The equity market on Monday resumed its downtrend as profit taking persists by investors. Last week, the market was down for five consecutive days triggered improved rate in the bond market as Federal Government issued savings Bonds at a mouth-watering interest rates of 4.2% and 5.2% for 2 years and 3 years respectively. The market is anticipating that the turn of events in the Bond market will continue and could be sustained.

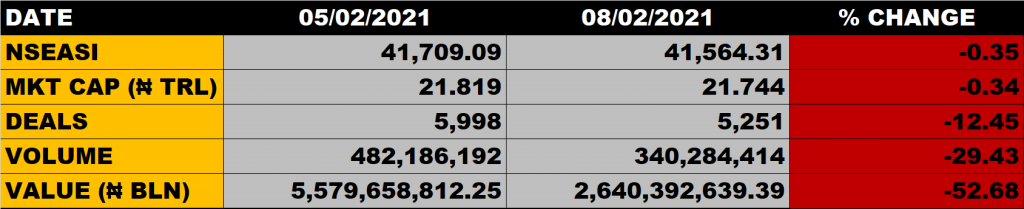

The All Share Index depreciated by 0.35% to settle at 41,564.31 points from the previous close of 41,709.09 points. Year to date, the market has returned 3.23%. The Market Capitalisation closed at N21.744 trillion, down by 0.34% from the previous close of N21.819 trillion, thereby shedding N75bn.

An aggregate of 340.28 million units of shares were traded in 5,251 deals, valued at N2.64 billion. The Market Breadth closed positive as 23 equities emerged as gainers while 16 equities declined in their share prices.

Reviewing the market with Aruna Kebira, Chief Dealer of Global View Capital Limited, the capital market guru pointed out that the current market decline has provided another BUY opportunity for discerning investors.

According to Mr Kebira: “The issuance of FG savings bond at over 5% drew people’s attention from the equity market to the bond market. Moreover, most of the prices have established their new 52 weeks high. A number of people were thinking that the market has topped out at that point, so they find it wise to take their profit and move their resources from the equity market to the bond market. You know when one person starts it successfully, other people will join and before you know it, the market will go down.

“Going forward, that decline only provided BUY opportunity for discerning investors.

Stocks to Watch

- Access Bank grew to N8.6 from N8.55. It is currently trading 18.10% away from its 52 weeks high of N10.5, hence there is uptrend potential in Access Bank. With the book value of N19.12, Access Bank is considered cheap at the current share price of N8.60.

- FBN Holdings grew to N7.35 from N7.25. It is trading 18.33% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N19.84, relative to the current share price of N7.35, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank traded flat at N26. It is trading 8.77% away from its 52 weeks high of N28.5. With the book value of N32.94, relative to the current share price of N26, Zenith Bank is underpriced.

- WAPCO grew to N26.85 from N26.65. It is trading 14.76% away from its 52 weeks high of N31.5. There is uptrend potential in Wapco as records have it that it has touched about N52 a few years back.

- UBA grew to N8.8 from N8.45. It is trading 10.20% away from its 52 weeks high of N9.8. With the book value of N19.16 as against its current share price, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N32.85 from N36. It is trading 14.56% away from its 52 weeks high of N38.45.

Percentage Gainers

MCNICHOLS led other gainers with 9.59% growth, closing at N0.80 from the previous close of N0.73.

UPDC Real Estate Investment Trust, Multiverse, Fidson Healthcare and Africa Prudential among other gainers also grew their share prices by 9.09%, 8.33%, 8.31% and 8.21% respectively.

Percentage losers

Champions Breweries led other price decliners, as it shed 9.75% of its share price to close at N2.50 from N2.77.

PZ, Jaiz Bank and Cornerstone Insurance, RT Briscoe and Guaranty Trust Bank among other price decliners also shed their share prices by 9.73%, 9.72% and 9.23%, 9.09% and 8.75% respectively.

Volume Drivers

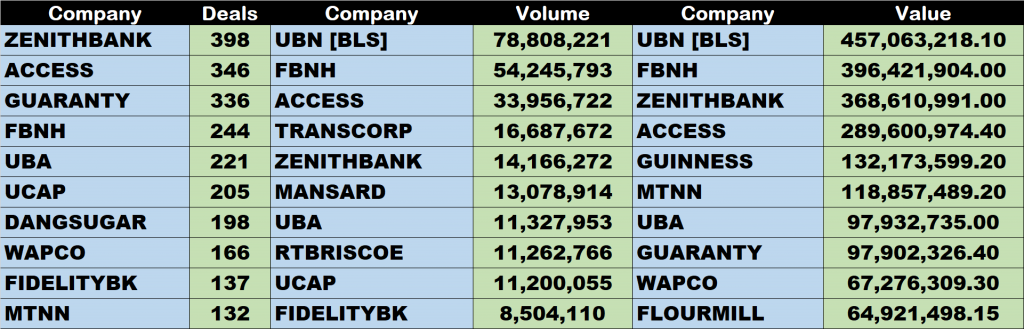

- Union Bank traded about 78.808 million units of its shares in 34 deals, valued at N457 million.

- FBN Holdings traded about 54.246 million units of its shares in 244 deals, valued at N396.42 million.

- Access Bank traded about 33.957 million units of its shares in 346 deals, valued at N289.6 million.