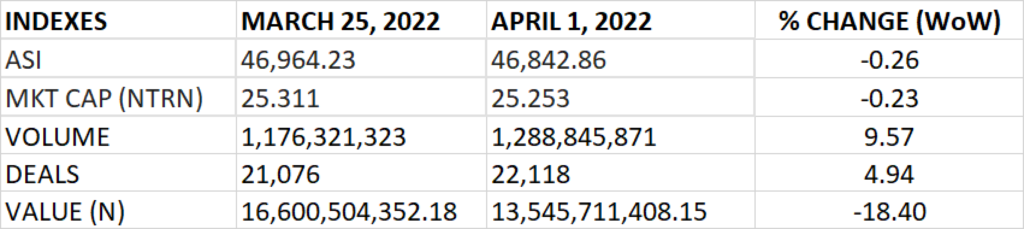

The Nigerian stock market last week closed on a bearish note, occasioned by profit taking and portfolio rebalancing by investors.

The All Share Index declined by 0.26% week on week, closing at 46,842.86 points from the previous close of 46,964.23 points.

The Market Capitalisation declined by 0.23% in the course of last week to close at N25.253 trillion from the previous close of N25.311 trillion.

An aggregate of N1.289 billion units of shares were traded in 22,118 deals, valued at N13.55 billion.

The Market Breadth closed negative as 20 equities emerged as gainers against 50 equities that declined in their share prices.

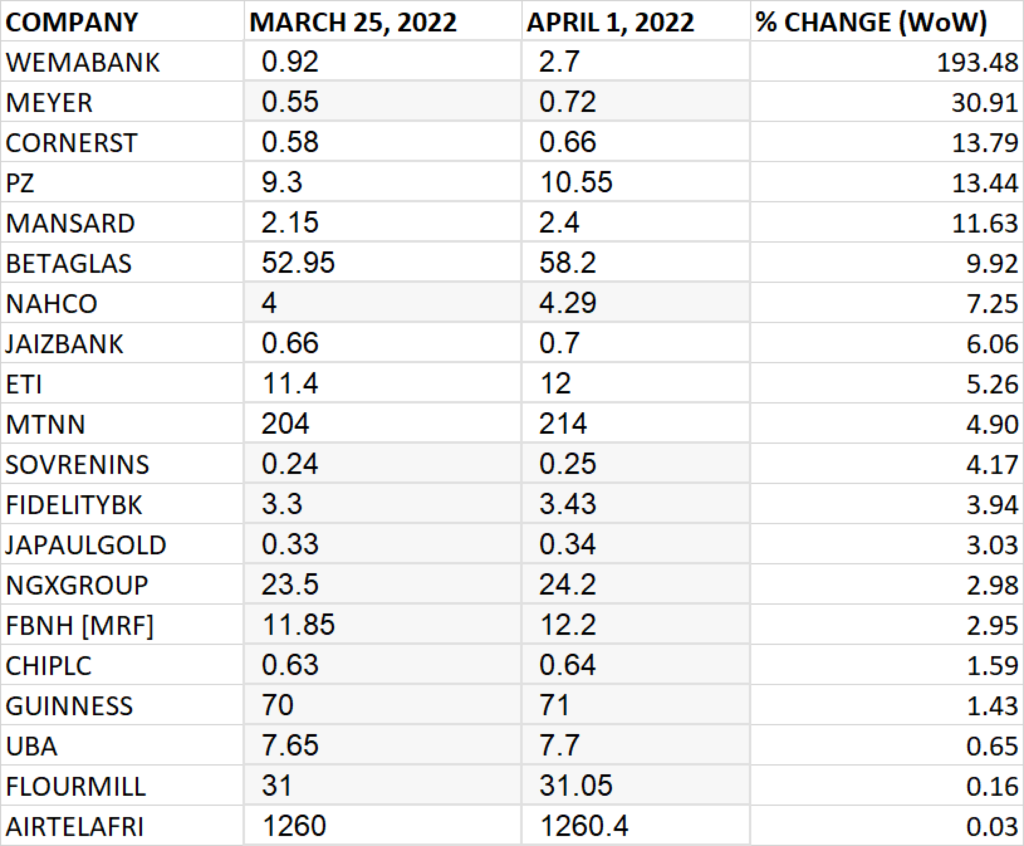

TOP 10 GAINERS

Wema Bank led other gainers with 193.48% growth to close at N2.70 from the previous close of N0.92.

Meyer Plc, Cornerstone Insurance, PZ and AXA Mansard grew their share prices by 30.91%, 13.79%, 13.44% and 11.63% respectively.

Others among 10 gainers include: Beta Glass (9.92%), NAHCO (7.25%), Jaiz Bank (6.06%), Ecobank (5.26%) and MTN (4.90%).

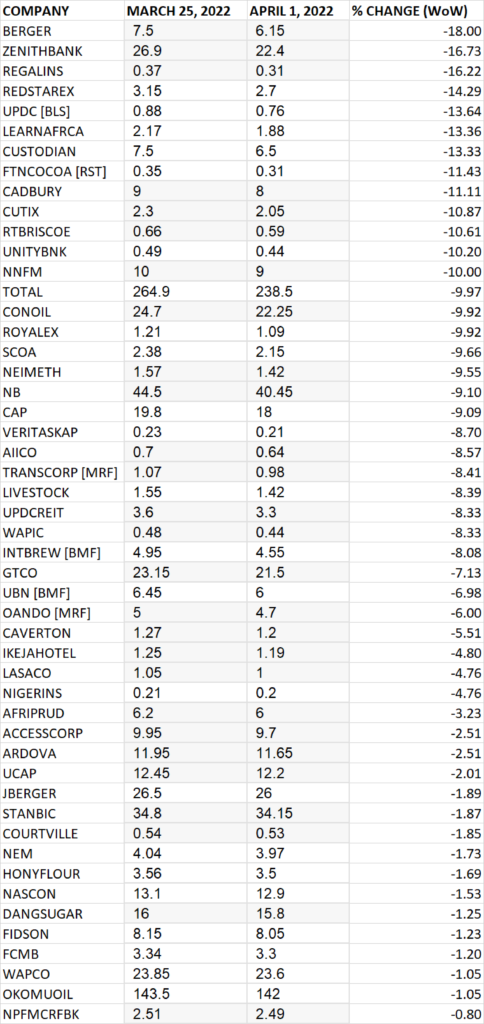

TOP 10 LOSERS

Berger Paints led other price decliners in the course of last week as it shed 18% of its share price to close at N6.15 from the previous close of N7.5.

Zenith Bank, Regency Alliance, Red Star Express and UPDC shed their share prices by 16.73%, 16.22%, 14.29% and 13.64% respectively.

Others among top ten price decliners include: Learn Africa (-13.36%), Custodian Investment (-13.33%), FTN Cocoa (-11.43%), Cadbury (-11.11%) and Cutix (10.87%) respectively.

GAINERS

LOSERS