- Zenith, GTCO, Presco to surprise the market

- Access promises steady growth in dividend payout

Wole Olajide (ACS)

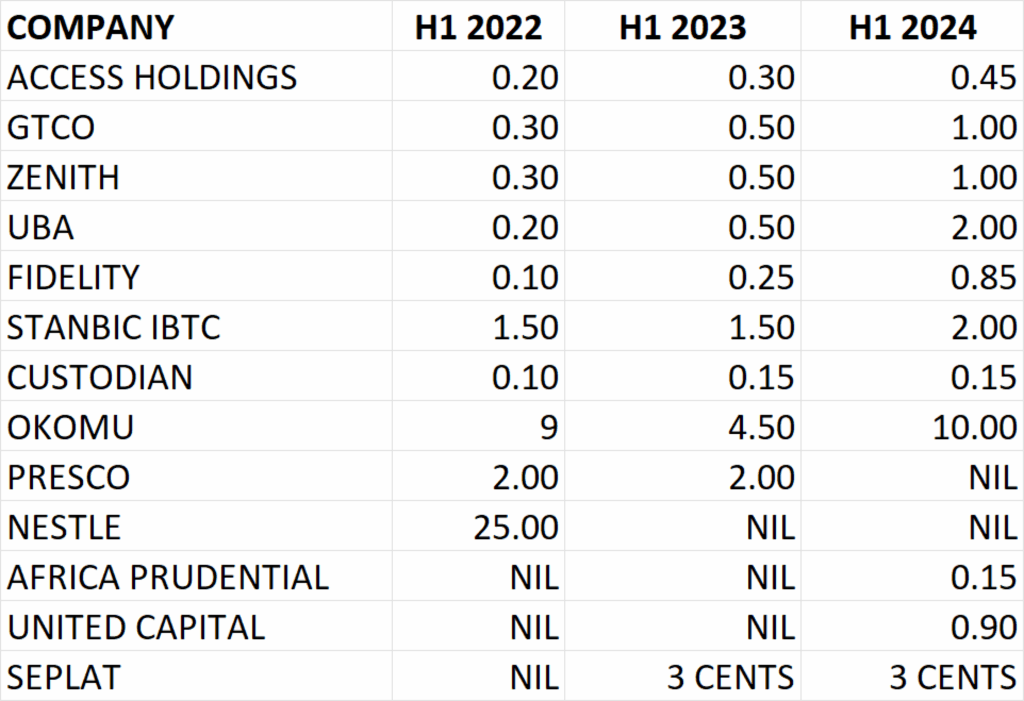

Half Year results of quoted companies on the floor of the Nigerian Exchange will obviously start rolling in this new week as we are approaching the end of July which is the deadline for filing Q2 2025 report. Except for Companies that would declare interim dividends, their Audited report might come in around August or latest by September.

A few companies have been consistent in paying interim dividends to investors year on year. Smart investors have already started taking position ahead in order to take advantage of interim dividend. Companies that are likely to pay interim dividend this year include: Access, Zenith Bank, GTCO, UBA, Fidelity Bank, Stanbic IBTC, Presco, Okomu, UCAP, Africa Prudential, Nestle and Seplat.

The regulatory forbearance clause by the Central Bank of Nigeria (CBN) to Banks which could hinder them from paying dividend has been sorted out. Moreso, the affected banks have assured investors that they will not stop paying dividend as most have them would have exited the CBN forbearance window by 30th June 2025. At that, it’s very certain to expect interim dividends from these financial institutions.

UNITED BANK FOR AFRICA (UBA)

United Bank for Africa (UBA) surprised the market in H1 2024 when it declared N2 as interim dividend from the previous payout of 50 kobo the previous year. This represents 300% increase in dividend payout. There could be another surprise this year.

Interim dividend history of UBA since 2022 shows geometric growth in the Company’s dividend payout. In H1 2022, UBA declared 20 kobo interim dividend. By the following year (H1 2023), interim dividend has increased by 150% to 50 kobo. The Bank eventually increased it by 300% to N2 in H1 2024.

Following the growth trajectory of interim dividend payout by UBA, interim dividend expectation for H1 2025 cannot be less than N2.00. As a matter of fact, there’s a possibility they might increase it.

FIDELITY BANK

Fidelity Bank increased their H1 2024 interim dividend by 240% to 85 kobo from 25 kobo. There is possibility for another surprise in H1 2025.

Interim dividend history of Fidelity Bank is indeed a geometric progression. From 10 kobo interim dividend in H1 2022, the bank grew dividend payout by 150% to 25 kobo in H1 2023. Dividend payout in H1 2024 grew by 240% to 85 kobo in H1 2024. There is possibility that Fidelity will pay N1.00 as interim dividend or retain the previous dividend of 85 kobo.

ZENITH BANK

Zenith Bank over the years has been consistent in paying interim dividends to shareholders.

Looking at their interim dividend history for the past 3 years, there have been consistent growth in their dividend payout.

In Half Year 2022, Zenith Bank declared 30 kobo interim dividend. By Half year 2023, the Bank grew the interim dividend by 66.67% to 50 kobo. Half year 2024 interim dividend was increased to N1.00 from 50 kobo, which translates to 100% increase. Following the growth trajectory of the interim dividend payout of Zenith Bank, there’s a possibility that the bank might increase the interim dividend to N1.50. Worst case scenario, Zenith will pay N1.00.

GTCO

Guaranty Trust Holding Company Plc (GTCO) share the same interim dividend history with Zenith Bank.

In Half Year 2022, GTCO declared 30 kobo interim dividend. By Half year 2023, the GTCO increased their interim dividend to 50 kobo from 30 kobo, up by 66.67%. Half year 2024 interim dividend grew by 100% to N1.00 from 50 kobo. There is possibility that GTCO might increase their dividend pay out to N1.50 or retain the previous payout of N1.00.

ACCESS HOLDINGS

Access Holdings has been consistent with payment of interim dividend year on year. The growth in interim dividend payout has been moderate. In H1 2022, Access paid 20 kobo interim dividend. By the following year (H1 2023), dividend payout increased by 50% to 30 kobo. By the following year (H1 2024) interim dividend the company declared 45 kobo interim dividend, up by 50%. There is possibility that Access Holdings might increase its interim dividend 60 kobo.

STANBIC IBTC HOLDINGS

Stanbic IBTC Holdings has consistently made investors smile to the bank with good interim dividend payout.

The Financial Institution paid N1.50 as interim dividend in H1 2022. They paid same amount in H1 2023. In H1 2024, dividend payout increased by 33.33% to N2.00 from N1.50.

There’s a possibility that Stanbic IBTC would retain interim dividend payout of N2.00 for H1 2025.

OKOMU

Okomu Oil Palm has been consistent with payment of interim dividend over the years.

The Company in H1 2022 declared N9 as interim dividend. By the following year (H1 2023), dividend payout declined by 50% to N4.5. In H1 2024, dividend payout grew to N10, which is a growth of 122% from N4.5 declared the previous year.

There’s a possibility that Okomu will increase its dividend payout for H1 2025. Better still, Okomu could retain the payout of N10.

PRESCO

Presco consistently paid N2 as interim dividend in H1 2022 and H1 2023. However, in H1 2024, the Company did not declare interim dividend. They however compensated investors in FY 2024 with a whopping N42 final dividend.

There’s a possibility that Presco would declare interim dividend for H1 2025.

SEPLAT

Seplat pays dividend in US dollars at CBN official rate. The Company has been consistent in dividend payment, both interim and final.

Seplat paid interim dividend of 3 cents in both in H1 2023 H1 2024 respectively. At the official CBN rate of N1,533.11 per dollar, interim dividend of 3 cents is equivalent to N45.99.

Seplat is likely to declare interim dividend of 3 cents in H1 2025.

UCAP

United Capital Plc (UCAP), the only listed stockbroking firm on NGX made a debut declaration of 90 kobo interim dividend in H1 2024. There is every possibility that the Company will continue with this gesture of exciting investors. The financial institution might retain 90 kobo interim dividend for H1 2025.

AFRICA PRUDENTIAL

Africa Prudential Plc also made a debut interim dividend declaration of 15 kobo in H1 2024. AFRIPRUD as fondly called is the only listed Registrar on NGX. We expect AFRFIPUD to continue payment of interim dividend. They are likely to still pay 15 kobo interim dividend In H1 2025.

CUSTODIAN INVESTMENTS

Custodian Investment in the past 3 years has consistently paid interim dividend to shareholders.

In H1 2022, the Company paid 10 kobo interim dividend to shareholders. By the second year (H1 2023) dividend payout increased to 15 kobo, up by 50%. In H1 2024, the Company maintained 15 kobo dividend payout. We expect Custodian to still pay 15 kobo interim dividend in H1 2025.

NESTLE

The last time Nestle paid interim dividend was in H1 2022 when the Company declared N25 as interim dividend. Since then, Nestle has not declared any dividend, either final or interim since 2023.

The chances are very slim that Nestle will declare interim dividend, but we hope there could be final dividend at the end of the year 2025.