The Nigerian stocks market lost its winning streak at the close of Tuesday’s trading session as Investors sold down stocks with low Dividend Yields which consequently pulled down the market 0.66% after 5days rally, despite positive GDP growth, bringing the market YtD returns to 10.61%

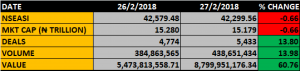

The All-Share index declined 0.66% to close at 42,299.56 points as against the 42,579.48.

Growth was recorded in the number of deals moving up 13.8% to 5,433, as against the previous 4,774. Volume and value of transactions closed 13.98% and 60.76% higher at 438.651million units and N8.799billion respectively.

Market Breadth

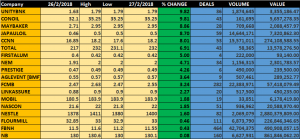

With 18 Gainers led by Unity Bank, against 37 Losers topped by AFRIPRUD, the market breadth closed negative.

Highest Percentage Gainers

Highest Percentage Gainers

Three tickers on the top 10 gainers’ list emerged from the oil and gas sector as positive sentiments were noted on a number of large cap counters in this space. In contrast, AFRIPRUD was the top laggard following the release of its FY2017 results today. The company proposed dividends of 0.40kobo per share while PAT advanced by 68.25% to NGN1.71bn during the period.

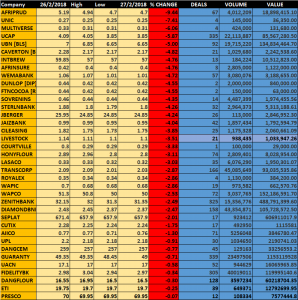

Transcorp traded the highest volume while Nestle attracted more fund, with FBNH leading with highest numbers of deals.