- NEM Insurance leads in turnover growth

- Mutual Benefit Assurance, Veritas Kapital most attractive insurance stocks

- NEM Insurance, Sovereign Trust Insurance grows PAT significantly

Wole Olajide, ACS

The performance of insurance companies listed on the Nigerian Exchange for the first half of 2025 hasn’t been particularly fantastic. In fact, only a handful of companies in this sector managed to grow their bottom line during this period.

Though, most insurance firms recorded growth in turnover, majority recorded decline in their profit after tax, year on year. A few others even declared losses for the period under review.

The insurance sector generally in Nigeria have struggled in business over the years compared to ‘his’ rich “cousin’, the banking sector. Low patronage of insurance products and policies is largely attributed to poor orientation and ignorance about the need for insurance. A fraction of those who patronize insurance products mostly do so because they were compelled to. Such sentiment have over the years push the share prices of insurance stocks down among others in the market.

The Nigerian Insurance Industry Reform Act (NIIRA) 2025 recently signed by President Tinubu has changed the narrative in the insurance sector. The recapitalization news triggered positive sentiment for insurance stocks on the floor of the Nigerian Exchange, waking up stocks that have been sleeping for years. The angel indeed actually came to stir the waters.

Ranking of the performance of the insurance sector in H1 2025 revealed that Mutual Benefits Assurance emerged best in terms of growth in profit after tax (PAT), profit margin and earnings yield. NEM Insurance and Sovereign Trust Insurance came second and third respectively in PAT growth.

The metrics used for ranking the earnings performance of insurance sector in H1 2025 includes: Turnover Growth (Revenue Growth), Profit after Tax Growth, Earnings per Share (EPS), Price/Earnings Ratio (P/E Ratio), Earnings Yield and Profit Margin.

PERFOMANCE IN TURNOVER GROWTH

- NEM Insurance emerged first in turnover growth in Half Year 2025 as the Company reported gross earnings of N84.237 billion, up by 75.64% from N47.961 billion reported the previous year.

- LASACO Assurance ranked second in turnover growth. The underwriting firm achieved turnover of N18.739 billion for the 6 months period. This represents 56.85% growth from N11.947 billion achieved in H1 2025.

- Sovereign Trust Insurance emerged third in terms of turnover growth. The Company reported turnover of N34.074 billion for the 6 months period, up by 44.59% from N23.566 billion revenue reported the previous year.

- Mutual Benefits Assurance emerged fourth in turnover growth. The Company reported revenue of N41.195 billion for the 6 months period, up by 44.58% from N28.494 billion revenue reported the previous year.

- Guinea Insurance is the fifth in terms of turnover growth. The Company reported revenue of N1.77 billion in H1 2025, up by 23.52% from N1.433 billion revenue reported in H1 2024.

- Others in the ranking for turnover growth include: AIICO Insurance (17.45%), Linkage Assurance (16.18%), Coronation Insurance (14.84%), Consolidated Hallmark (14.05%), Veritas Kapital Assurance (7.93%) and Sunu Assurance (6.40%), respectively.

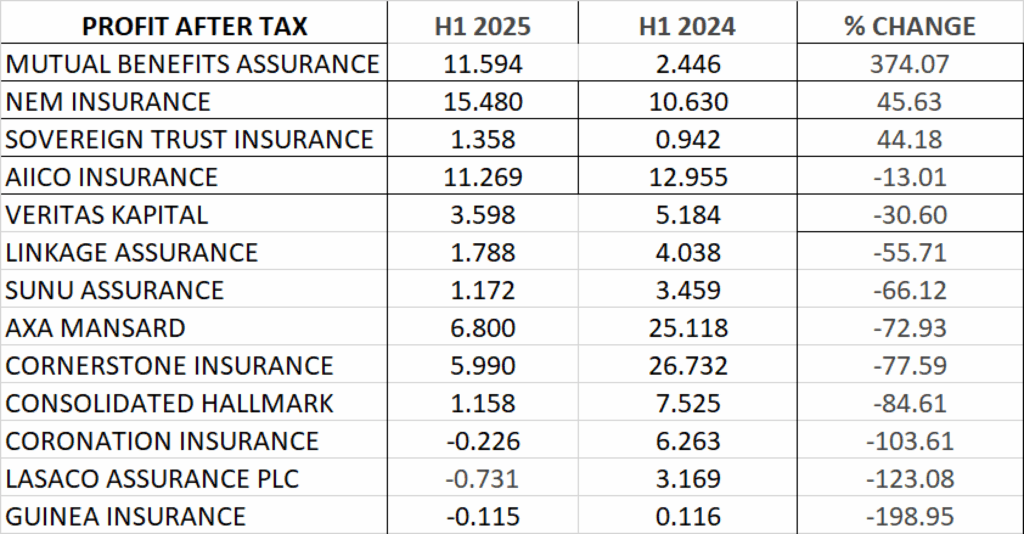

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Mutual Benefits Assurance grew its profit after tax by 374.07% year on year to N11.594 billion from N2.446 billion reported the previous year, emerging as best in terms of PAT growth.

- NEM Insurance Plc ranked second in terms of growth in profit after tax. The company reported profit after tax of N15.48 billion for the 6 months period, up by 45.63% from N10.63 billion reported in H1 2024.

- Sovereign Trust Insurance Plc grew its profit after tax by 44.18% year on year to N1.358 billion from N942 million reported in H1 2024.

- AIICO Insurance reported profit after tax of N11.269 billion for the 6 months period, down by 13.01% from N12.955 billion profit after tax reported the previous year.

- Veritas Kapital Assurance reported profit after tax of N3.598 billion for the 6 months period, down by 30.60% from N5.184 billion profit after tax reported the previous year.

- Linkage Assurance reported profit after tax of N1.788 billion for the 6 months period, down by 55.71% from N4.038 billion profit after tax reported the previous year.

- Sunu Assurance reported profit after tax of N1.172 billion for the 6 months period, down by 66.12% from N3.459 billion profit after tax reported the previous year.

- AXA Mansard reported profit after tax of N6.8 billion for the 6 months period, down by 72.93% from N25.118 billion profit after tax reported the previous year.

- Cornerstone Insurance reported profit after tax of N5.99 billion for the 6 months period, down by 77.59% from N26.732 billion profit after tax reported the previous year.

- Consolidated Hallmark Insurance reported profit after tax of N1.158 billion for the 6 months period, down by 84.61%% from N7.525 billion profit after tax reported the previous year.

- Coronation Insurance, LASACO and Guinea Insurance for the period under review declared losses of N226 million, N731 million and N115 million respectively

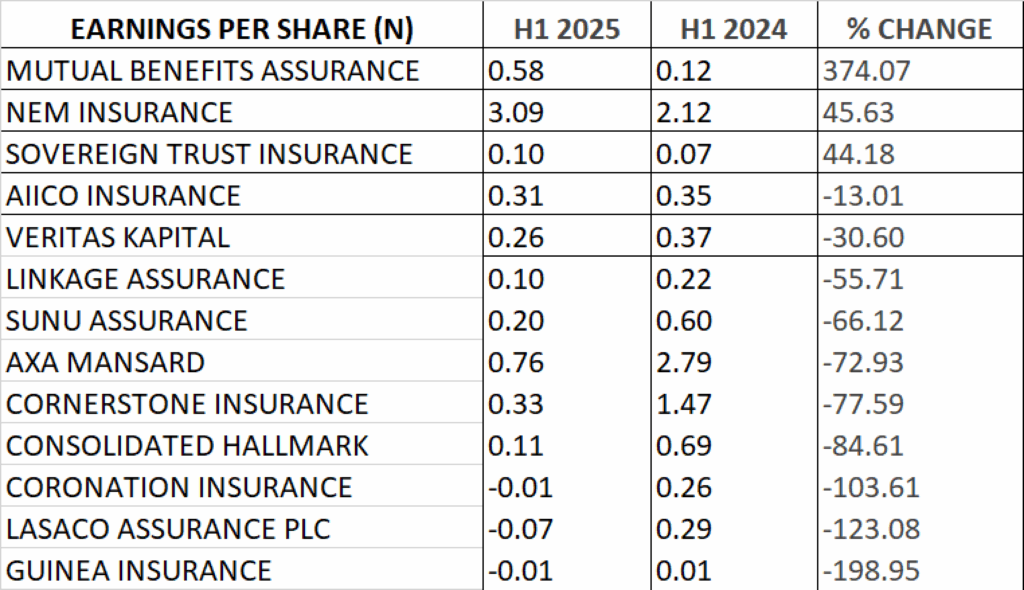

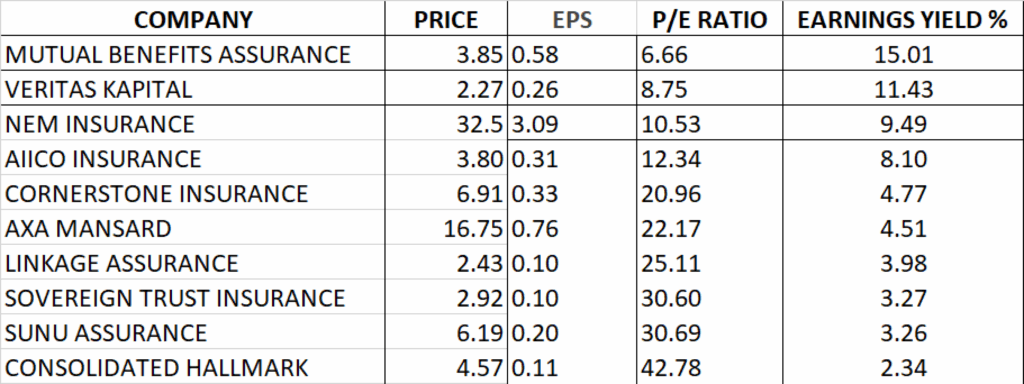

PERFORMANCE IN EARNINGS PER SHARE, P/E RATIO AND EARNINGS YIELD

- Mutual Benefits Assurance is currently trading at N3.85. In the recent rally, the share price of Mutual Benefits Assurance touched 52 weeks high of N4.26 from a year low of 67 kobo. With the H1 2025 earnings per share (EPS) of 58 kobo, Mutual Benefits has P/E ratio of 6.66x and earnings yield of 15.01%. Being the Company with the lowest P/E and highest earnings yield among the insurance firms captured for this review, Mutual Benefits Assurance emerged the most attractive.

- Veritas Kapital Assurance is currently trading at N2.27. In the past one year, the share price of the Company has touched a high of N3.06 from a low of 86 kobo. With H1 2025 Earnings per share of 26 kobo, the P/E ratio of Veritas Kapital stands at 8.75x with earnings yield of 11.43%.

- NEM Insurance Plc is currently trading at N32.50. In the past 52 weeks, the share price of NEM Insurance has touched a high of N39.60 from a low of N7.50. With H1 2025 EPS of N3.09, the P/E ratio of NEM Insurance stands at 10.53x with earnings yield of 9.49%.

- AIICO Insurance is currently trading at N3.80. In the past one year, the share price of AIICO has touched a high of N5.11 from a low of N1.07. With the EPS of 31 kobo, the P/E ratio of AIICO stands at 12.34x with earnings yield of 8.10%.

- Cornerstone Insurance is currently trading at N6.91. The share price of the Company has touched a high of N9.37 from a low of N2.02 in the past one year. With the EPS of 33 kobo, the P/E ratio of Cornerstone Insurance stands at 20.96x with earnings yield of 4.77%.

- AXA Mansard is currently trading at N16.75. The share price of AXA Mansard has touched a high of N21.42 from a low of N5 in the past 52 weeks. With the EPS of 76 kobo, the P/E ratio of AXA Mansard stands at 22.17x with earnings yield of 4.51%.

- Linkage Assurance is trading at N2.43. The share price of the Company has touched a high of N2.99 from a low of 73 kobo in the past 52 weeks. With the EPS of 10 kobo, the P/E ratio of Linkage Assurance stands at 25.11x with earnings yield of 3.98%.

- Sovereign Trust Insurance is trading at the share price of N2.92. The price of the stock has touched a high of N3.96 from a low of 50 kobo in the past one year. With the EPS of 10 kobo, the P/E ratio of Sovereign Trust Insurance stands at 30.60x with earnings yield of 3.27%.

- Sunu Assurance is currently trading at the share price of N6.19. The price of the stock has touched a high of N11.65 from a year low of N1.18. With the EPS of 20 kobo, the P/E ratio of Sunu Assurance stands at 30.69x with earnings yield of 3.26%.

- Consolidated Hallmark is currently trading at the share price of N4.57. The price of the Company has touched a high of N6.19 from a year low of N1.27. With the EPS of 11 kobo, the P/E ratio stands 42.78x with earnings yield of 2.34%

PROFIT MARGIN

- Mutual Benefits Assurance achieved the profit margin of 28.14%, emerging top in the insurance sector for the period under review. With a turnover of N41.195 billion and profit after tax of N11.594 billion, the company achieved profit margin of 28.14% despite tough business climate. This shows operational efficiency of the Company’s management. Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. It indicates how much profit the company makes for every revenue generated.

- Veritas Kapital Assurance achieved profit margin of 26.51% for the period under review, emerging as second in the ranking for profit margin.

- Cornerstone Insurance emerged third in ranking with the profit margin of 21%.

- NEM Insurance achieved profit margin of 18.38%, emerging as fourth in the ranking.

- Linkage Assurance achieved profit margin of 14.26% emerging as fifth in the ranking.

Other insurance companies and their profit margin for Half- Year 2025 include:

AIICO Insurance (10.98%), Sunu Assurance (10.78%), AXA Mansard (7.50%), Consolidated Hallmark (4.39%) and Sovereign Trust Insurance (3.98%) respectively.