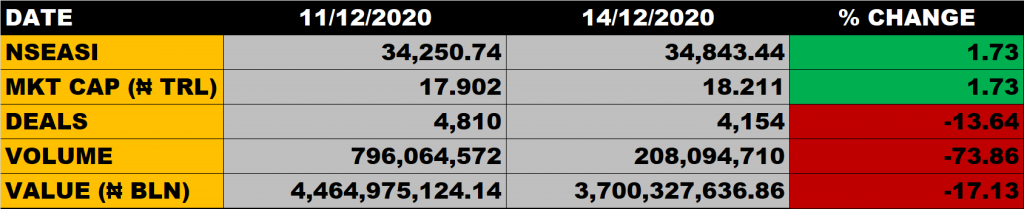

The Nigerian equity market on Monday admitted the Bulls as Dangote Cement and Airtel ended the day with 2.73% and 10% gain respectively. The All Share Index grew by 1.73% to settle at 34,843.44 points from the previous close of 34,250.74 points. Investors gained N309 billion as market capitalization grew to N18.211 trillion from the previous close of N17.902 billion.

An aggregate of 208.09 million units of shares were traded in 4,154 deals, valued at N3.7 billion.

The market breadth closed positive as 26 stocks gained while 14 stocks declined in their share prices.

Stocks to Watch

We have always advised investors to take position in fundamentally sound stocks. If such stocks drop in a down market, there is every tendency that there position will come back when the market becomes good.

We need to continue to look at stocks that will continue to pay good dividend if you miss capital appreciation, you will be compensated by good dividend

Percentage Gainers

Airtel Africa led other gainers with 10% growth to close at N704 from the previous close of N640.

Royal Exchange Assurance and AIICO Insurance both grew their share prices by 9.52% to close at N0.23 and N1.15 respectively.

Dangote Cement grew its share price by 2.73% to close at N188 from the previous close of N183.

Percentage Losers

Prestige Assurance led other price decliners as it shed 10% of its share price to close at N0.45 from the previous close of N0.50.

International Breweries and Cutix Plc among other price decliners also shed their share prices by 9.89% and 9.47% respectively.

Volume Drivers

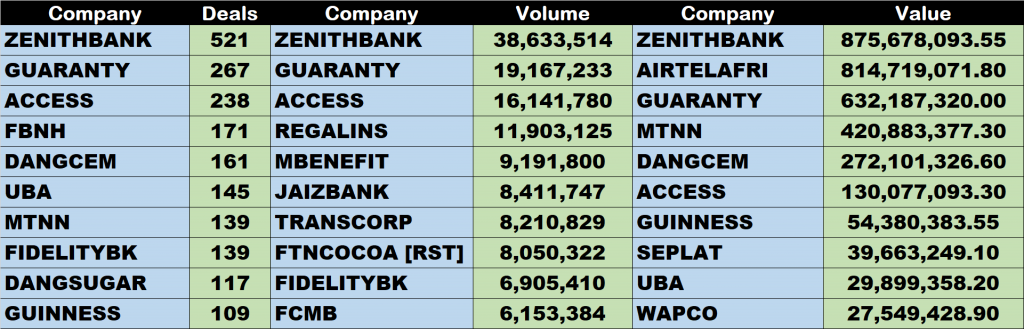

- Zenith Bank traded about 38.63 million units of its shares in 521 deals, valued at N875.68 million.

- Guaranty Trust Bank traded about 19.17 million units of its shares in 267 deals, valued at N632.18 million.

- Access Bank traded about 16.14 million units of its shares in 238 deals, valued at N130.077 million.