- Long term retirement savings versus short term PFA performances.

- Common mistakes in choosing a PFA

- 2017 Returns of PFAs

LONG TERM RETIREMENT SAVINGS VERSUS SHORT TERM PFA PERFORMANCES:

In as much as pension contribution and retirement planning is a long term affair and relationship with managers of pension savings a lifelong adventure, performances of the managers in the short term can’t be overlooked. Unfortunately, most retirement savers never bothered to take into considerations, performances of their savings even in the short term.

Notably, the long term is nothing more than culmination of short terms. In other words, except where a geometric growth is possible at a point in time within a long term period such that consequences of previous low or outright negative performances of short term intervals are not only wiped off but competitive profits are returned on to the savers, the notion that short term performances should be overlooked while planning for the long term makes no sense. To that effect, wisdom demands that even while ultimately focussing on the long term, retirement savers must of necessity keep tab on the growth or otherwise of their contributions in the very short term and in this case, as short as monthly, quarterly and yearly performances.

The above assertion is of importance in the sense that:

- A consistently growing savings in the short term can only lead to compounded positive returns in the long term. Please note that the value of money is in what it could buy. Consequently, the value of saving is what the saving today can buy at a later date. The future being an unknown, short term growth is the reality. In infers that the savings for today being the short term is secured while long term plans are being made to ensure future possibilities.

- Guaranteed future possibilities of a declining short term performance of a savings scheme is only a probabilistic tendency. This assertion is predicated on the fact that the future is always an unknown and could not be predicted to the highest level of accuracy. In many cases, investments and savings don’t follow the pattern of forecast.

- An underperforming saving platform, that is, a platform that performs below others in same pattern of operation or industry in the short term can’t guarantee standard long term value or promise to catch up with current better performer in same industry. Short term excellent performance is always predicated on certain deployed dexterity and understanding of the now, whereas, laggard performance is equally a result of some measures of failures on the part of the managers. Consequently, a long term saver is expected to follow through on short term performance of the platform to achieve long term growth value.

- If your savings platform consistently performs below others in the same industry, you should be concerned. Your future is not guaranteed.

THE WORTH OF SAVINGS:

Like earlier postulated, the worth of money is in its purchasing power and the worth of today’s saving is in its value in the future. Technically speaking, there are basically two factors to determine this. They are the rate of growth of the savings platform and inflation growth. Of these two factors, the one that is easier achievable is the rate of growth of the savings platform, inflation growth or otherwise is a function of many largely unforeseen, uncontrollable factors. Of course, forecast, to a large extent could be apt on inflation performance but it is also a known fact that forecast could also fail. It suggests therefore, the need for the retirement savers to always match short term or current rate of return on the savings platform against current rate of inflation. Following through on short term basis in the long term and taking appropriate measures will determine the overall worth of the savings platforms.

COMMON MISTAKES IN CHOOSING A PENSION FUND ADMINISTRATOR:

- IMPOSITION: The very first general issue in the choice of pension funds administrator to patronise is the fact that the preference is determined by the management of the organisation where the savers currently work. At that, individual savers do not have the choice to object but will have to comply. The question remains, what were the parameters deployed by the employer in the determination of PFA for patronage in his/her organisation? Often, this is limited to past relationship and in some cases, brand and level of publicity and not necessarily performance.

- NON-CHALLANT ATTITUDE: Most retirement savers are never bothered to check the performances of the administrator they patronise. Ask an average saver what the growth rate of his or her retirement accounts is and they go blank. In one of our surveys in 2017, we discovered that 90% of retirement savers don’t even bother to open their quarterly statement of accounts which the administrators do send to them. These are common mistakes. Statements must be scrutinised and growth rate seen to be upward. Actions should be taken if rate of growth consistently declines or underperforms other operators in the industry.

- ASSUMPTIONS ON PFA’s PROFITABILITY PERFORMANCE: It might sound funny but it is true that most retirement savers do often assume that, just because the product is identical, returns are also same. This is a great mistake. Tables from year to year clearly show that accruals to retirement savers do differ from one PFA to another.

- AGE AND BRAND BRING RESULTS: Analysis of performances of about twenty PFAs in Nigeria has revealed that performances are no functions of age and brand. As a matter of fact, most PFAs with rated brands are by far underperforming in the industry. Ditto age. Of course a few of the earliest PFAs are reporting relatively good performance but a number of new entrants are performing far better in returns than older ones.

- SIZE EQUALS RETURNS: If you were one of the PFAs that entered into the business early with good publicity and aggressive drive, because of the nature of the business, you will be big today but equally complacent and in the process yield less than expected. Evidently, there are relatively smaller players in the industry because of their entry into the business but yet performing far better than older ones.

2017 IN REVIEW:

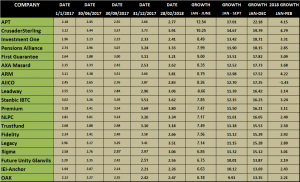

TABLE: PFAs 2017 Retirement Savings Account-RSA performances

HOW TO USE THE TABLE ABOVE

- Consider the column– GROWTH(JAN-DEC) That is where you will see the return on your savings in the year 2017. Please note that figures don’t tell lies, irrespective of size, age and brand, the best are those with higher returns in the year.

- The first column is the position that your PFA currently occupies going by the accruals on deposits/savings with them in the year 2017.

- Other columns- GROWTH(JAN-JUNE), GROWTH(JAN – SEPT) are the returns for the half year and the third quarter of the year 2017. Using this with the performance at the end of the year 2017 will enable you see the consistency in growth within the year 2017.

- The column 2018 GROWTH(JAN-FEB) tells of the performances so far in 2018.

RELATIVITY OF TABLE:

The table above sure shows you the quarterly growth patterns of your PFAs in 2017, the next step is compare with Nigeria’s rate of inflation.

On the strength of the above table therefore, seeing that inflation in Nigeria for 2017 showed a declining movement from 17.78% as at January of the year to 15.37% as at December 2017, best PFAs in Nigeria in the year under review are those that generated 16% returns and above. Every other PFAs in 2017 actually depleted your retirement savings.

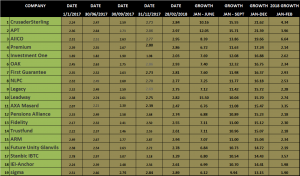

TABLE: PFAs 2017 Retiree performances:

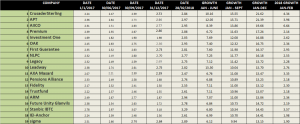

BEST PFAs IN 2017:

Please note: This report is not sponsored: