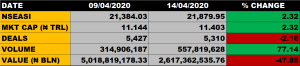

The Nigerian equities market on Tuesday closed on a positive note as the All Share Index rose further by 2.32% to settle at 21,879.95 points from the previous close of 21,384.04 points last week Thursday.

The market capitalisation likewise grew by 2.32% to close at N11.403 trillion from the previous close of N11.144 trillion, thereby gaining N259 billion.

Aggregate volume of traded stocks closed at 557.8 million units, up by 77.14% from the previous close of 314.9 million units.

The value of traded stocks was N2.62 billion, down by 47.85% from the previous close of N5.02 billion.

Total number of deals at the close of trade was 5,310, down by 2.16% from the previous close of 5,427 deals.

Market Breadth

The market breadth closed positive as 29 equities gained while 12 equities declined in their share prices.

Percentage Gainers

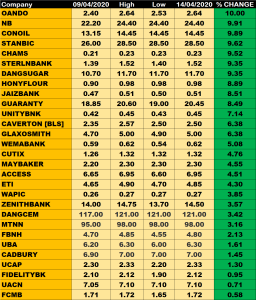

Oando Plc led other percentage gainers with 10% growth, closing at N2.64 from the previous close of N2.40.

Nigerian Breweries, Conoil and Stanbic IBTC among other gainers also grew their share prices by 9.91%, 9.89% and 9.62% respectively.

Percentage Losers

PZ led other price decliners, shedding 9.09% of its share price to close at N4.00 from the previous close of N4.40.

Redstar Express and LASACO among other price decliners also shed their share prices by 5.86% and 4.35% respectively.

Volume Drivers

Omoluabi Mortgage Bank traded about 293 million units of its shares in one deal, valued at N161.15 million.

First Bank of Nigeria Holdings (FBNH) traded about 51.8 million units of its shares in 557 deals, valued at N243.45 million.

UBA traded about 35.65 million units of its shares in 316 deals, valued at N220.52 million.