- Comparative analysis of manufacturing stocks in HY 2021

Performance of quoted firms on the Nigerian Exchange for the First Half of 2021 to a large extent is very impressive as most stocks performed beyond market expectation. The manufacturing sector performed well as most of them achieved year on year growth in their top line and bottom line figures.

In a way to gauge the performance of stocks in the manufacturing sector, we deem it necessary to do a comparative analysis of the Half Year earnings of the manufacturing sector. This will gauge their performance in terms of profitability, turnover, earnings growth, earnings yield and profit margin.

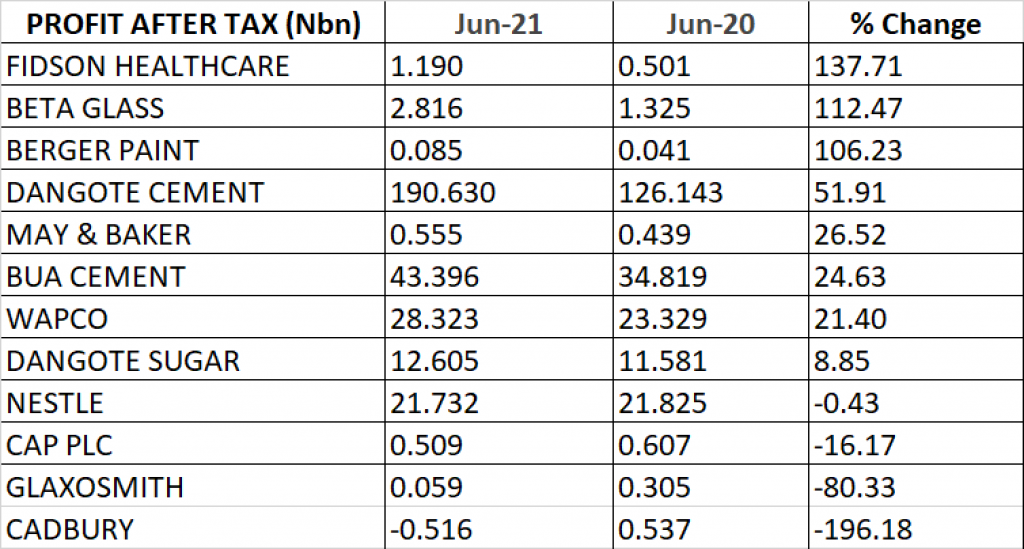

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Fidson Healthcare Plc grew its profit after tax by 137.71% year on year from N501 million to N1.19 billion, emerging best in terms of growth in profit after tax among others in the manufacturing sector.

- Beta Glass emerged second best in terms of growth in profit after tax as it grew by 112.47% year on year from N1.325 billion to N2.816 billion.

- Berger Paint grew its profit after tax by 106.23% to N84.746 million from N41.092 million, emerging third on the ranking in terms of growth in profit after tax.

- Dangote Cement achieved profit after tax of N190.630 billion, up by 51.91% from N126.143 billion achieved the previous year, emerging fourth in ranking in terms growth in profit after tax.

- May & Baker grew its profit after tax by 26.52% from N438.886 million to N555.274 million.

- BUA Cement grew its profit after tax by 24.63% year on year to N43.396 billion from N34.819 billion.

- Lafarge Africa (WAPCO) achieved profit after tax of N28.323 billion, up by 21.40% from N23.329 billion achieved the previous year.

- Dangote Sugar grew its profit after tax by 8.85% year on year to N12.605 billion from N11.581 billion reported the previous year.

- Nestle declined in profit after tax marginally by 0.43% to N21.732 billion from N21.825 billion reported the previous year.

- CAP Plc declined in profit after tax by 16.17% to N509.110 million from N607.327 million.

- GlaxoSmithkline declined in profit after tax by 80.33% to N59.905 million from N304.538 million.

- Cadbury declared a loss after tax of N516.167 million as against the profit after tax of N536.660 million declared in the first half of 2020.

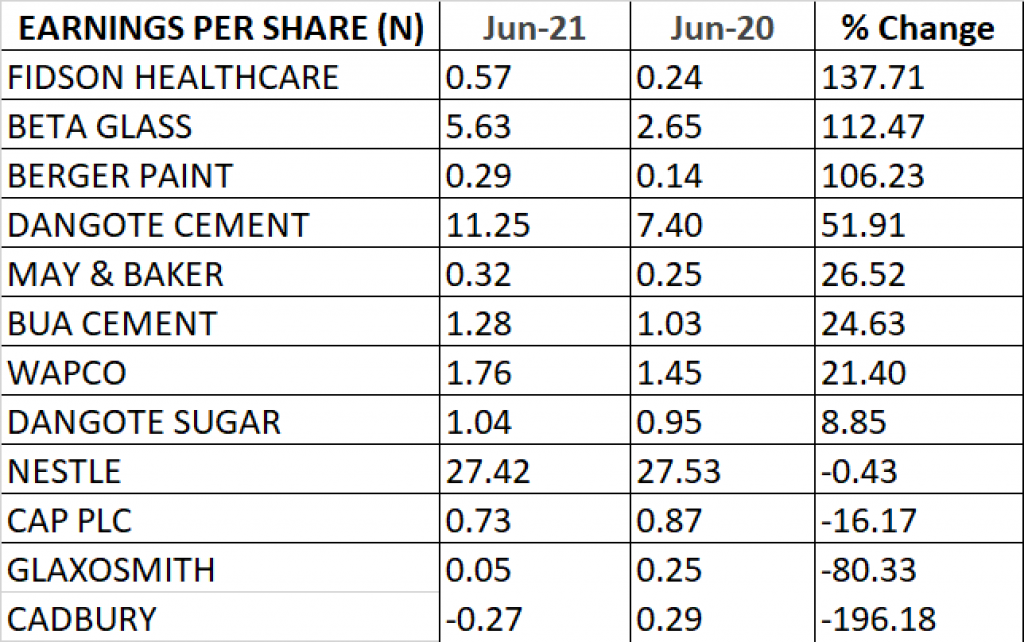

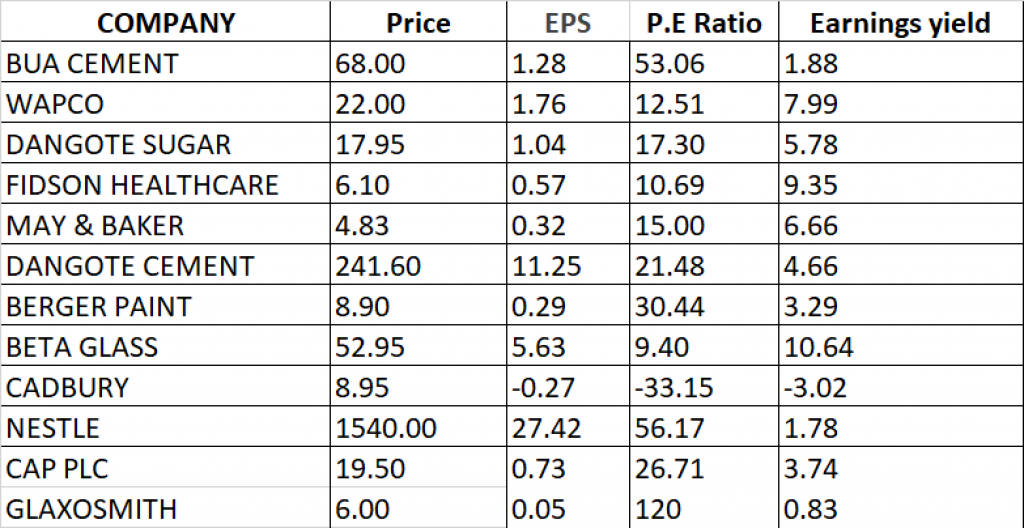

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNING’S YIELD

- Earnings per share of Fidson Healthcare increased by 137.71% to 57 kobo from 24 kobo, emerging as overall best in terms of growth in earnings per share in the manufacturing sector. At the share price of N6.10, the P.E ratio of Fidson Healthcare stands at 10.69x with earnings yield of 9.35%.

- Beta Glass emerged second best in terms of growth in earnings per share as EPS grew by 112.47% year on year from N2.65 to N5.63. At the share price of N52.95, Beta Glass has a P.E ratio of 9.40x with earnings yield of 10.64%.

- Berger Paint grew its earnings per share by 106.23% to 29 kobo from 14 kobo, emerging third on the ranking in EPS growth. At the share price of N8.90, the P.E ratio of Berger Paint stands at 30.44x with earnings yield of 3.29%.

- Dangote Cement achieved earnings per share of N11.25, up by 51.91% from the EPS of N7.40 achieved the previous year, emerging fourth in ranking in terms of growth. At the share price of N241.60, P.E ratio of Dangote Cement stands at 21.48x with earnings yield of 4.66%.

- May & Baker grew its earnings per share by 26.52% to 32 kobo from 25 kobo. At the share price of N4.83, the P.E ratio of May & Baker stands at 15x with earnings yield of 6.66%.

- BUA Cement grew its earnings per share by 24.63% year on year to N1.28 from N1.03. At the share price of N68, the P.E ratio of BUA Cement stands at 53.06x with earnings yield of 1.88%.

- Lafarge Africa (WAPCO) achieved the earnings per share of N1.76, up by 21.40% from the EPS of N1.45 achieved the previous year. At the share price of N22, the P.E ratio of Lafarge Africa stands at 12.51x with earnings yield of 7.99%.

- Dangote Sugar grew its earnings per share by 8.85% year on year to N1.04 from N0.95 reported the previous year. At the share price of N17.95, the P.E ratio of Dangote Sugar stands at 17.30x with earnings yield of 5.78%.

- Nestle declined marginally in its earnings per share by 0.43% to N27.42 from N27.53 reported the previous year. At the share price of N1,540, the P.E ratio of Nestle stands at 56.17x with earnings yield of 1.78%.

- CAP Plc declined in earnings per share by 16.17% to 73 kobo from 87 kobo. At the share price of N19.50, the P.E ratio of CAP Plc stands at 26.71x with earnings yield of 3.74%

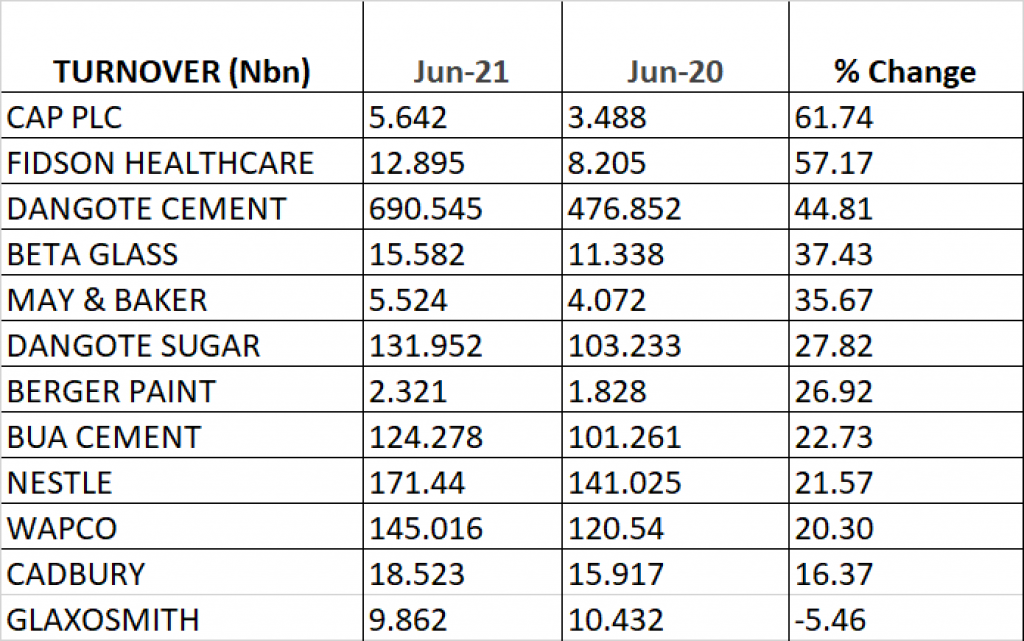

PERFORMANCE IN TURNOVER GROWTH

- CAP Plc emerged top in terms of turnover growth among others in the manufacturing sector as it grew its turnover by 61.74% year on year to N5.642 billion from N3.488 billion.

- Second on the list is Fidson Healthcare with a turnover of N12.895 billion, up by 57.17% from N8.205 billion reported the previous year.

- Dangote Cement is third among manufacturers that grew their turnover in Half Year 2021. The revenue of Dangote Cement increased by 44.81% year on year to N690.545 billion from N476.852 billion.

- Beta Glass Plc is fourth in ranking of turnover growth as it grew its revenue by 37.43% to N15.582 billion from N11.338 billion.

- May & Baker emerged fifth in terms of turnover growth as revenue increased by 35.67% to N5.524 billion from N4.072 billion.

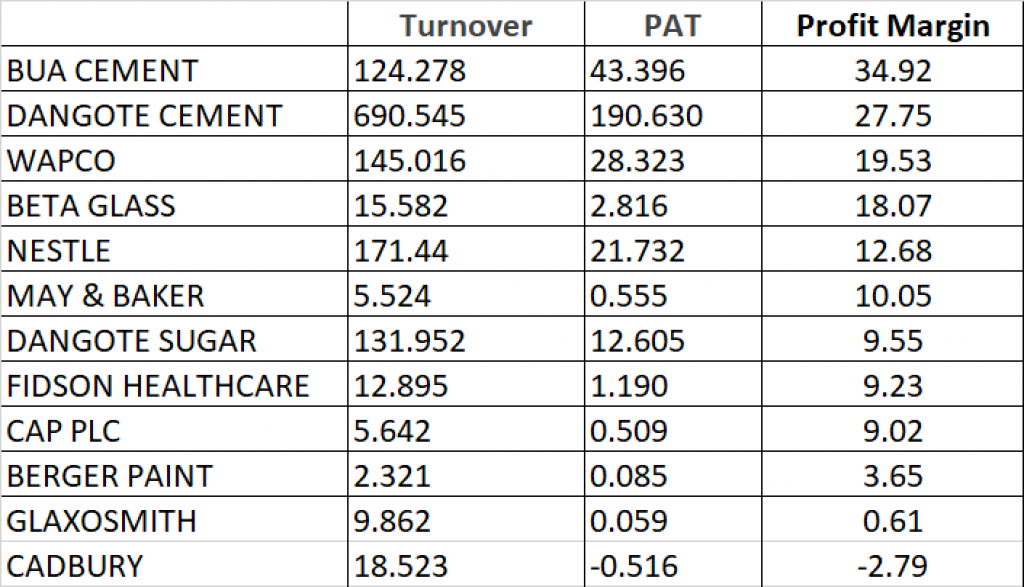

PROFIT MARGIN

- BUA Cement emerged top among others with a profit margin of 34.92% in half year 2021.

- Dangote Cement achieved a profit margin of 27.75%, emerging second among others in the manufacturing sector in terms of profit margin.

- Lafarge Africa (WAPCO) in Half Year 2021 achieved a profit margin of 19.53%, emerging third among others.

- Beta Glass Plc achieved a profit margin of 18.07% emerging fourth among others.

- Nestle made a profit margin of 12.68% in Half Year 2021, emerging fifth among others in terms of profit margin.