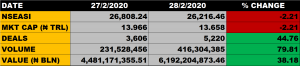

The Nigerian stock market on Friday closed on a negative note as the All Share Index declined further by 2.21% to close at 26,216.46 points against the previous close of 26,808.24 points on Thursday.

Market Capitalisation declined by 2.21% to close at N13.658 trillion from the previous close of N13.966 trillion, thereby shedding N308 billion.

Aggregate volume of traded stocks closed at 416.3 million units, up by 79.81% from the previous close of 231.5 million units.

Value of traded stocks grew by 38.18% to close at N6.19 billion from the previous close of N4.48 billion.

Total number of deals at the close of trade was 5,220, up by 44.76% from the previous close of 3,606 deals.

Market Breadth

The Market Breadth closed negative as only 2 stocks gained while 41 stocks declined in their share prices.

Percentage Gainers

![]()

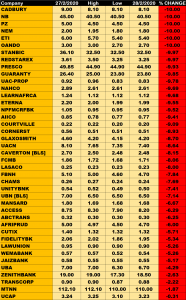

Only 2 stocks emerged as gainers at the close of trade on Friday. Vita Foam grew its share price by 5.88% to close at N4.32 from the previous close of N4.08. Flour Mills of Nigeria grew its share price by 4.76% to close at N22.00 from the previous close of N21.00

Percentage Losers

At the close of trade on Friday, 41 equities declined in their share prices.

Cadbury, Nigeria Breweries, PZ, NEM Insurance, Ecobank Transnational Incorporated and Oando Plc all shed 10% of their share prices respectively.

Stanbic IBTC and Redstar Express among others both shed 9.97% of their share prices to close at N32.50 and N3.25 respectively.

Volume Drivers

- Guaranty Trust Bank traded about 96 million units of its shares in 731 deals, valued at about N2.29 billion.

- UBA traded about 49.5 million units of its shares in 373 deals, valued at about N318.78 million.

- Zenith Bank traded about 45.56 million units of its shares in 812 deals, valued at about N827.88 million.