The Nigerian Exchange last week closed on a bearish note occasioned by profit taking by investors. At that, a lot of equities shed dropped in their share prices, thereby creating another entry opportunities for discerning investors.

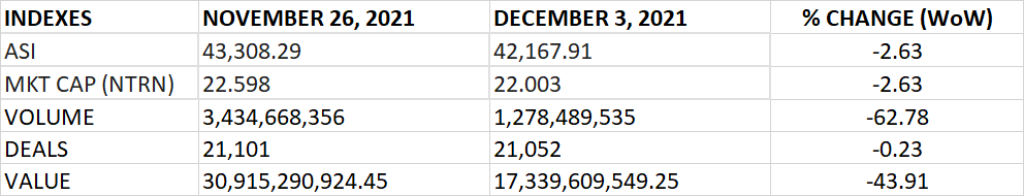

The All Share Index and the Market Capitalisation declined by 2.63% week on week to close at 42,167.91 points and N22.003 trillion respectively. Year to date, the market returned 4.71%.

Last week, an aggregate of 1.278 billion units of shares were traded in 21,052 deals, valued at N17.34 billion.

The Market Breadth closed negative as 18 equities emerged as gainers against 49 equities that declined in their share prices.

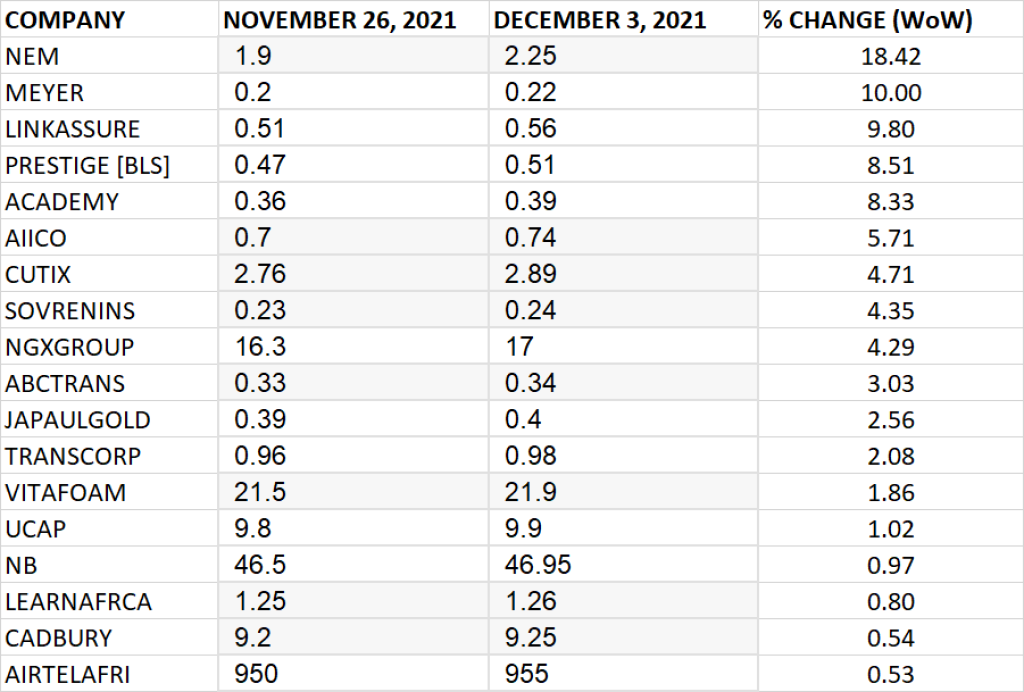

Top 10 Gainers

NEM Insurance led other gainers with 18.42% growth to close at N2.25 from the previous close of N1.90.

Meyer Plc, Linkage Assurance, Prestige Assurance and Academy Press grew their share prices by 10%, 9.80%, 8.51% and 8.33% respectively.

Others among top ten gainers for last week include: AIICO Insurance (5.71%), Cutix Plc (4.71%), Sovereign Trust Insurance (4.35%), NGX Group (4.29%), ABC Transport (3.03%) respectively.

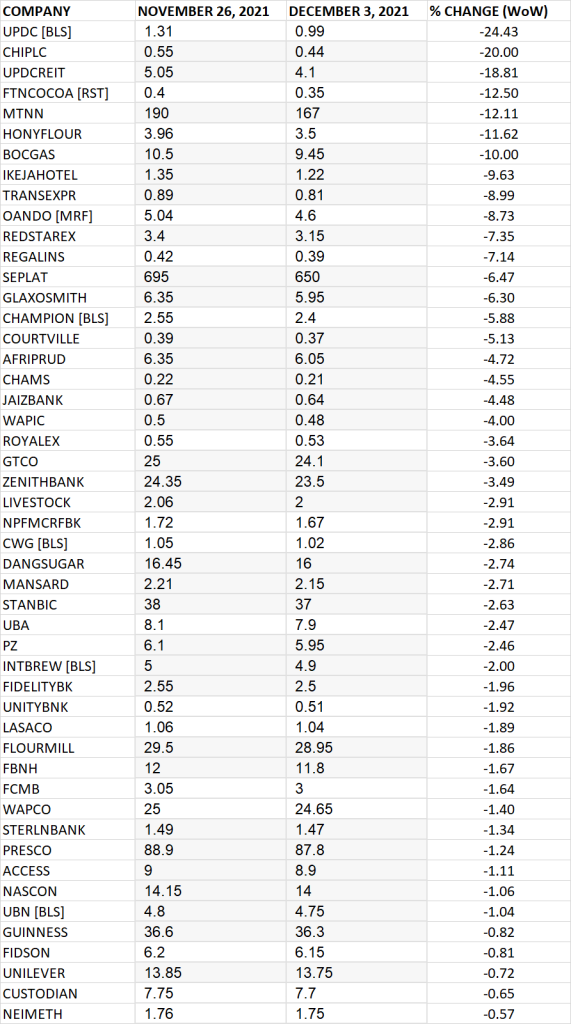

Top 10 Losers

UDPC led other price decliners as it shed 24.43% of its share price to close at N0.99 from the previous close of N1.31.

Consolidated Hallmark Insurance, UDPC Real Estate Investment Trust, FTN Cocoa and MTN shed their share prices by 20%, 18.81%, 12.50% and 12.11% respectively.

Others among top ten price decliners last week include: Honeywell (-11.62%), BOC Gases (-10%), Ikeja Hotel (-9.63%), Trans-Nationwide Express (-8.99%) and Oando (-8.73%) respectively.

GAINERS

LOSERS