currently stands at 13. 34% or 0.99% less than 14.33% record of February 2018. According to NBS, notably, this is the 14th consistent decline in inflation since January 2017 as it inches closer to the single digits target set by both monetary and fiscal authorities for the nation’s economy. What is the significance of reducing inflation on the prices of stocks and the market generally?

Please note that inflation is the general reduction in the prices of goods and services. In other words, inflation measures the value of money or what money can buy in real terms. So how do we approach investments in stocks should the regulators achieve their aims of digit inflation?

- If rising inflation must be curtailed, MPC rates would have to be kept low by the regulators. If that is achieved, money markets will not be attractive to investors. At that, immediate next beneficiary will be the stock market.

- If rising inflation is curbed by the lowering of MPC rates, cost of borrowings will be low. This will affect the prices of stocks in two ways.

- Market Operators and active players can borrow cheap funds for investment in stocks. Increasing demands will sure lead to enhanced positive performances of equity prices.

- Low rates in the money markets will inadvertently boost stock market investment as an alternative particularly short term trading. Consequently, stock prices will not be down. Special attentions and skills will however be required to benefit.

- Low inflation helps manufacturing. Costs of goods and services will be low and these include the cost of raw materials particularly if locally sourced. The ensuing probable effect is low price of finished products. At that, boost in sales is bound to be recorded. Increasing turnover and profitability can only boost dividend payout to investors and when dividend payout is boosted, prices most likely will not be down.

How to Dabble:

- Financial markets stocks will require pumping up of volume and other strategies to meet up expected challenges.

- Manufacturing/industrial and domestic goods stocks will emerge immediate beneficiaries.

- Early position takers will benefit more

- Late entry will require dexterity to win

- Skills and knowledge of short term market play will be required

- Late buy and hold investors will need to wait longer.

Possibilities this week:

- Directions from combined indicators see the market in relaxed mood at open Monday. Performance will still be topsy-turvy, on the whole, the week will still be shared among green and red days.

- Friday’s bids and offers closing figures were not bad. A number of stocks will be opening Monday morning strong.

- Reducing inflation figures should induce a measure of confidence

- Price shedding may abate but not quashed.

STOCKS TO WATCH THIS WEEK:

- ACCESS BANK PLC: The stock might open low Monday but likely to inch up later in the week. Attentions should not be shifted from 2017 Q4 earnings until its 2018 Q1 earnings are released to the market around end of April. If the results come in early, it would be this week.

- AFRICAN PRUDENTIAL PLC: Afriprud’ Q1 earnings are due this week after its board meeting. The expected improvement should reverse its price which is due to decline gradually based on indicators from technical charts and closing offer Friday last week.

- C&I LEASING: Except if the company changes gear this year, its Q1 earnings is expected around first week in May. Between now and then, its price will vacillate and for this week? it is bound to open strong but might cave way. Its about 66 kobo 2017 Q4 earnings is good enough at current price of N1.90. The open Monday is bound to be strong. Indicators are within buy range.

- COURTVILLE: Suitable for smaller investors, Courtville seems prepared to witness a strong Monday. Technically too, the stock is a buy in outlook. Its Q1 earning is being expected in the market between April 22 and the end of the month if precedence is to be observed. The 2017 Q4 earnings is however low at about just 1kobo per share but the price at 21kobo is equally low.

- DANGOTE SUGAR & DANGOTE FLOUR: Both stocks might start the week low though on charts, Dangote Flour is more promising than Dangote Sugar.

- DIAMOND BANK PLC: Opening Monday stands to be strong but there are possibilities of bids waning out with likely accompanying price drop. While the bank’s 2017 Q4 audited report is being delayed, by precedence, its Q1 2018 earnings are also due around end of April. May be one or two days of growth might suffice this week as the price dwells around its lowest in the year.

- ETERNA OIL AND GAS: There are possibilities that price might first look down before a recovery this week. The stock is however good for short, medium and long term. Dividend of 40kobo on a price of N6.15 makes the stock attractive even as its 2018 Q1 earnings are being expected in the market in early May.

- FBNH: The stock recorded two days of losses and another two days of gains last week. One day was flat. The money flow is almost at the oversold level thus indicating a good period to consider. The audited report historically released around end of April with the Q1 at about same period.

- GUARANTY: Impact of 2017 Q4 earnings and dividend payout waned. Market looks forward to next week, a period between April 20th and 26th when its Q1 for 2018 is released. There are indicators that fresh fund is not entering in there. A lower price regime makes the stock attractive. Opening Monday looks likely strong.

- OANDO PLC: Going by the charts, the stock is absolutely not buyable. Its been so since November 8th Of course the stock stands another week of consistent price growth by virtue of the closing bids size Friday, until its results are released, Buyers should beware.

- REGENCY ALLIANCE INSURANCE PLC: Except for one or two years, Regency has always paid a dividend. The 3kobo from EPS of 4kobo. The company likes to build reserves hence, a retained profit carried forward is in excess of 5 kobo which by implication suggests that the company can still pay higher dividend in the following year without stress. At current price of 28kobo, the dividend yield is 10.71%, EPS yield is 14% while PER is 7. The stock got as low as 26kobo.

- WAPIC: The insurance company’s 11kobo 2017 Q4 earnings per share at current price gives 20% earnings yield and PER of 5. Its Q1 is being expected around end of April. It is suitable for long term hold.

- WEMA BANK PLC: Frankly speaking, Wema keeps innovating. A little more resilience is hoped to compensate for the efforts. Major takeaway from its audited reports are increase in turnover, slightly lower PAT and decline in EPS. It is certain that the bank’s outstanding shares is large and would need to be looked into before any meaningful dividend could be declared.

- ZENITH BANK PLC: The stock price is still largely underpriced. Its earnings are positive enough for a long term hold. Going by precedence, its Q1 earnings might hit the market as early as this week but if not, definitely towards the end of April. Possibility is high.

- OTHER STOCKS TO WATCH:

- NB PLC

- SKYE BANK PLC

- UCAP

- UPL

- UACN

- UBA