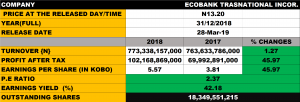

Ecobank Transnational Incorporated on Thursday 28th March declared its 2018 financial reports, which showed that the bank grew its topline figures to N773.338 billion for the current period, which is marginally 1.27% better than N763.633 billion recorded in the corresponding period of 2017.

The Profit After Tax (PAT) for the group soared by 45.97% to stand at N102.168 billion above N69.992 billion reported same period last year

According to the company’s full year results released by the Nigerian Stock Exchange (NSE), Net Interest Income dropped by 3% to settle at N289.039 billion below 2017’s N299.322 billion

The company which as at Thursday, 28 March, 2018 had its share price grow by 0.15%, recorded its most percentage growth in Profit before Tax (PBT) for FY’2018 at 53.48%, closing at N135.534 billion compare with N88.3 billion filed the same period in 2017.

The report also showed that the bank had its loan and advances to customers up by 17% to arrive at N3.339 billion from N2.863 billion of 2017, while loan and advances to other banks stood at N625.506 billion, which 26% better than 2017’s N515.856 billion.

The company’s Total Assets for the current period closed at N8.223 trillion, representing 20.00% growth from N6.864 trillion recorded in the same period in 2017 and on the other side the bank Total Liabilities was up by 22% from N6.199 trillion recorded in 2017 to N7.563 trillion in the current period of 2018.

The Pan African Bank had its Earnings per Share grow by 45.97% from N3.81of 2017 to N5.57 in the period under review. The Price to Earnings (P.E.) Ratio stood at 2.37x while the earnings yield is at 42.18%.

Commenting on the company’s 2018 Audited Financial Statements, the Group CEO, Ade Ayeyemi, said, “Our financial performance in 2018 was remarkable in many ways and reflected the meaningful and significant progress that we have made against the priorities that we set in our ‘Roadmap to Leadership’ strategy. We delivered a 51% growth in profit before tax to $436 million and generated a return on tangible equity of 21%. Our cost-of-risk of 2.4% was an improvement on 2017 and demonstrated the progress that we have made addressing credit quality issues and enhancing internal control processes.”

Ayeyemi said “In Francophone and Anglophone West Africa regions we delivered sustainable growth and value for shareholders. While in Nigeria, and the Central, Eastern and Southern Africa, regions we are spurred on by the gradual progress being made. Our businesses continued to serve customers

diligently and with purpose and all delivered profit growth in 2018, with Commercial Bank overturning the loss before tax made in 2017.”

Ecobank has invested and continue to invest in the technology platforms to accelerate their shift from ‘physical’ to ‘digital’ and they are supporting customers with digitally innovative products to enrich their engagements with the bank.

To meet a key goal of expanding financial services to the unbanked, the group boss said “we

have increased the number of Xpress Points, our agency network, to about 14,000 and we plan to grow this number. Our cash management and trade finance products, such as, Omni and e-Trade, are providing our customers with the convenience and efficiency of executing their cross-border”

The financial statements were approved for issue by the board of directors on 22 February 2019

The Group CEO and Group CFO who are both signatories to the financial statements of ETI, were granted a waiver by the Financial Reporting Council (FRC) of Nigeria, allowing them to sign the ETI financial statements (without indicating their FRC registration numbers) together with the

Chairman on behalf of the board.