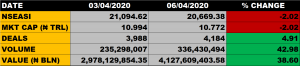

The Nigerian equities market on Monday closed on a negative note as the All Share Index dropped further by 2.02% to settle at 20,669.38 points against the previous close of 21,094.62 points on Friday.

The market capitalisation likewise declined by 2.02% to close at N10.772 trillion from the previous close of N10.994 trillion, thereby by shedding N222 billion.

Aggregate volume of traded stocks closed at 336.43 million units, up by 42.98% from the previous close of 235.3 million units.

The value traded stocks was N4.13 billion, up by 38.6% from previous close of N2.98 billion.

Total number of deals at the close of trade was 4,184, up by 4.91 % from the previous close of 3,988 deals.

Market Breadth

The market breadth closed positive as 21 equities gained against 13 equities that declined in their share prices.

Percentage Gainers

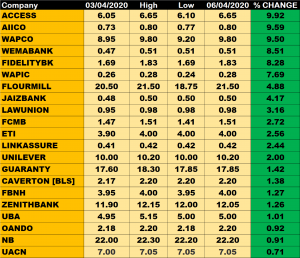

Access Bank led other percentage gainers with 9.92% growth, closing at N6.65 from the previous close of N6.05.

AIICO Insurance, WAPCO and Wema Bank among other gainers also grew their share prices by 9.59%, 9.50% and 8.51% respectively.

Percentage Losers

NACHO, Learn Africa and Cutix Plc shed 10% of their share price to close at N2.34, N0.90 and N1.26 respectively.

Seplat, Bua Cement and BOCGAS among other price decliners also shed their share prices by 9.99%, 9.92% and 9.88% respectively.

Volume Drivers

First Bank of Nigeria Holdings (FBNH) traded about 98.62 million units of its shares in 518 deals, valued at N393.42 million.

Guaranty Trust Bank traded about 55.66 million units of its shares in 392 deals, valued at N1 billion.

Zenith Bank traded about 32.53 million units of its shares in 612 deals, valued at N392.77 million.