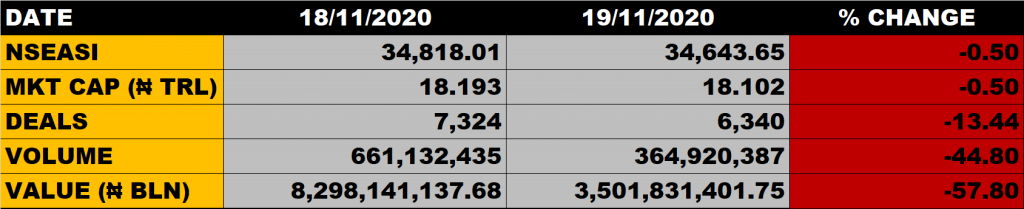

The Nigerian equity market after a major recovery move of yesterday with a growth of 1.68%, closed in red today (Thursday, November 19, 2020) as the All Share Index dropped by 0.50% to settle at 34,643.65 points against the previous close of 34,818.01 points. The market capitalization closed at N18.102 trillion, shedding N91 billion from the previous close of N18.193 trillion. This is coming just after Q3 earnings of a few banks were published today.

According to capital market experts, the market is reacting to the Q3 results of banks, thinking that what happened to Guaranty Trust Bank result will happen to the other ones they have not seen yet. There was a slight drop in Guaranty Trust Bank’s earnings from N5.19 to N5.02, which is 17 kobo drop. Market participants always try to factor in today into tomorrow. When GT Bank result hit the market today, people began to sell down some of the stocks especially the banking stocks, including Zenith Bank. Going forward, this is not the end of the market. Once the recent information has been factored into the prices, the market will take off again.

An aggregate of 364.92 million units of shares were traded in 6,340 deals, valued at N3.50 billion.

Market Breadth

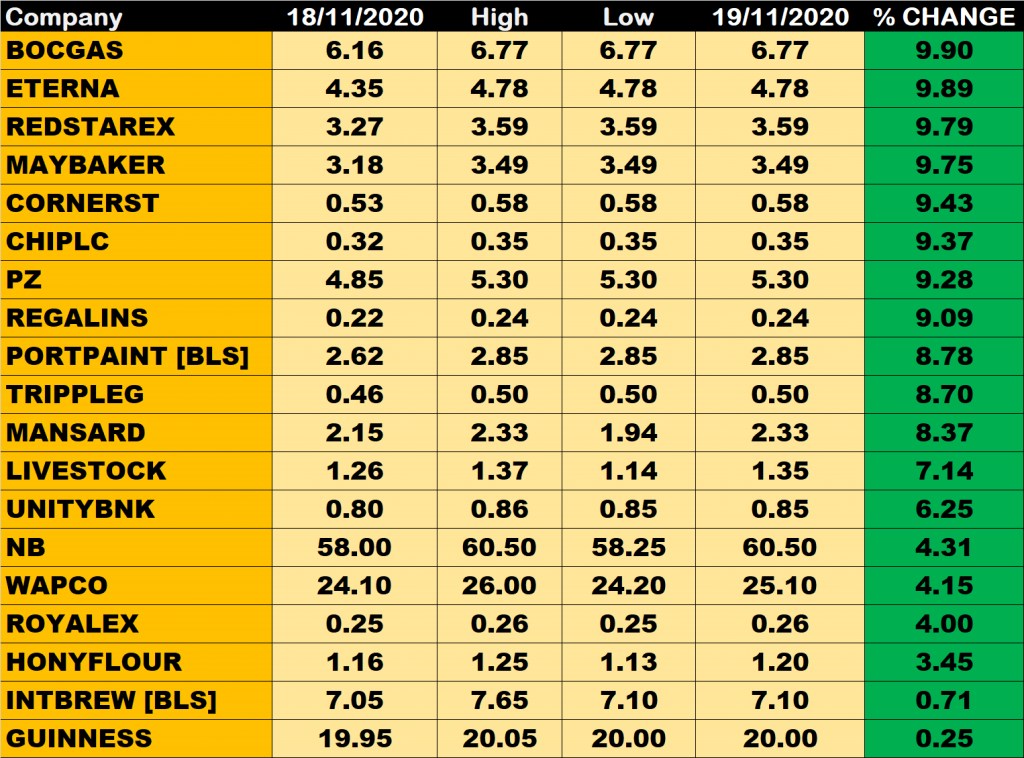

The market breadth closed positive as 19 equities gained while 28 equities declined in their share prices.

Percentage Gainers

BOC Gas led other gainers with 9.9% growth to close at N6.77 from the previous close of N6.16.

Eterna Plc, Redstar Express and May& Baker among other gainers also grew 9.89%, 9.79% and 9.75% respectively.

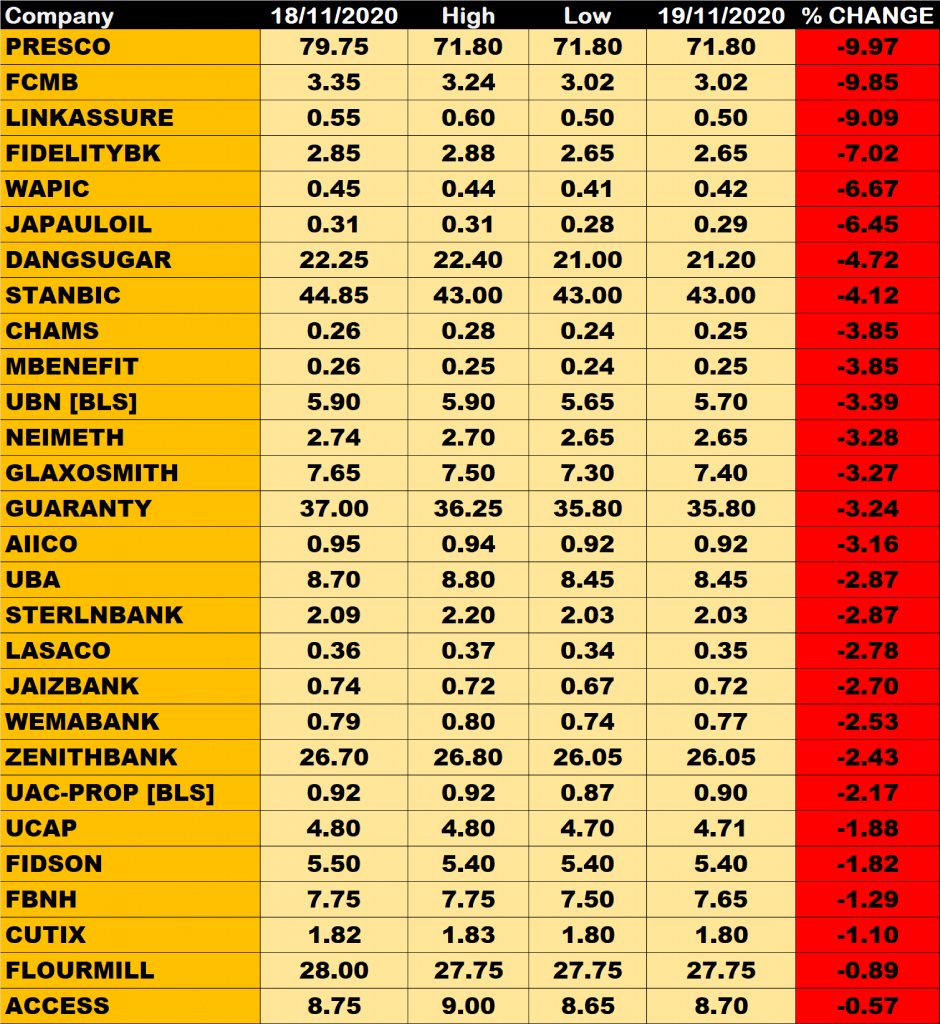

Percentage Losers

Presco Plc led other price decliners as it shed 9.97% of its share price to close at N0.53 from the previous close of N0.58.

FCMB, Linkage Assurance and Fidelity Bank among other price decliners also shed their share prices by 9.85%, 9.09% and 7.02% respectively.

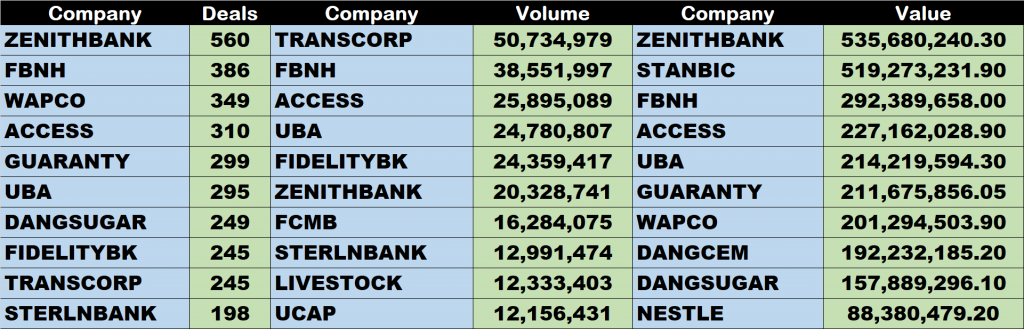

Volume Drivers

- Transcorp Plc traded about 50.73 million units of its shares in 245 deals, valued at N53.92 million.

- FBN Holdings traded about 38.55 million units of its shares in 386 deals, valued at N292.39 million.

- Access Bank traded about 25.895 million units of its shares in 310 deals, valued at N227 million.

Good work you are doing.