- Berger Paint, Presco, Fidson, Okomu soar in PAT growth

- Comparative analysis of manufacturing stocks in Q3 2021

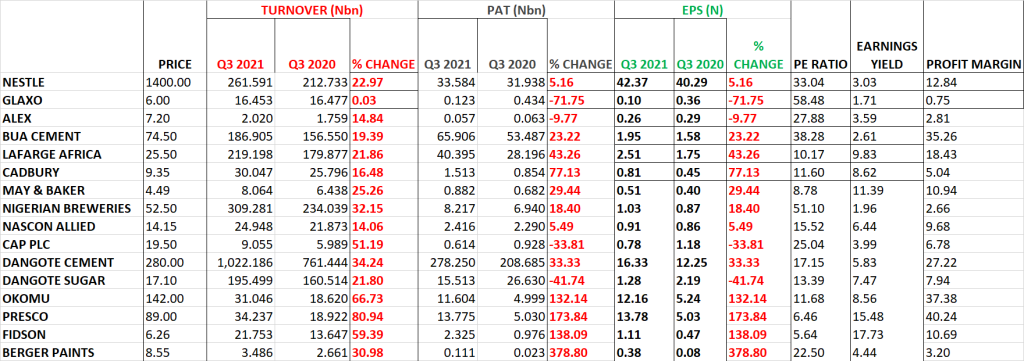

Performance of quoted firms on the Nigerian Exchange for the third quarter of 2021 to a large extent is very impressive as most stocks performed beyond market expectation. The manufacturing sector performed well as most of them achieved year on year growth in their top line and bottom line figures.

Compared to the covid year when the economy was on lockdown, the Q3 2021 earnings reflects a positive outlook for the economy and also shows that Nigerians are good managers.

In a way to gauge the performance of stocks in the manufacturing sector, we deem it necessary to do a comparative analysis of their Q3 earnings. This will gauge their performance in terms of profitability, turnover, earnings growth, earnings yield and profit margin.

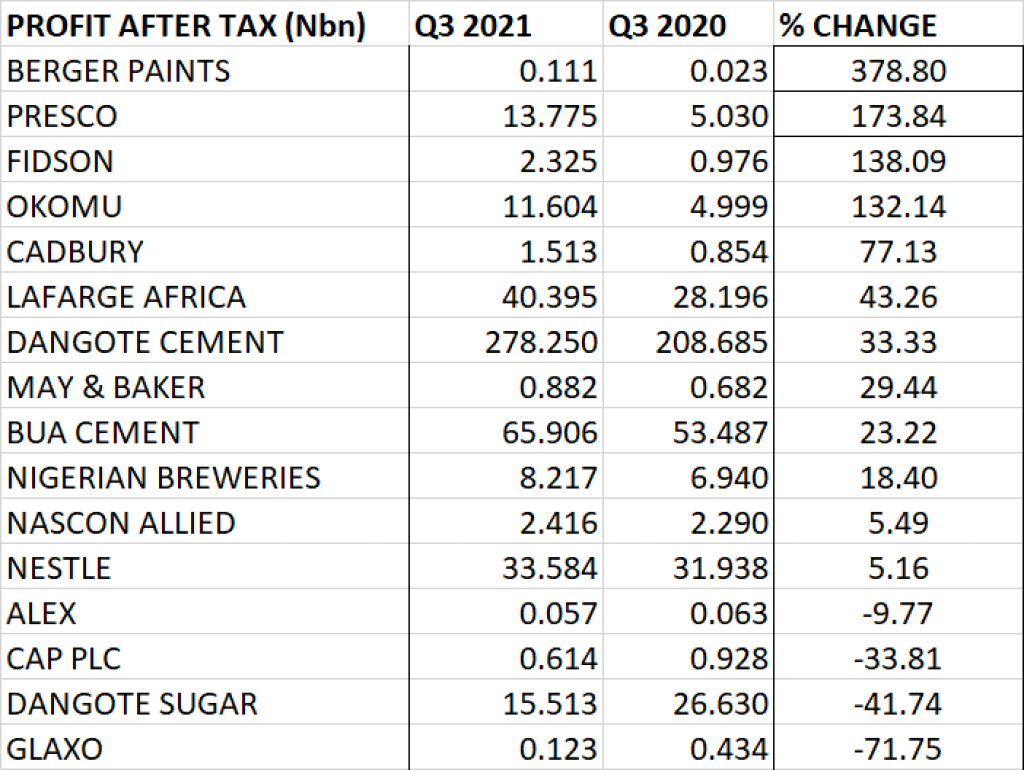

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Berger Paints Plc grew its profit after tax by 378.8% year on year from N23 million to N111 million, emerging best in terms of growth in profit after tax among others in the manufacturing sector.

- Presco emerged second best in terms of growth in profit after tax as it grew by 173.84% year on year from N5.030 billion to N13.775 billion.

- Fidson grew its profit after tax by 138.09% to N2.325 billion from N976 million, emerging third on the ranking in terms of growth in profit after tax.

- Okomu Oil achieved profit after tax of N11.604 billion, up by 132.14% from N4.999 billion achieved the previous year, emerging fourth in ranking in terms growth in profit after tax.

- Cadbury grew its profit after tax by 77.13% from N854 million to N1.513 billion.

- Lafarge Africa (WAPCO) grew its profit after tax by 43.26% year on year to N40.395 billion from N28.196 billion.

- Dangote Cement achieved profit after tax of N278.25 billion, up by 33.33% from N208.685 billion achieved the previous year.

- May & Baker grew its profit after tax by 29.44% year on year to N882 million from N682 million reported the previous year.

- BUA Cement grew its profit after tax by 23.22% to N65.906 billion from N53.487 billion reported the previous year.

- Nigerian Breweries grew its profit after tax by 18.40% to N8.217 billion from N6.94 billion.

- NASCON Allied Industries grew its profit after tax by 5.49% to N2.416 billion from N2.29 billion.

- Nestle grew its profit after tax by 5.16% to N33.584 billion from N31.938 billion.

- Aluminium Extrusion Industries declined in profit after tax by 9.77% to N57 million from N63 million.

- CAP Plc declined in profit after tax by 33.81% to N614 million from N928 million.

- Dangote Sugar declined in profit after tax by 41.74% to N15.51 billion from N26.63 billion.

- Glaxo Smithkline declined in profit after tax by 71.75% to N123 million from N434 million.

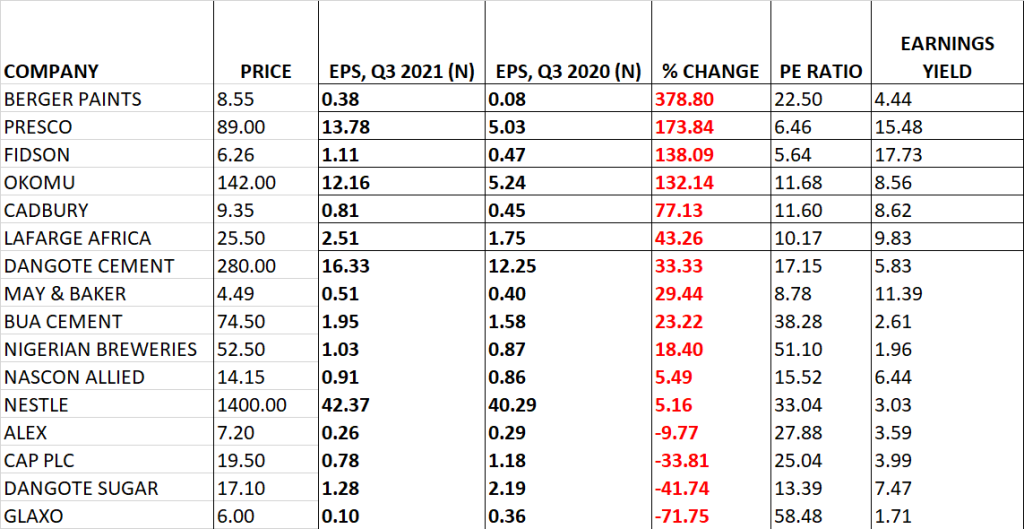

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNINGS YIELD

- Earnings per share of Berger Paint increased by 378.80% to 38 kobo from 8 kobo. At the share price of N8.55, the P.E ratio of Berger Paint stands at 22.50x with earnings yield of 4.44%.

- Presco grew its earnings per share as EPS grew by 173.84% from N5.03 to N13.78. At the share price of N89, Presco has a P.E ratio of 6.46x with earnings yield of 15.48%.

- Fidson Healthcare grew its earnings per share by 138.09% to N1.11 from 47 kobo. At the share price of N6.26, the P.E ratio of stands at 5.64x with earnings yield of 17.73%.

- Okomu Oil achieved earnings per share of N12.16, up by 132.14% from the EPS of N5.24 achieved the previous year. At the share price of N142, P.E ratio of Okomu Oil stands at 11.68x with earnings yield of 8.56%.

- Cadbury grew its earnings per share by 77.13% to 81 kobo from 45 kobo. At the share price of N9.35, the P.E ratio of Cadbury stands at 11.60x with earnings yield of 8.62%.

- Lafarge Africa (WAPCO) grew its earnings per share by 43.26% to N2.51 from N1.75. At the share price of N25.50, the P.E ratio of Lafarge Africa stands at 10.17x with earnings yield of 9.83%.

- Dangote Cement achieved the earnings per share of N16.33, up by 33.33% from the EPS of N12.25 achieved the previous year. At the share price of N280, the P.E ratio of Dangote Cement stands at 17.15x with earnings yield of 5.83%.

- May & Baker grew its earnings per share by 29.44% year on year to 51 kobo from 40 kobo reported the previous year. At the share price of N4.49, the P.E ratio of May & Baker stands at 8.78x with earnings yield of 11.39%.

- BUA Cement grew its earnings per share by 23.22% year on year to N1.95 from N1.58 reported the previous year. At the share price of N74.50, the P.E ratio of BUA Cement stands at 38.28x with earnings yield of 2.61%.

- Nigerian Breweries grew its earnings per share by 18.40% year on year to N1.95 from N1.58 reported the previous year. At the share price of N52.50, the P.E ratio of Nigerian Breweries stands at 51.10x with earnings yield of 1.96%.

- NASCON Allied Industries grew its earnings per share by 5.49% year on year to 91 kobo from 86 kobo reported the previous year. At the share price of N14.15, the P.E ratio of NASCON Allied Industries stands at 15.52x with earnings yield of 6.44%.

- Nestle grew its earnings per share by 5.16% year on year to N42.37 from N40.29 reported the previous year. At the share price of N1400, the P.E ratio of Nestle stands at 33.04x with earnings yield of 3.03%.

- Aluminium Extrusion Industries declined in earnings per share by 9.77% to 26 kobo 29 kobo. At the share price of N7.20, the P.E ratio of the company stands at 27.88x with earnings yield of 3.59%.

- CAP Plc declined in earnings per share by 33.81% to 78 kobo from N1.18. At the share price of N19.50, the P.E ratio of the company stands at 25.04x with earnings yield of 3.99%.

- Dangote Sugar declined in earnings per share by 41.74% to N1.28 from the EPS of N2.19. At the share price of N17.10, the PE ratio of Dangote Sugar stands at 13.39x with earnings yield of 7.47%.

- Glaxo Smithkline declined in earnings per share by 71.75% to 10 kobo from 36 kobo. At the share price of N6, the PE ratio of the company stands at 58.48x with earnings yield of 1.71%

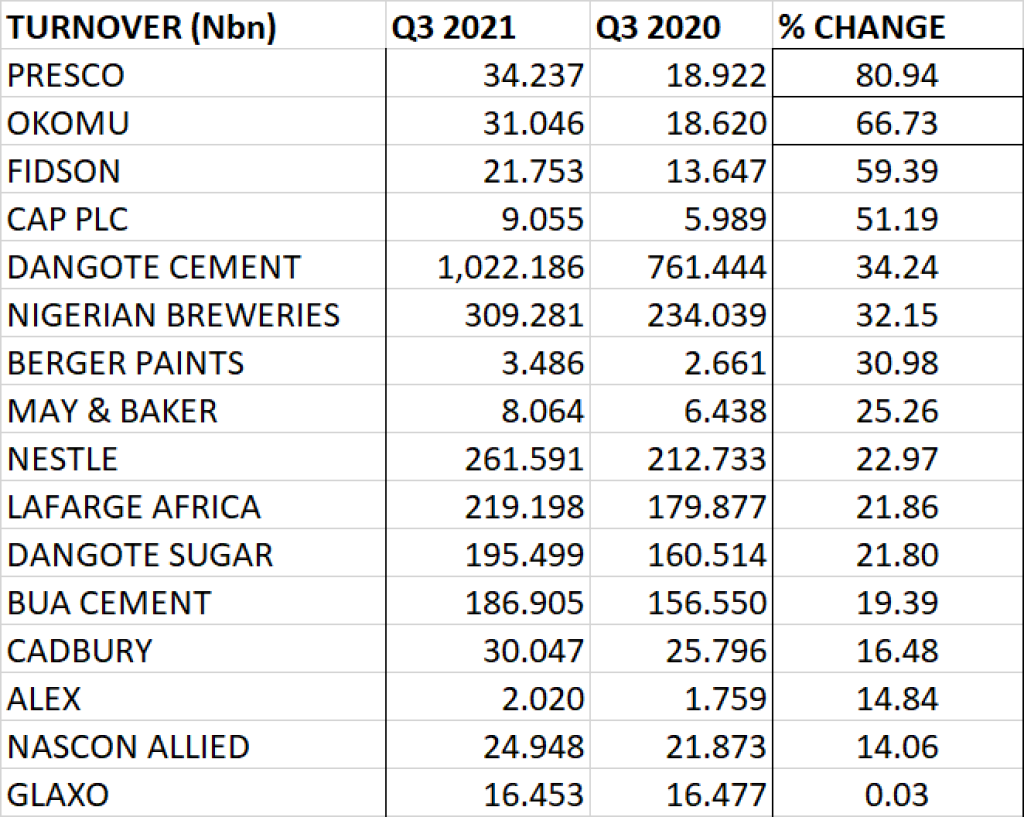

PERFORMANCE IN TURNOVER GROWTH

- Presco emerged top in terms of turnover growth among others in the manufacturing sector as it grew its turnover by 80.94% year on year to N34.237 billion from N18.922 billion.

- Okomu Oil is second on the rank in turnover growth with a turnover of N31.046 billion, up by 66.73% from N18.62 billion reported the previous year.

- Fidson is third among manufacturers that grew their turnover in Q3 2021. The revenue of Fidson Healthcare increased by 59.39% year on year to N21.753 billion from N13.647 billion.

- CAP Plc is fourth in ranking of turnover growth as it grew its revenue by 51.19% to N9.055 billion from N5.989 billion.

- Dangote Cement emerged fifth in terms of turnover growth as revenue increased by 34.24% to N1.022 trillion from N761.444 billion.

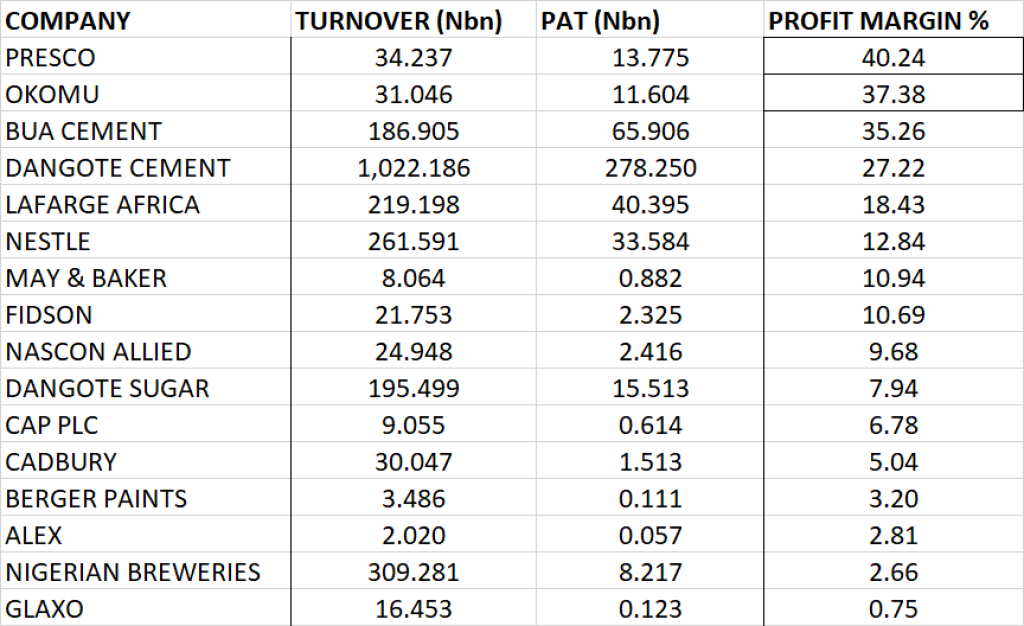

PROFIT MARGIN

- Presco emerged top among others with a profit margin of 40.24% in Q3 2021.

- Okomu Oil achieved a profit margin of 37.38%, emerging second among others in the manufacturing sector in terms of profit margin.

- BUA Cement in Q3 2021 achieved a profit margin of 35.26%, emerging third among others.

- Dangote Cement achieved a profit margin of 27.22% emerging fourth among others.

- Lafarge Africa (WAPCO) made a profit margin of 18.43% in Q3 2021, emerging fifth among others in terms of profit margin.