Nigerian stock market last week closed on bearish note occasioned by drop in the share price of MTN by 2.30%.

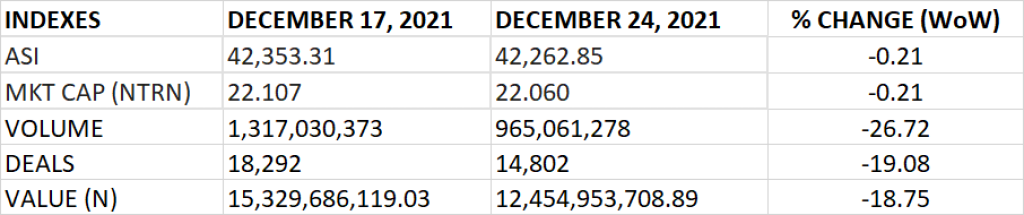

The All Share Index and Market Capitalisation declined by 0.21% week on week to close at 42,262.85 points and N22.060 trillion respectively. Year to date, the market has returned 4.95%.

In the course of last week, an aggregate of N965 million units of shares were traded in 14,802 deals, valued at N12.5 billion.

The market breadth closed positive as 33 equities emerged as gainers while 25 equities declined in their share prices.

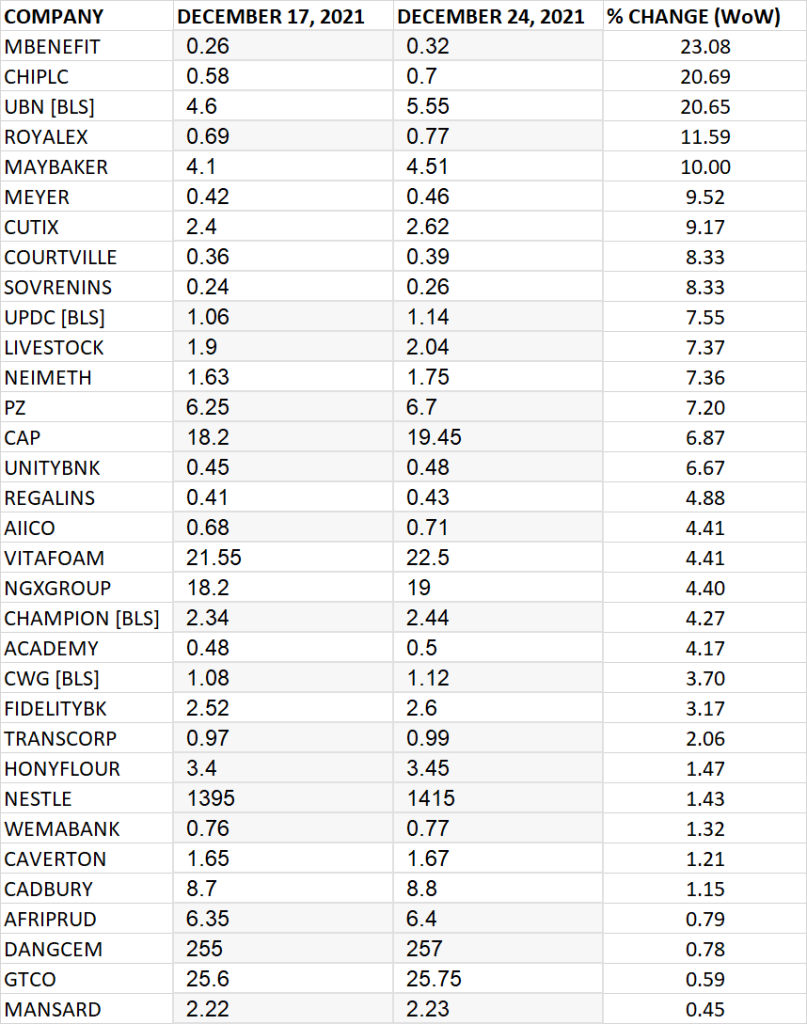

Top 10 Gainers

Mutual Benefit Assurance led other gainers with 23.08% growth week on week, closing at N0.32 from the previous close of N0.26.

Consolidated Hallmark Insurance, Union Bank, Royal Exchange and May & Baker grew their share prices by 20.69%, 20.65%, 11.59% and 10% respectively.

Others among top ten gainers include: Meyer (9.52%), Cutix (9.17%), Courteville (8.33%), Sovereign Trust Insurance (8.33%) and UDPC (7.55%) respectively.

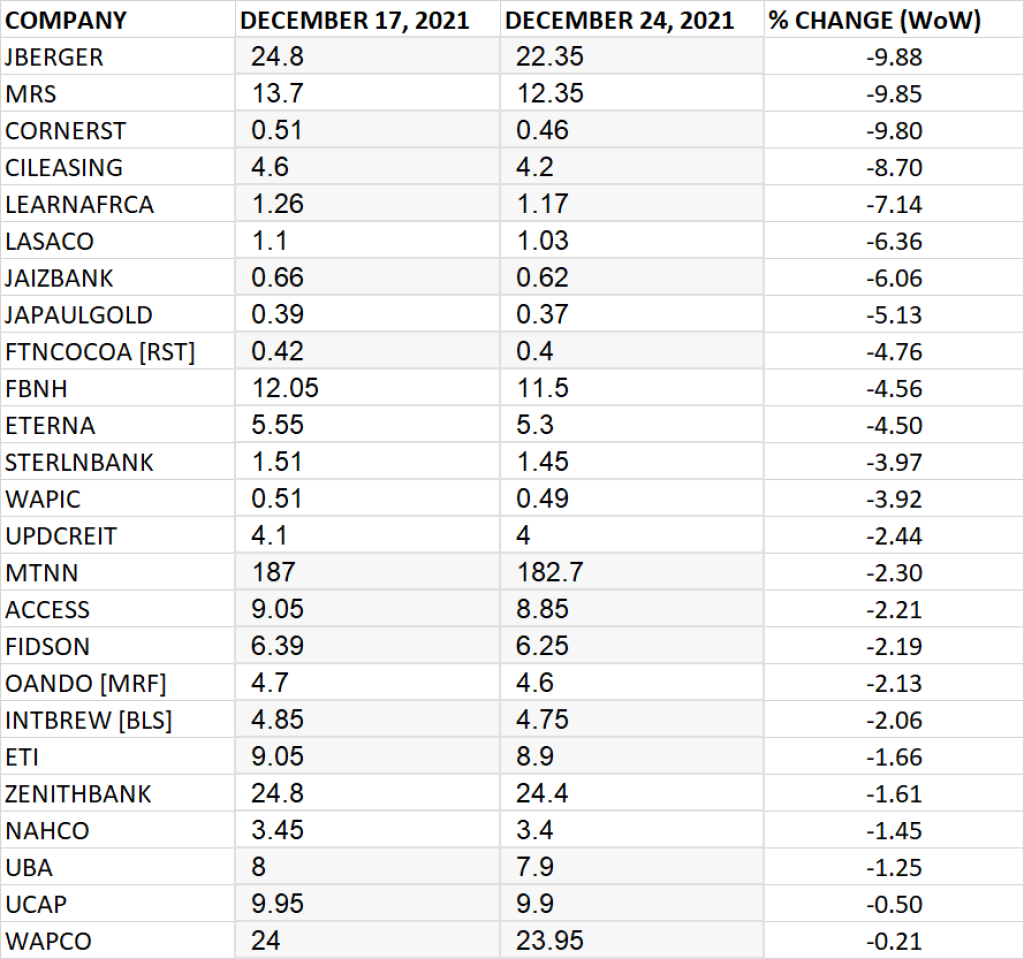

Top 10 Losers

Julius Berger led other price decliners as it shed 9.88% of its share price to close at N22.35 from the previous close of N24.8.

MRS, Cornerstone Insurance, C&I Leasing and Learn Africa shed their share prices by 9.85%, 9.80%, 8.70% and 7.14% respectively.

Others among top ten price decliners include: LASACO (-6.36%), Jaiz Bank (-6.06%), Japaul Gold (-5.13%), FTN Cocoa (4.76%) and FBNH (4.56%) respectively.

GAINERS

LOSERS