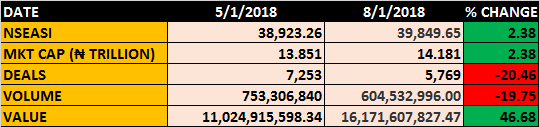

The Nigerian equities market in a broad rally stance sustained its positive momentum at the close of trading sessions on Monday 8th of January 2017, closing 2.38% above the previous corresponding records, as the share prices of some major highly capitalised stocks such as: Dangote Cement, which accounts for a third of total market capitalisation rose 5 percent, and Nigerian Breweries Plc, also closed 1.38 percent higher pushing the ASI from 38,923.26 to about 39,849.65, and Market capitalization hitting N14.181trillion away from the N13.851trillion it closed last trading day of the week ended 5th January 2018.

The market started the year with an impressive gains and heighten optimism, and of course the markets’ exuberance isn’t so irrational, rather the market is poised to set new records and deliver better returns based on known economic realities and anticipations of strong full year results that are expected to impact the market.

The value of trade increased considerably by 46.68 percent, but the number of deals and volume traded fell by 20.46 and 19.75 percent respectively as investors bought 753.306million shares worth N16.171billion, in 5,769 deals, compared to 671.26 million shares worth N11.024 billion, in 7,253 deals exchanged last Friday.

Market Breadth

The general market performance as measured by the market breadth continue to stay positive as the number of gaining stocks substantially overweigh the losing stocks.

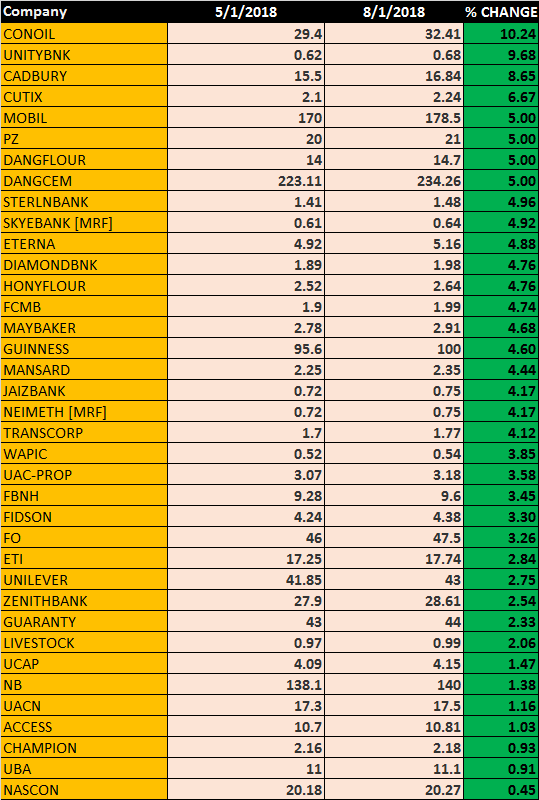

37 equities led by Conoil Plc advanced on the floor as at the close of the trading session for the day under review. Conoil gained 10.24% and closed at N32.41,to emerge the highest percentage gainer. Unity Bank gained 9.68% to close at 68kobo, while Cadbury gained 8.65% among others to close at N16.84.

%Gainers (37)

Vitafoam, leading 8 other losing stocks lost 4.92% to close at N3.09. The company had earlier in the day released its full year results proposing a 15 kobo dividend to its shareholders. Also on the percentage losers list are CILEASING, MERYER, AIICO, WEMA, NPFMB and few others.

%losers (9)

Ten Best Stocks

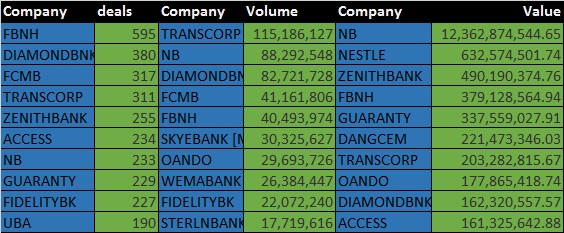

The banking sector of the Financial Service Sector remained investors toast, though with a declining vigor, FBNH, DIAMOND and FCMB occupied the three top space for the highest deal exchanging hands 595, 380, 317 times respectively.

Transcorp Plc is the most active in term of the number of shares traded. It led the equities sector with a total of 115,186 million ordinary shares valued at N203.202.16 billion made in 311 deals.

Nigerian Breweries attracted more cash flow ahead of Nestle with a total sum of N12.362billion splashed on Nigerian Breweries alone.