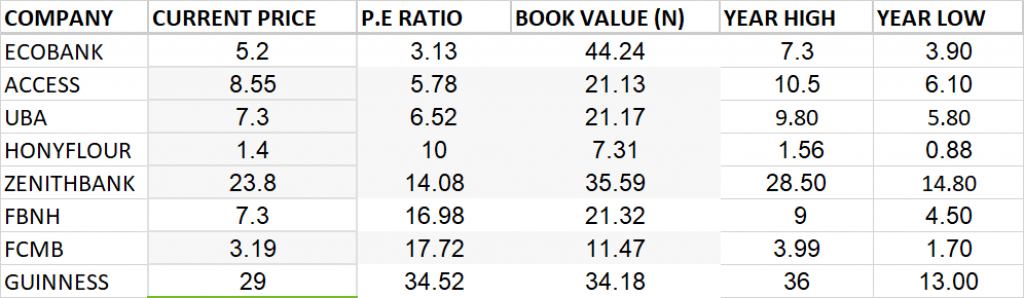

- Book value, P.E Ratio and Year Low Price Analysis

If investment in stocks is treated as normal transaction of buying and selling, the best for an investor at any point in time is an entry at relatively comfortable price, with the mindset for an exit at higher price level than the entry. At that, due considerations are needful at the entry and close monitoring in the process of holding the stock. These are essentials seeing that market trends and fundamentals do change and in most cases, in the opposite direction to performances of specific companies.

When a market losses its fundamentals in disregard to performances of listed companies, it behoves on the investors in such market to sell stocks and hold cash, hold on to existing positions, do fresh purchases or buy more of existing holdings. Such decisions as the case may be should not be frivolous but hinged on certain motivations which could vary from one investor to another.

It is noteworthy to categorically state the fact that equity selection process might not come easy as there are many metrics that could be deployed. The question remains how and when does a stock become cheap? Let’s take a look at just a few.

P/E RATIO:

Many times, a Cheap Stock could be easily be determined by a Low Price-to-Earnings Ratio but then, just like other metrics, there are limitations based on the cyclical nature of the companies involved but P/E Ratio is still largely considered as a back of the envelope analysis in finding a cheap stock. It sounds over simplified quite well but it remains true that the relationship between current price and earnings of a stock will largely remain relevant in the comparative analysis between one stock and another in same industry and between a year and another in same stock. Of course this is bound to change often and so should investors update the data base and keep tab on the changing figures to be well guided.

YEAR’ LOW/ HIGH PRICES AGAINST CURRENT PRICE:

Technically speaking, tracking high and low price levels of a stock might just tell a little about how cheap or expensive a stock has become. In most cases, these are the prices that often form the support and resistance levels. Support is that price level a stock price gets to and it refuses to decline below while resistance is the level a price gets to and it finds it difficult to climb further at an immediate period as these are often later broken.

Questions need be asked if a decline persist. If such decline is propelled by either realistic or expected poor performance from a company, it could be said to be justified but in cases where a company keeps releasing good reports while the price dwells at support level or its year low, it could be technically stated that such stock is cheap at that price though further confirmation might be required to initiate a purchase. In most cases, a year low could be further adjusted down depending on the elongation of market downtrend. A stock that is trending around its year low is however such that should be paid close attentions to particularly if the company fundamentals are sound enough.

BOOK VALUE AND PRICE-TO-BOOK VALUE RATIO:

A company’s book value is a figure calculated from the balance sheet of a company, it represents the net worth (assets – liabilities) of the company on per share. It is often referred to as shareholder’s equity. Book value tells of the relationship between the assets and liability of a company.

Book value analysis brings to fore the question on what does an investor really buy in a stock, could it be the name, assets or what? It is arguable because stocks are not being bought for a company to be stripped and investors share the proceeds but truth is that it should be more that what an investor should be interested in. What should interest an investor in a stock is the assets the institution has been able to accumulate over years and much more, future possibilities in assets growth. Book value simply tells of per share accruals to a holder of one unit of a stock should all the companies assets be sold. It thus infers that at every point, it should interest investors what the book value per share of a company is, relative to its stock price on the stock exchange which is the making of the market. When book value is divided by the number of outstanding shares, we get the book value per share (BVPS)

In a situation therefore, where an equity’ price is lower than the company’s book value per share, such a stock could be considered cheap with higher possibilities of future price growth. This is not however to state that higher stock prices than book value should suggest a ‘no buy’ rating as that could suggest a level of confidence in the organisation going forward but even at that, such a stock could not be said to be cheap.

It is possible for a corporation’s stock price to fall below book value, meaning the stockholder has a chance to buy into the firm for less than the accounting basis of the net assets. If things turn around, this can be a huge windfall, albeit one that takes years to manifest.’

In view of the foregoing, let’s take a quick look at a few stocks within the limit of space.

ACCESS BANK

Access Bank is currently trading at N8.55. The share price of the bank has ranged between a high of N10.5 and low of N6.10 in the last 52 weeks. It is trading 18.57% away from its 52 weeks high of N10.50.

On the basis of the bank’s 2021 Q1 earnings per share of N1.48, Access Bank’s book value at N21.13 and the P/E ratio standing at 5.78x, make the stock a bargain at the current price, more so its 2020 Q2 earnings is anticipated with expectation of interim dividend payout.

On the technical chart, a strong BUY is recommended for Access Bank.

FBN HOLDINGS PLC

Currently trading at N7.3, the share price of the big elephant in the past 52 weeks has ranged between a high of N9 and a low of N4.50. It is trading 18.89% away from its year high of N9, which suggests an uptrend potential for the stock.

With the Book Value of N21.32, relative to its current share price suggests that FBHN is cheap at the current price.

On the technical chart, a BUY recommendation is indicated for FBNH.

It is advisable that an investor should have at least FBNH in its portfolio. No bank in the history of Nigeria has made a provision of N1 trillion with bad debt and survived; and they have started making recovery. We have no doubt that FBNH will fully recover as the Board of the Holding company has been restructured.

UBA

The share price of UBA on Friday closed at N7.3. In the last 52 weeks, the share price of UBA has touched a high of N9.8 and a low of N5.80. It is trading 25.51% away from its year high of N9.8. At that, a position in UBA has an upside potential of about 25% relative to its year high of N9.8.

With Q1 earnings per share of 1.12, relative to the current share price of N7.3, P/E ratio of 6.52x suggest how cheap the stock is.

Book value of UBA stands at N21.17, relative to the current price of N7.3, UBA is considered cheap.

A strong BUY is recommended for UBA on the technical chart.

ZENITH BANK

Q2 earnings of Zenith Bank will soon hit the market with anticipated interim dividend of at least 30 kobo.

Zenith Bank is currently trading at N23.80 and the price has touched a high of N28.5 and a low of N14.8 in the past 52 weeks. It is trading 16.49% away from its year high of N 28.50 which suggests that Zenith Bank has potential to recover; and on the strength of anticipated interim dividend payout, the price is expected to climb up.

On the strength of its book value at N35.59 at the current share price of N23.8, Zenith Bank is a bargain at current price as it could be said to be selling 33.13% away from its book value.

ECOBANK

Ecobank is currently trading at N5.20 and the share price has touched a high of N7.3 and a low of N3.90 in the last 52 weeks. Year to date Ecobank has lost 13.33% and 28.77% of its year high of N7.3. At the share price of N5.2, Ecobank has upside potential of 28.77% relative to its year high.

Q1 2021 earnings per share of N1.66 and the current share price of N5.20 gives a low P/E ratio of 3.13x which suggests that the price of the stock is cheap.

Book value of N44.24 relative to the current price of N5.20 makes the stock very cheap.

On the technical chart, a BUY recommendation is indicated for Ecobank.

GUINNESS

Guinness Nigeria Plc released a fantastic Q3 results with growth in its topline and bottom line figures. Earnings per share increased by 34.97% to 84 kobo from the EPS of 62 kobo reported the previous year.

The share price of Guinness on Friday closed at N29. In the last 52 weeks, the price has ranged between a high of N36 and a low of N13. It is trading 19.44% away from its 52 weeks high of N36, which suggests an upside potential for the stock.

Based on the Company’s book value at N34.18, Guinness is a bargain at the current price.

On the technical chart, a BUY recommendation is indicated for Guinness Nigeria Plc

HONEYWELL FLOUR

The Audited Financial Statement of Honeywell Flour recently released for the year ended 31 March 2021 showed tremendous growth in the company’s turnover and profit after tax. Earnings per share increased year on year by 73.08% to 14 kobo from 8 kobo the previous year.

Currently trading at N1.4, the share price of Honeywell has ranged between a high of N1.56 and a low of N0.88. It is trading 10.26% away from its 52 weeks high of N1.56.

With the book value of N7.31, relative to its current share price of N1.4. Honeywell Flour is considered very cheap.

A strong BUY is recommended for Honeywell Flour on the technical chart

FCMB

The share price of FCMB on Friday closed at N3.19. It has ranged between a high of N3.99 and a low of N1.70 in the last 52 weeks. It is trading 20.05% away from its 52 weeks high of N3.99 which implies an uptrend potential for the stock.

A book value of N11.47, relative to its current share price of N3.19 implies that FCMB is very cheap as it trading 72.19% below its book value.

A buy recommendation is indicated for FCMB on the technical chart.