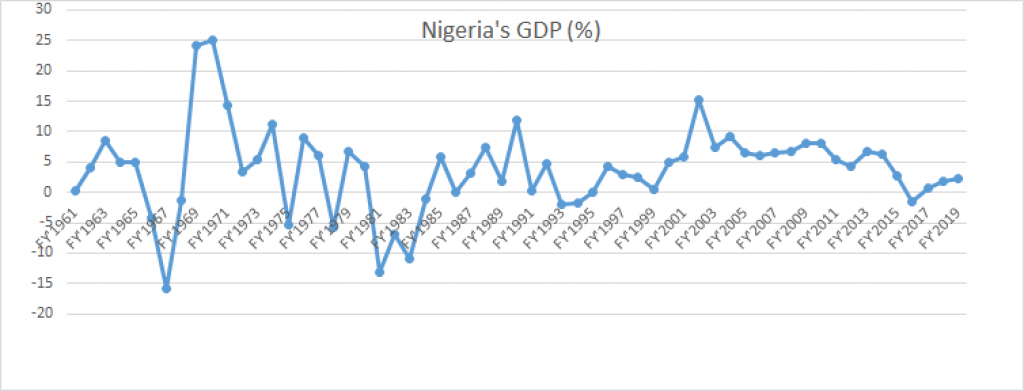

- Historical data show 91.16 percentage point decline between 1970 and 2019

Our previous publication was centered on Q2 GDP report versus stock market performance as the National Bureau of Statistics reported GDP decline of 6.10% in the second quarter of 2020, ending the 3-year trend of positive real growth rates recorded since the 2016/17 recession.

As far back as 1970, Nigeria recorded an annual GDP growth of 25.01%. Fast forward to 2019, GDP growth was 2.21%, which translates to 91.16 percentage point decline within the last 49 years (1970-2019). Year on year since 1961 till date, there have been several moments of growths and declines, however, the wide gap between GDP growth of 25.01% in 1970 and 2.21% in 2019 is a serious concern for our economy.

Gross Domestic Product (GDP) is the total goods and services produced within a geographical area for a particular year. In the periods when our GDP was very high, we were export based and fully involved in agriculture. Then we have Groundnut Pyramid in Kaduna, Palm Oil in Enugu, Hide &Skin from Kano, Cocoa from the west and so on. We were in a diversified economy, not mono-economy that we are practicing now. We were in a diverse economy and things were booming. We had enough production as compared to what we have now. By the time your production is high, you get to sell more and get more money, and that is a measure of GDP. Now we are spending more to get what we need, and that reduces what we produce locally.

According to opinions from experts, over-reliance on oil is a major cause of Nigeria’s declining GDP. Way back in the 60s and 70s, and 80s, Nigeria had two major sources of income. Agriculture was a major source of income and we were doing well. We were exporting cocoa, timber and other products such that other foreign countries were looking up to us. All these were contributing to Nigeria’s GDP on their own while the oil was also contributing to GDP. Then we forgot about Agriculture and solely relied on oil such that, if you don’t export oil, you cannot earn any form of foreign exchange. That’s where the problem started from. The only thing we have now is crude oil and we are even having issues with it. Currently, we have cargoes of oil waiting to be exported, but there is no demand.

We also understand that from year to year, more oil was discovered in other countries. For instance oil was discovered in Ghana about 5-10 years ago. The moment Ghana became an oil nation, customers will obviously deflect to them. Since they are new, they will like to woo buyers either by reducing their price or putting value added incentives to gain more customers. As we begin to lose market from oil, the GDP will be reducing.

Prior to now, other sectors of the economy were contributing meaningfully to the growth of GDP. Now it is only oil we are looking at. Current reality is that the world is beginning to look away from oil, and that is why we are trying as much as possible to diversify so that we will not be caught in that trap. Overdependence of oil will allow other sectors to fizzle down over time. Nigeria removed resources out of other sectors into the oil sector and the oil sector is having issue which is an obvious reality.

It is on record that some government officials actually purchased vehicles from abroad, rather than patronizing the brand of vehicle locally assembled here in Nigeria. Imagine if all the 36 state governments purchase cars assembled here in Nigeria, that means production of cars will go high. These are the things that keep reducing our GDP; and by the time we don’t have anything to produce, we will keep importing, local production will shrink and foreign reserve will come down.

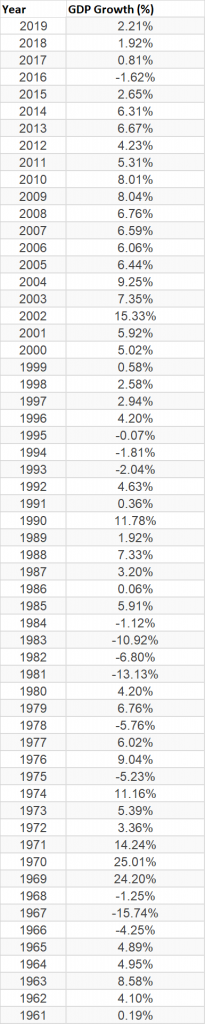

Trend in GPD growth since 1961

Within the first 20 years of democratic rule in Nigeria, we observed the following:

- GDP growth rate for 2019 was 2.21%, a 0.29% increase from 2018.

- GDP growth rate for 2018 was 1.92%, a 1.12% increase from 2017.

- GDP growth rate for 2017 was 0.81%, a 2.42% increase from 2016.

- GDP growth rate for 2016 was -1.62%, a 4.27% decline from 2015.

- GDP growth rate for 2015 was 2.65%, a 3.66% decline from 2014.

- GDP growth rate for 2014 was 6.31%, a 0.36% decline from 2013.

- GDP growth rate for 2013 was 6.67%, a 2.44% increase from 2012.

- GDP growth rate for 2012 was 4.23%, a 1.08% decline from 2011.

- GDP growth rate for 2011 was 5.31%, a 2.70% decline from 2010.

- GDP growth rate for 2010 was 8.01%, a 0.03% decline from 2009.

- GDP growth rate for 2009 was 8.04%, a 1.27% increase from 2008.

- GDP growth rate for 2008 was 6.76%, a 0.17% increase from 2007.

- GDP growth rate for 2007 was 6.59%, a 0.53% increase from 2006.

- GDP growth rate for 2006 was 6.06%, a 0.38% decline from 2005.

- GDP growth rate for 2005 was 6.44%, a 2.81% decline from 2004.

- GDP growth rate for 2004 was 9.25%, a 1.90% increase from 2003.

- GDP growth rate for 2003 was 7.35%, a 7.98% decline from 2002.

- GDP growth rate for 2002 was 15.33%, a 9.41% increase from 2001.

- GDP growth rate for 2001 was 5.92%, a 0.90% increase from 2000.

- GDP growth rate for 2000 was 5.02%, a 4.43% increase from 1999.

Note that GDP growth that is used for this analysis is the Real Growth Rate at market price.

Growth is used to describe the state and performance of the economy by measuring GDP. GDP takes into account a multitude of factors to determine how the overall economy is doing. These factors include private consumption, gross investment, government spending, and net exports. When an economy is growing, it is a sign of prosperity and expansion. Positive economic growth means an increase in money supply, economic output, and productivity. An economy with negative growth rates has declining wage growth and an overall contraction of the money supply. Economists view negative growth as a harbinger of a recession or depression.

Negative growth refer to contraction in a country’s economy, which is reflected in a decrease in its gross domestic product (GDP) during any quarter of a given year.

The 2020 COVID-19 pandemic is significant for negative growth as most countries of the world recorded negative GDP.

Other factors that can cause decline in GDP include:

Changes in customer spending

Any reduction in customer spending will cause a decrease in GDP. Customers spend more or less depending on their disposable income, inflation, tax rate and the level of household debt.

Wage growth, for example, encourages more expensive purchases, leading to an increase in real GDP. If inflation increases, customers can no longer afford to buy their favorite products at a reasonable price, so they reduce their expenses. These shifts in demand will negatively impact the real GDP.

Rising interest rates

When interest rates go up, so does the cost of borrowing money. As a result, disposable income decreases, which limits customer spending. This can cause a reduction in GDP, affecting economic growth.

Companies that sell high-end goods, such as automobiles, are particularly vulnerable to rising interest rates. Since most customers need to borrow money to purchase these products, they will either postpone their plans or choose cheaper models.

Government spending reduction

Governments spend money on a variety of goods and services, such as buildings for schools and hospitals, housing programs, public safety, social protection and more. Additionally, governments pay public employees and independent contractors who work on various projects. One impact of government spending reduction is a decrease in GDP.

For instance, if the government decides to cut wages and reduce social benefits, public employees will earn less. Individuals who receive social benefits can no longer afford to buy certain goods. As a business owner, you may lose customers and revenue. These factors affect a country’s real GDP and the overall economy.