- Okomu leads others in profit margin

- Comparative Analysis of Manufacturing Sector in H1 2023

Wole Olajide

The manufacturing sector in Nigeria was the worst hit sector of the impact of political and economic uncertainties that plagued the country at the beginning of the year 2023. The woes began with Naira scarcity; followed by weakening of naira against dollar in the FOREX market, continuous rising inflation and high interest rate among others. These affected Half Year earnings performance of manufacturing firms, particularly the fast moving consumer goods (FMCG) sub sector. Companies like Nestle, Nigerian Breweries, Dangote Sugar and Cadbury actually recorded losses for the first half of 2023.

In ranking the performance of the manufacturing sector regarding their second quarter earnings, we shall consider the following metrics: Turnover, Turnover Growth, Profit after tax (PAT), PAT Growth, Earnings per share (EPS), P/E ratio, Earnings Yield and Profit Margin.

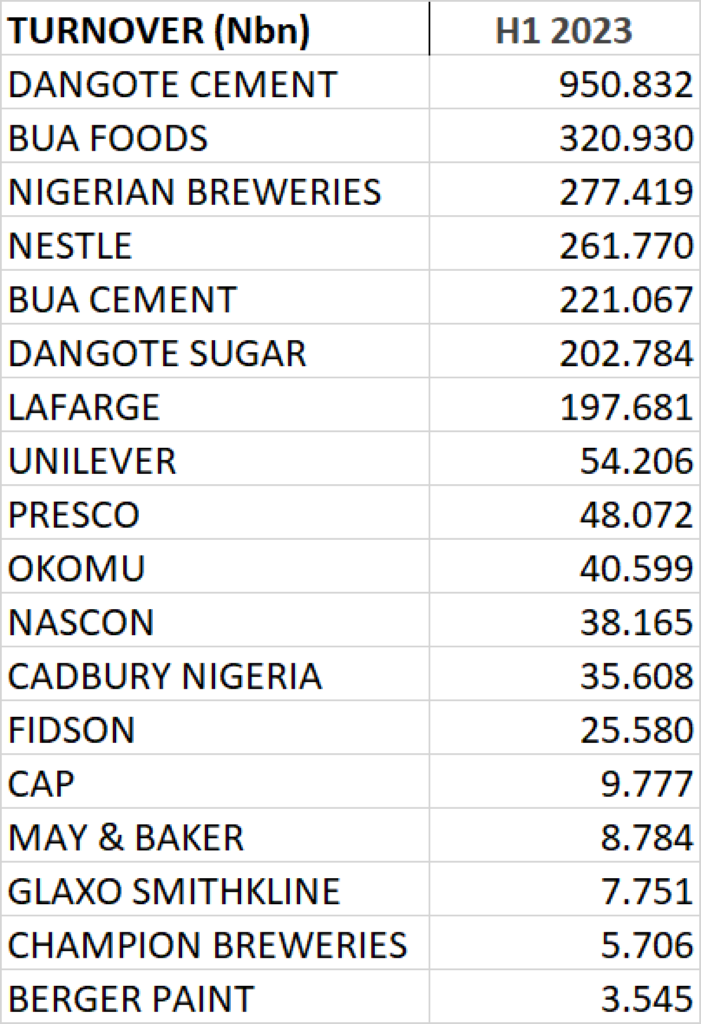

TURNOVER

Dangote Cement, BUA Foods and Nigerian Breweries are ranked first, second and third respectively in turnover for the 6 months period. Dangote Cement reported a revenue of N950.832 billion, BUA Foods recorded revenue of N320.930 billion and Nigerian Breweries recorded N277.419 billion as turnover.

Others in the ranking include: Nestle, BUA Cement, Dangote Sugar, Lafarge, Unilever, Presco, Okomu, NASCON, Cadbury, Fidson, CAP, May & Baker, Glaxo Smithkline, Champion Breweries and Berger Paints respectively with corresponding revenues that can be found in the table below.

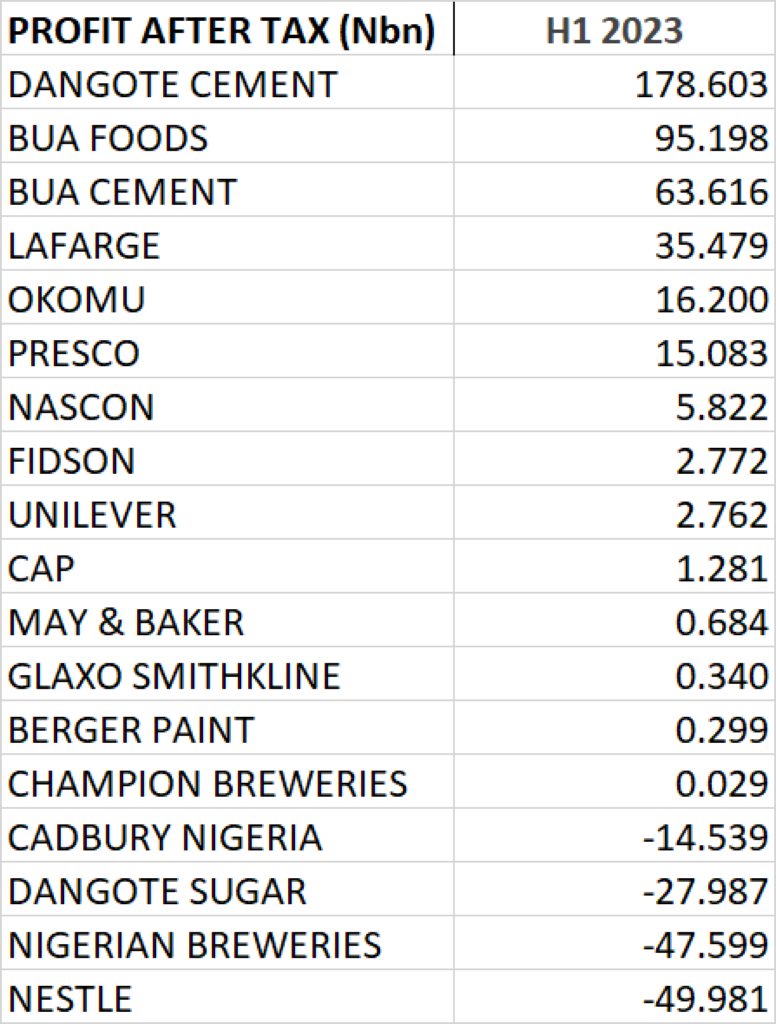

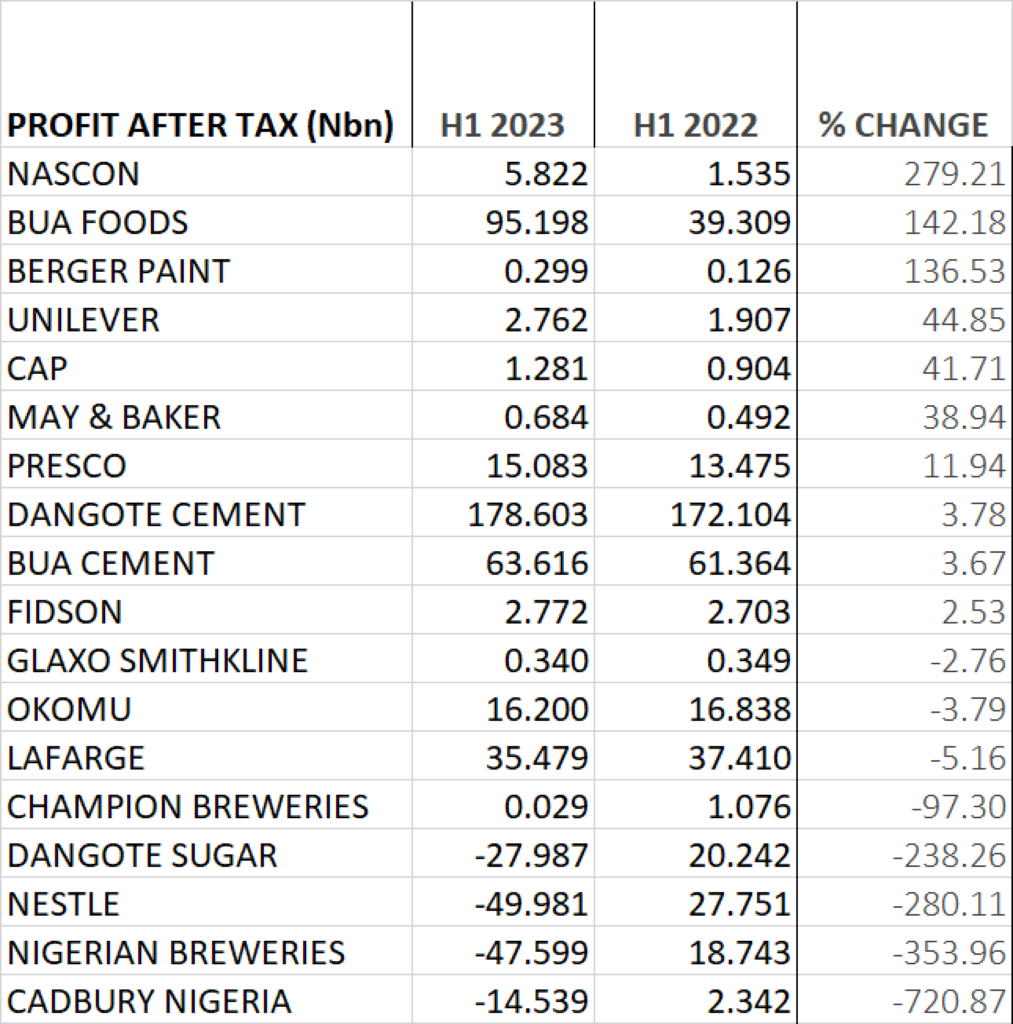

PROFIT AFTER TAX

- Dangote Cement emerged top in profit after tax for the period under review. The cement manufacturing giant reported N178.603 billion as profit for the 6 months period.

- Second in the rank is BUA Foods with Profit after Tax of N95.198 billion in the first half of 2023.

- Third in the rank is BUA Cement which recorded N63.616 billion as profit after tax for the 6 months period

- Fourth and Fifth on the rank are Lafarge and Okomu with the profit after tax of N35.479 billion and N16.2 billion respectively.

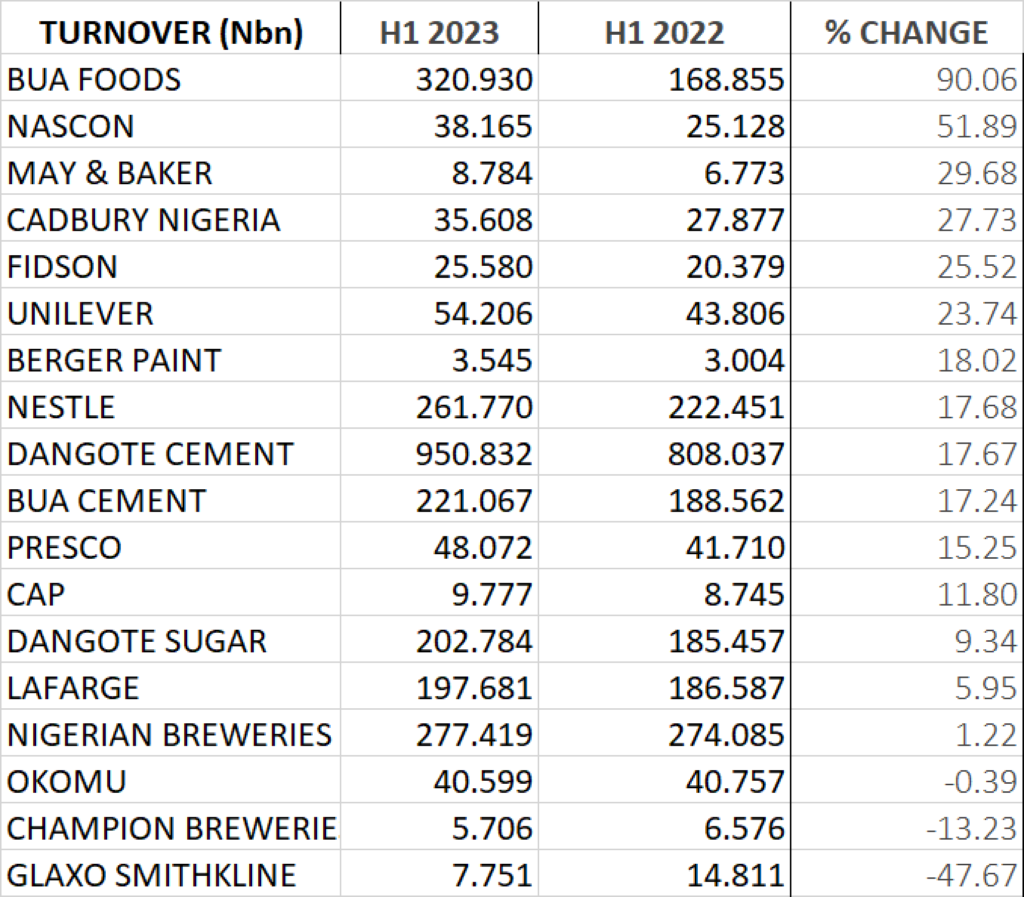

PERFOMANCE IN TURNOVER GROWTH

- BUA Foods emerged first in terms of turnover growth in half year 2023 as it reported revenue of N320.93 billion, up by 90.06% from N168.855 billion reported the previous year.

- Second in rank in terms of growth in turnover is NASCON Allied Industries Plc. The Company recorded a turnover of N38.165 billion for the 6 months period, up by 51.89% from N25.128 billion reported the previous year.

- May & Baker emerged third in terms of turnover growth. The Company reported revenue of N8.784 billion for the 6 months period, up by 29.68% from N6.773 billion reported the previous year.

- Others in the ranking for turnover growth include: Cadbury (27.73%), Fidson (25.52%), Unilever (23.74%), Berger Paints (18.02%), Nestle (17.68%), Dangote Cement (17.67%), BUA Cement (17.24%), Presco (15.25%), CAP Plc (11.80%), Dangote Sugar (9.34%), Lafarge (5.95%) and Nigerian Breweries (1.22%) respectively.

PERFORMANCE IN PAT GROWTH

- NASCON Allied Industries Plc grew its profit after tax, year on year by 279.21% to N5.822 billion from N1.535 billion reported the previous year, emerging as best in terms of PAT growth.

- BUA Foods ranked second in terms of growth in profit after tax. The Company reported profit after tax of N95.198 billion, up by 142.18% from N39.309 billion reported the previous year.

- Berger Paints grew its profit after tax by 136.53% year on year to N299 million from N126 million reported in H1 2022.

- Unilever grew its profit after tax by 44.85% to N2.762 billion from N1.907 billion achieved the previous year.

- Fifth on the ranking is CAP Plc with a PAT growth of 41.71% year on year, achieving N1.281 billion profit after tax from N904 million reported the previous year.

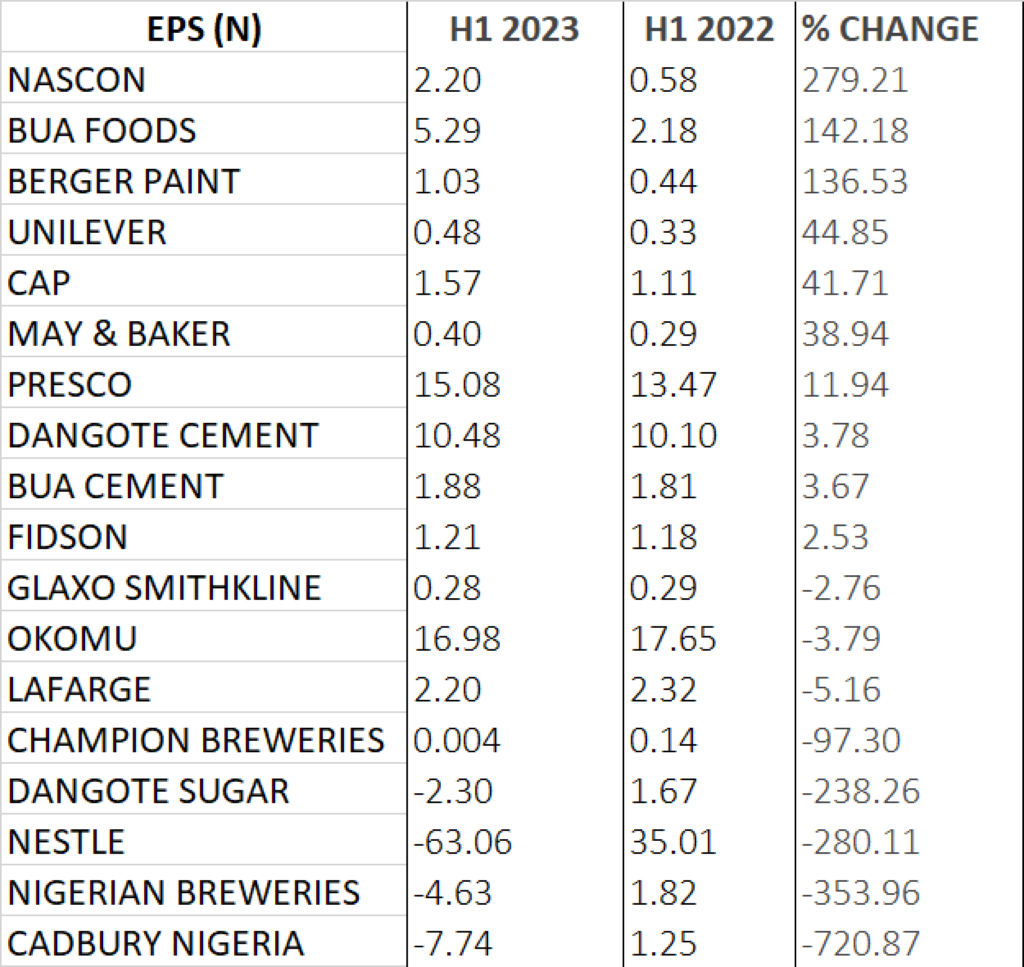

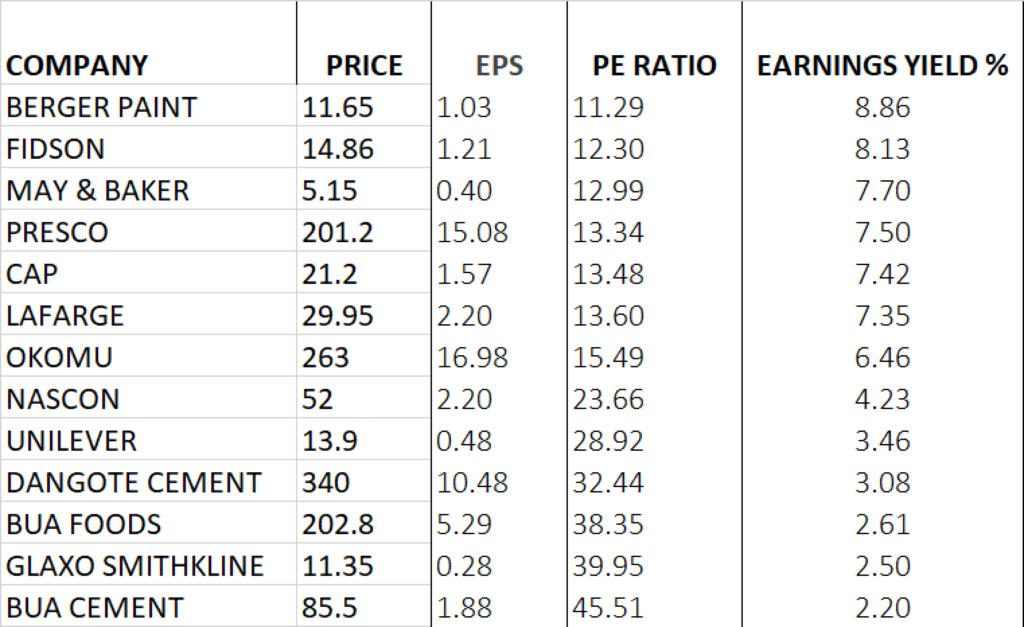

PERFORMANCE IN P/E RATIO AND EARNINGS YIELD

- Berger Paints is currently trading at N11.65. With the Q2 2023 earnings per share (EPS) of N1.03, the P/E ratio the Company stands at 11.29x with earnings yield of 8.86%.

- Fidson Healthcare is currently trading at N14.86. With EPS of N1.21, the P/E ratio of the Fidson stands at 12.30x with earnings yield of 8.13%.

- May & Baker is currently trading at N5.15. With the EPS of N0.40, the P/E ratio of the Company stands at 12.99x with earnings yield of 7.70%.

- PRESCO is currently trading at N201.2. With the EPS of N15.08, the P/E ratio of PRESCO stands at 13.34x with earnings yield of 7.50%.

- CAP Plc is currently trading at N21.2. With the EPS of N1.57, the P/E ratio of the CAP Plc stands at 13.48x with earnings yield of 7.42%.

- Lafarge Africa (WAPCO) is trading at N29.95. With the EPS of N2.20, the P/E ratio of Lafarge stands at 13.6x with earnings yield of 7.35%.

- Okomu is trading at N263. With the EPS of N16.98, the P/E ratio of Okomu stands at 15.49x with earnings yield of 6.46%.

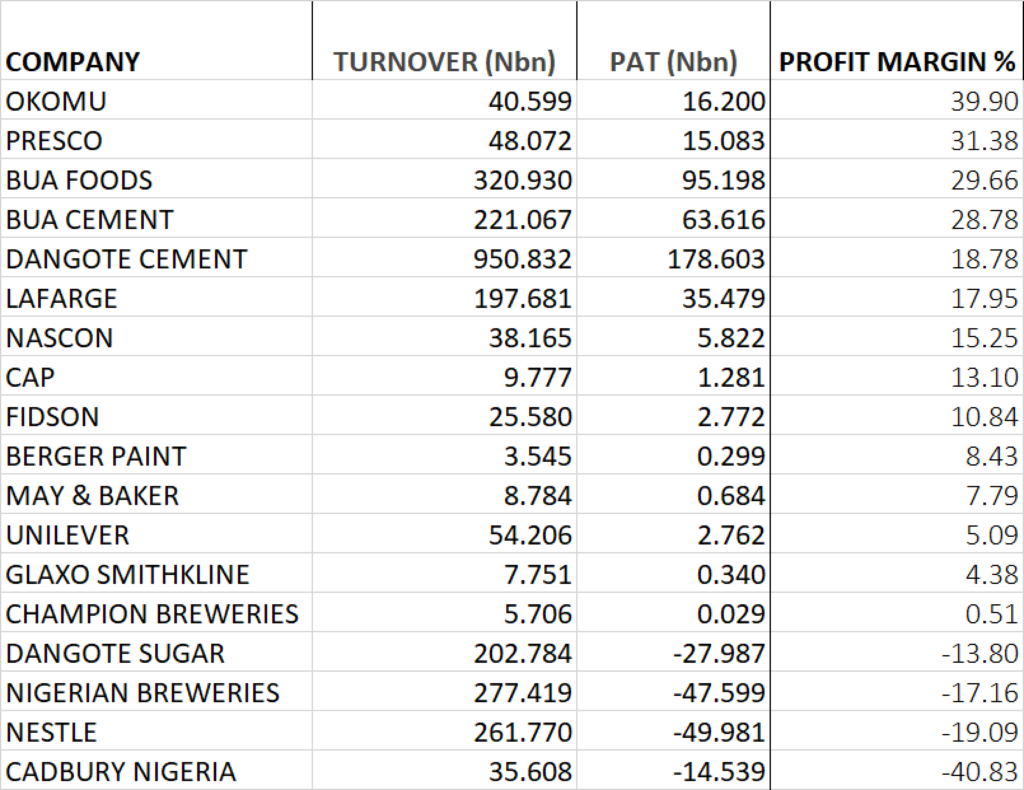

PROFIT MARGIN

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every revenue generated.

Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry.

It is calculated as Profit After Tax, divided by Revenue or Turnover, multiplied by 100.

Okomu achieved the profit margin of 39.90%, emerging top in the manufacturing sector for the period under review. This is followed by PRESCO, BUA Foods, BUA Cement and Dangote Cement with the profit margin of 31.38%, 29.66%, 28.78% and 18.78% respectively.